Claims

PI firms risk being sued if they continue to undervalue serious injury claims

Claims management companies reportedly targeting under-settled claims.

Aviva grilled over ABS ambitions

Aviva has confirmed it is not in the process of applying for an alternative business structure after direct questioning by the Transport Select Committee.

Airmic 2013: Airmic CEO offers ‘antidote’ to basis clauses problem

Airmic chief executive John Hurrell has told members the body will be more focused on the “technical agenda than ever before” as it tackles issues such as basis clauses.

Interview: Chris Hall - A quest for success

A decade ago Chris Hall led a small team that risked it all to buy loss adjuster Questgates. Now it is worth £11m – and the managing director hopes to double that figure within the next 10 years.

Penny Black's Insurance Week - 20 June 2013

Penny saw several delegates looking a little jaded on the final day of the Airmic 2013 conference in Brighton, but none quite so worse for wear as the good fellows from the Institute of Risk Management.

HBC Vehicle Services completes MBO from founder Terry Holding

The management team at HBC Vehicle Services has successfully completed a management buyout of the business from founder Terry Holding.

Talanx expects under €250m losses from European floods

German insurance giant Talanx has estimated its net loss from flood claims in Germany and neighboring countries at less than €250m.

Payment Protection Insurance: Paying the price

With payment protection insurance complaints putting a seemingly never-ending financial strain on the industry, can the product ever bounce back?

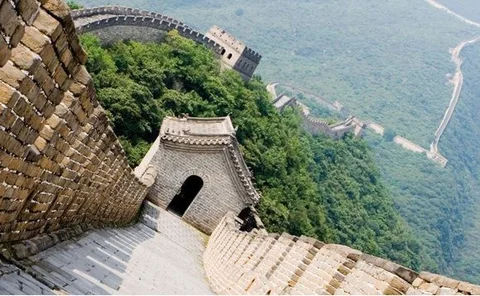

Directors and officers' premiums soar in China

The costs of obtaining directors' and officers' insurance has soared thanks to a rising number of multi-million dollar lawsuits.

Law report: Moped racer sees claim reduction

This law report has been contributed by law firm Berrymans Lace Mawer.

Law report: Building firm successfully argues obligation breach was not bad enough to be repudiatory

This law report was contributed by law firm Berrymans Lace Mawer.

Law report: Welding insurer awarded costs after breach of warranty row

This law report has been contributed by law firm Berrymans Lace Mawer.

Comment: Creative fraudbusting

Appealing to the casual fraudster’s conscience won’t work – it’s time for a more direct approach, says Eddie Longworth.

Ex-RBSI claims trio targets insurance industry with advisory firm

A group of senior claims professionals have joined forces to target the insurance sector with the aim of helping firms navigate the raft of new legislation that is reshaping the industry.

3D film whiplash injury named in LV report of top rejected claims

A woman who attempted to claim £1000 for a cancelled holiday, having told her insurer she had suffered whiplash injuries after being startled by a 3D film, has been named among LV’s top 10 failed claims.

Early monsoon rain causes airport damage in Delhi

Powerful monsoon rain including a record amount at Delhi's Indira Gandhi Airport meaning passengers had to wade through water.

Insure the Box hackers sentenced after Ifed investigation

Two men who hacked into Insure the Box’s payment systems and secured £187 000 worth of car insurance for just £30 have been sentenced at Liverpool Crown Court.

Claims Awards 2013: Innovation of the Year – AIG

AIG’s use of the latest technology has revolutionised its investigation reporting, heralding a dramatic drop in time taken to assess and process claims, bringing benefits to policyholders.

Quindell prepares for full stock exchange listing

Quindell said it will be holding three "teach-ins" starting next Tuesday at its offices in Hampshire and London, in a bid to "provide a deeper understanding of the business".

Post Claims Awards - Ageas, AIG, Allianz, LV, Hiscox and RSA among the winners

LV and Ageas both won individual and team awards at last night's Post Claims Awards at the Grosvenor House Hotel.

Post Audio Supplement - 13 June 2013

Too busy to read the magazine or website? Want a quick update on the latest news?

Swiss Re warns of $44bn loss scenario from Chinese flood and storm surge

With its large economy and over half of its manufacturing centres exposed to flood risk, China represents a much bigger risk to insurers than Thailand, according to a new report from Swiss Re.

Charles Taylor targeting UK adjusting growth

Charles Taylor is looking to expand adjusting operations in the UK company market group, chief executive David Marock told Post today.

Post magazine - 13 June 2013

The latest issue of Post magazine is now available to subscribers as a digital and interactive e-book.