Feature

Rehabilitation First Awards 2012 - The winners

Guests were welcomed to the eighth annual Rehabilitation First Awards, held at the Royal Garden Hotel in Kensington, by chair of the judging panel and editor of Post Lynn Rouse, who spoke of how the hugely successful London Paralympics could prove a …

SMEs: A web of complexity

UK companies are quick to take advantage of technological advances to create new business opportunities, and the industry must get up to speed with the many and varied risks this brings.

SMEs: Home advantage

The Olympic experience showed that flexible working is a viable option for many, but companies need to weigh up the risks as well as the benefits.

Direct Line Group: Divestment dilemma

The Royal Bank of Scotland may have formally announced plans for an initial public offering of Direct Line Group, but it still faces final decisions on the divestment of its insurance arm.

Motor insurance: Driving down cover costs

With two major indices reporting a fall in the cost of motor insurance, there are signs that the sector’s fortunes are improving. Can insurers afford to be optimistic, or should they proceed with caution?

Periodical payment orders: Struggling with settlements

Periodical payment orders are being used to settle increasing numbers of serious personal injury claims, and their popularity is likely to continue. How can insurers cope with the challenges they present?

Alternative Business Structures: a blueprint for change?

Despite the possibilities presented by Alternative Business Structures, there has been only a muted response from the insurance industry thus far.

The impact of European downgrades

This year has seen an increasing number of downgrades by ratings agencies for European insurers. Anne-Louise Fogtmann investigates how seriously these are taken and their impact on insurers.

UK riots: Reading the riot act

The out-dated Riot Damages Act, policyholder confusion and poor communication led to some heavy criticism of the industry's handling of last year's riots - but what has been learnt and what still needs to change?

IUMI 2012 preview: The agenda

Despite positives for the sector, including a reduction in piracy, this year's International Union of Marine Insurance conference in San Diego looks set to be dominated by the loss of the Costa Concordia.

Whiplash still on the agenda insists MoJ, as consultation delayed again

The Ministry of Justice has confirmed that the promised consultation on whiplash remains on its agenda, despite being delayed as a consequence of last week's government reshuffle.

Scrapping metal theft

How effectively will incoming legislation tackle the perennial issue of metal theft and the problems it causes for UK businesses?

Claims Club 10th anniversary: A decade of debate

The Post Claims Club will mark its 10th anniversary next year, and the group's advisory board looks back on a decade of change.

Day in the life: Loss adjuster - more than meets the eye

Having spent 14 months writing about the loss adjusting and claims handling industry, Post reporter Chinwe Akomah decided to experience the trials and tribulations of the job first hand by shadowing LAS' Paul Wright for a day.

FSCS consultation: Burdening brokers

Proposed changes to the Financial Services Compensation Scheme could see brokers contributing more than ever, but are they still paying for the mistakes of others?

Cyber liability: Combatting cyber crime

From the £21bn bill for businesses to the inevitable reputation damage, cyber crime can have a devastating impact on UK organisations. So why do so few understand or act on the risks?

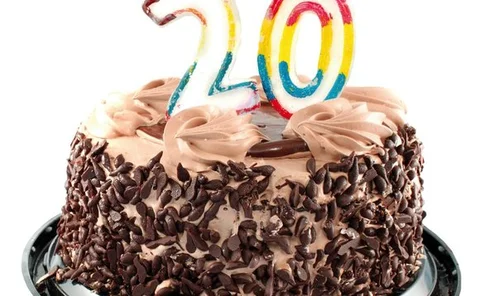

Forum of Insurance Lawyers: 20 years of Foil

Two decades after its inception, the Forum of Insurance Lawyers is still going strong. But with the legal and insurance industries standing on the brink of radical change, how will the body evolve from here?

Loss adjusting: Rules of rejection

It's a process that can be fraught with pitfalls, so what are the crucial considerations for loss adjusters when it comes to repudiating claims?

Equality Act: Age concern

The Home Office has exempted the insurance industry from the Equality Act, allowing underwriters to continue using age as a risk factor. But will Europe intervene as it did with gender?

Stamping out fraud

As insurance fraud losses top £2.1bn - a 23% year-on-year rise - and offer rich pickings for fraudsters, what are the factors behind the figures and how can firms can fight back?

Social media: Facebook is your friend

Social media has allowed insurers to learn more about the risk profiles of their policyholders, but could, and should, this information be used to compile quotes?

Credit hire: Paying a hire price

Credit hire is a significant factor in private motor insurance premiums being inflated by £225m a year, but would Competition Commission intervention help or hinder policyholders and the industries involved?

Eurozone crisis: Continental thrift

Trouble in the Eurozone is causing headaches for governments across the continent, but what impact will it have on the insurance industry? And how can companies prepare?

Olympics: A golden opportunity

The Olympic Games are now well underway, with top athletes and millions of tourists now in the UK. But are businesses able to reap the benefits? Or are the problems associated with such an influx unbeatable?