Claims

Analysis: D&O and the rise in securities class actions

Securities class actions are on the increase as law firms target smaller companies and focus on litigation related to initial public offerings

Insurers may be forced to re-write cyber policies in preparation for GDPR

Insurers offering cyber policies may see themselves having to adjust the wording of their cyber policies as the General Data Protection Regulation comes into effect.

Lawyers urge Lords to ban 'tasteless and intrusive' cold calling

Lawyers have urged the House of Lords to ban the “scourge” of cold calls by personal injury CMCs.

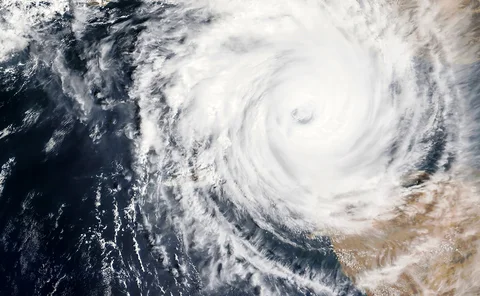

Hurricane season highlights need to maintain adequate catastrophe loading, says Lloyd’s

The active hurricane season is a timely reminder for underwriters to maintain discipline and adequate catastrophe loading on rates, Lloyd’s Jon Hancock has said.

Harvey and Irma are not market turners, says Hancock

The financial fallout from hurricanes Harvey and Irma will not be enough to turn the market, according to Lloyd’s performance director Jon Hancock.

Ageas' Andy Watson's wish list for returning MPs

As goverment returns to business, Andy Watson, CEO of Ageas UK, reminds MPs that there are still three major areas of policy affecting insurance that need to be properly addressed before insurers can begin to control and then reduce customer premiums.

Ex-RSA employee sentenced after submitting £270,000 in fraudulent claims

An ex-RSA employee has been sentenced after pleading guilty to a number of fraud offences totalling to £270,000.

Three motor service providers acquired under new holding group AGL

Three brands in the vehicle repair, claims and technology sectors have been acquired under holding group AGL, which launched today.

Blog: How insurers can use data analytics to differentiate their products

Insurers shouldn't use data analytics just to drive efficiencies but also to innovate in terms of risk management, writes Paul Dix, insurance strategy consultant at CGI UK.

Beale calls for ‘urgent’ flood insurance reform

Hurricane Harvey and Irma both highlight the problem of inadequate flood insurance and need for reform in the United States, Inga Beale has said.

AIR pegs Irma insured losses at $20bn-$65bn

Hurricane Irma could result in insured losses of $20bn to $65bn, according to a preliminary estimate from AIR Worldwide.

Lloyd's report pegs Miami windstorm at $131bn as Irma heads for Florida

Hurricane Irma could see industry property losses of $131bn, according Lloyd's realistic disaster scenario analysis.

This Month in Post: Discount, diversity and data

There was some good news and some bad news this week for the insurance industry.

Aviva could see boost of up to £200m from Ogden discount rate reform

Aviva stands to make a one off gain of between £100m and £200m as a result of any future discount rate revision to 0-1%.

Insurers rejoice at new Ogden formula on Twitter

Insurers took to Twitter to express their satisfaction with the new mode of calculation for the discount rate, which the government unveiled today.

Live blog: Ogden discount rate reform

Follow reactions to the draft reform to the Ogden discount rate reform in our live blog.

Analysis: Going fishing: What is fuelling consolidation in the loss adjusting sector?

The loss adjusting space continues to shrink, with three major acquisitions of loss adjusting firms in the first two weeks of last month.

Industry welcomes draft reform on Ogden discount rate

Insurers have welcomed government plans to alter the way the discount rate is set in future.

Analysis: Renewables - Riding out the storm

The risk landscape in renewable energy is constantly changing and underwriters need to exercise proper due diligence, argues Fraser McLachlan, CEO of Gcube Underwriting.

Property losses to exceed $65bn after Hurricane Harvey, says AIR Worldwide

The expected cost of total uninsured and insured property losses in the US from Hurricane Harvey is likely to be between $65bn (£50bn) and $75bn according to catastrophe modeling firm AIR Worldwide.

Fixed costs for deafness claims proposed

The Civil Justice Council has published recommendations for fixed costs applying to noise induced hearing loss cases.

Strike Club's Monaco operations moved to London

The Strike Club has closed its Monaco office after finding “sizable efficiencies” in moving its operations to London.

Law firms warned over handling of holiday sickness claims

Solicitors have been slapped with a warning over the handling of holiday sickness claims following evidence of rising fraud.

Charles Taylor sees profits tumble in H1

Charles Taylor saw pre-tax profits fall by 41% as a result of losses following the acquisition of Cega by the group last year.