Lloyd’s/London

Frustration at Dive In ethnicity panel after c-suite execs drop out

Senior insurance executives scheduled to appear at a diversity event pulled out after discovering the session would be on the "sensitive" issue of the industry's Black, Asian and Minority Ethnic pay gap.

Q&A: Ajay Mistry, partnership director, Brokerbility and co-chair, Insurance Cultural Awareness Network

As part of the Inclusion at Lloyd's programme six partner networks have been set up to help bolster diversity and inclusion in insurance. Post spoke to a representative from each one to get an insight into what they doing, today focusing on The Insurance…

Neal emphasises the importance of speaking up about bullying and harassment

Lloyd’s CEO John Neal has underscored the importance of individuals speaking out about instances of bullying and harassment at a panel discussion on the first day of the Dive In festival.

Q&A: Iowa Morgan, manager of City Claims at AIG and chair of the Insurance Disability, Ability & Wellbeing Network

As part of the Inclusion at Lloyd's programme six partner networks have been set up to help bolster diversity and inclusion in insurance. Post spoke to a representative from each one to get an insight into what they doing, today focusing on iDAWN –…

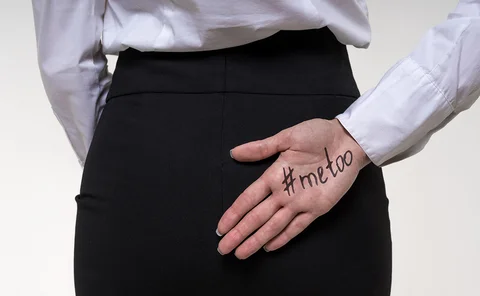

Blog: It’s just ‘banter’: The excuse that no longer washes in the #MeToo world

To mark Dive In this week Post content editor Jonathan Swift considers how language and actions that once might have been considered passable, are likely to be no longer tolerated if insurance is to become a truly diverse and inclusive profession.

Digital Fineprint closes $4m funding round, with insurtech Cuvva tipped to raise next

Digital Fineprint has become the latest UK-based insurtech to announce a significant fund raising round after unveiling a $4m (£3.2m) investment at Insurtech Connect in Las Vegas today.

Lloyd’s unveils further measures to tackle market culture amid ‘sobering’ survey

Lloyd’s has today revealed six additional measures it will take to improve culture at the market, after a survey labelled “sobering” by its chairman Bruce Carnegie-Brown.

Nearly one in ten workers saw sexual harassment at Lloyd’s over the last year

Lloyd’s CEO John Neal said he was “appalled” by Lloyd’s culture survey results, as the results show 8% of workers claim to have witnessed sexual harassment in the market in the last 12 months.

Q&A: Benjamin Hindson, vice-president for communications, media and technology, Marsh and chair of Next Generation Insurance Network

As part of the Inclusion at Lloyd's programme six partner networks have been set up to help bolster diversity and inclusion in insurance. Post spoke to a representative from each one to get an insight into what they doing, today focusing on the Next…

AIG's Anthony Baldwin on the evolution of the London market

2019 has been a year of changes in the London Market. The Decile 10 review at Lloyd’s in 2018 was the most high-profile example of insurance businesses reviewing their operations

This week: A diamond in the grind

In just over a fortnight I will be leaving the world of insurance, after 42 months in the job and almost twelve hundred bylines under my belt. Here’s what I’ve learned.

Brexit preparations slow as deadline draws near

Financial services firms have slowed down or paused their Brexit preparations, but "significant work" still remains over business transfers, EY has warned.

Blog: The diversity challenge - why inclusivity matters

Inclusiveness in insurance, especially broking, is woeful writes Richard Beaven, chief operating officer at Brightside Group. No matter how rose-tinted our spectacles are, the data on the number of women in senior positions, not to mention other groups,…

Lloyd's execs encouraged by more disciplined underwriting

Lloyd’s is beginning to see the green shoots of improved underwriting thanks to stringent business planning measures, executives have said following the market’s interim results.

Lloyd's posts £2.3bn first-half profit driven by investment income

Lloyd’s recorded pre-tax profits of £2.3bn in the first six months of 2019, with strong investment returns offsetting a year-on-year deterioration in underwriting profitability.

Sex discrimination a 'significant' insurance issue as claims and payouts increase

#MeToo is becoming a “significant” industry issue as harassment and discrimination claims rise, while in some countries the surge means claims are moving outside of traditional employment practices liability insurance, lawyers have warned.

Blog: Lloyd's Delegated Authority Management Survey – how is the sector performing?

Mazars recently published its sixth Lloyd's Delegated Authority Management Survey designed to monitor development and changes in the specialised area of the Lloyd’s insurance market. Michael Campbell, director of delegated authority reviews at Mazars,…

Aspen appoints UK CEO

Clive Edwards will become CEO of Aspen UK and Aspen Managing Agency.

RSA merges commercial businesses

RSA UK & International has merged its Commercial Risk Solutions and Global Risk Solutions businesses to create a single business unit focused on commercial lines, as it seeks to regain profitability.

2018 catastrophe loss levels are the new norm: Air Worldwide

The industry can expect to be hit with on average $92bn (£74.5bn) in insured losses from catastrophes annually going forward, according to catastrophe modeling firm Air Worldwide.

Charles Taylor to sell managing agency as it posts £2.1m loss

Charles Taylor saw a pre-tax loss of £2.1m as the group announced the sale of its managing agency to Premia Holdings.

Lloyd's prepared to 'hang' perpetrators of bad behaviour after sobering culture survey

Lloyd’s of London chairman Bruce Carnegie-Brown has said that the results of the specialty insurance market’s culture survey are “sobering” and that it won’t hesitate to make an example of perpetrators in order to stamp out bad behaviour.

Insurance stalwart David Palmer passes away

David Palmer, a well-known industry figure in the 80s and a past master of the Worshipful Company of Insurers has died. He was 92.

From Bolton to Palace; Gretna to Argyle - when insurance personalities invest time and money in football

As former Sabre CEO Keith Morris backs the Bolton Wanderers FC buyout, Post content director Jonathan Swift looks at other insurance individuals who have been closely involved in football over the last two decades.