Feature

Loss adjusting: A standards issue

Direct regulation of loss adjusters has been on the agenda for more than a decade but, with Europe ready to step in, is the industry prepared to be governed by forces on the continent?

Executive remuneration: For what it's worth

Executive remuneration in insurance has come under the spotlight following a shareholder revolt at Aviva, but what went wrong and how will its impact be felt throughout the wider industry?

Telematics: the data challenges

The gender ruling is only six months from enforcement, and Catherine Barton asks whether telematics and its data capture can be a real solution.

Managing general agents: A surge in popularity

Managing general agents are certainly on trend and increasing their interaction with insurers but, with some companies still suspicious of their value, will their popularity last?

Flood cover: Sink or swim?

The expiry of the Statement of Principles is a year away, and the industry is looking for a replacement to cover the impact of flooding. Two ideas have been floated, but which will sink and which will swim?

Broker Focus: Fraud - First line of defence

Insurers are often called to bear arms in the battle against fraud, but should brokers be doing more to defend the industry?

Telematics: Ready for the mainstream?

Telematics remains in its infancy, but many in the industry have high hopes for its growth. But is the technology ready to make the leap into the mainstream?

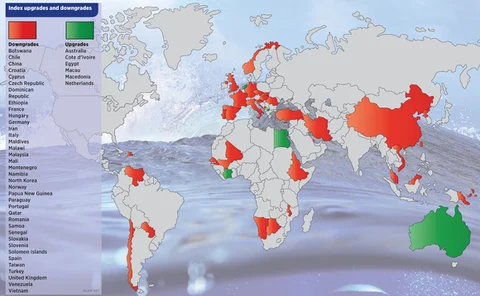

Political risks: Economic unrest triggers interest and questions over cover

The UK, France, Germany, Italy, Portugal and Spain have all been re-rated 'medium risk' from 'low risk' by Aon Risk Solutions, as part of a downgrade of 37 countries in the firm's annual Terrorism & Political Violence map.

High Net Worth: Asia's growing wealthy and insurers gradually waking up to opportunities

The population of wealthy people in Asia is continuing to soar, creating significant opportunities for insurers offering premium products catering to their needs.

Application fraud: Revving up rates

In an effort to bring down premiums, many drivers are telling 'white lies' on their application forms, compelling brokers to beef up their own fraud detection alongside insurers.

Analytics: Cultivating customers with tailored data

Customers need to be offered more than just a cheap deal to persuade them to stay with an insurer, and tailored data can help achieve an increase in retention rates.

Terrorism and civil unrest: Risky business

With several parts of the world engulfed by violence and civil unrest, is traditional terrorism and political risk cover increasingly irrelevant?

Dispute resolution: Cutting in the middle man

Financial savings and court support have never been sufficient to switch insurers onto alternative dispute resolution in big numbers. Will the Jackson reforms provide the essential incentives?

Workplace Stress: Under pressure

With an estimated 18 000 financial services employees taking time off work due to stress in 2011, how can companies protect themselves in financially fraught times?

Communicating Change: Preparing to be purchased

Groupama UK and its broker subsidiaries were put up for sale in January. How has its management communicated the process to ensure that positive commercial momentum is maintained?

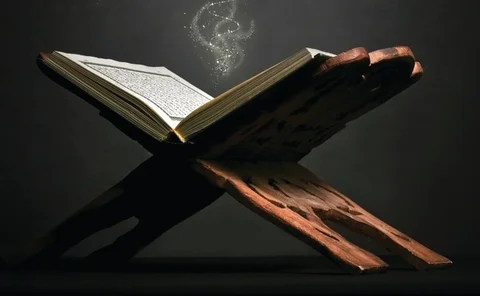

Opening the Takaful market

Initial forays into the Takaful market in the UK have so far met with failure. Despite this, there is still a conviction that a relevant Takaful market exists.

Social Media: The social media circle

With a culture of risk aversion, insurance is not a major social media player. But will the emergence of innovative German player Friendsurance change things?

Countdown to ISA: Is the renminbi the new dollar?

As the valuation of the Chinese renminbi has an impact on the global currency markets, Andrew Leung looks at Chinese monetary policy and the Global Reserve Currency System in a global context.

Making 'Agile' an insurance priority

As insurers face escalating regulatory control, fragile investor confidence and weakened demand in many key markets, John Milway explains why insurance companies can speed up responses to business process change by embracing an 'Agile’ approach.

Technology: more cash to splash?

With global insurance spend on IT set to increase by 6% over the next year, will a similar trend emerge in the UK during 2012 and beyond?

Mobile Phones: Success with smartphones

The development of mobile network technology combined with the increasing sophistication of smartphones has fundamentally changed the £620m mobile phone insurance market.

Marine: A stormy start to 2012 and choppy waters ahead

With the Costa Concordia disaster in January, the marine market has had a tough start to the year. What impact has this had on the state of play in an already difficult sector?

Health and Safety: Inspectors go hi-tech for a better service

Technology is transforming plant and equipment inspections and creating substantial improvements in the quality, speed and effectiveness of the inspections carried out and the inspectors that undertake them.

Health and Safety: All about the money

Facing a huge cut in its budget, the Health and Safety Executive is preparing to claw back the shortfall. But plans to charge fees for interventions have met with a mixed response.