Claims

Who is liable if AI in healthcare fails and causes harm?

Law firm DAC Beachcroft’s Simon Perkins and Stuart Wallace reveal what could happen if a claim is made against a healthcare provider that relies on artificial intelligence to spot diseases.

Axa and Zego reject generative AI for pricing

Axa and Zego have ruled out using generative artificial intelligence for pricing due to compliance concerns.

Chicken shop owner has wings clipped for fowl play in fraudulent fire claim

A chicken shop owner and his brother have been handed prison sentences following investigations by Allianz and Sedgwick into a fire in 2018.

Zurich’s Bush on why it’s never been more important to build resilience

View from the Top: Charles Bush, head of large and complex and commercial claims at Zurich, argues its incumbent on insurers to work with policyholders on innovating new resilience solutions.

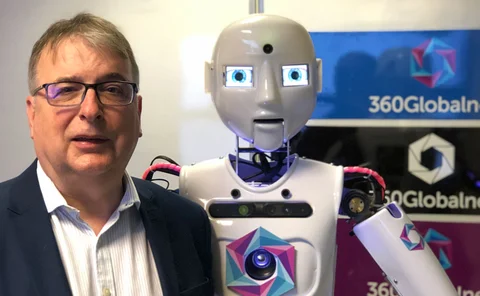

Q&A: Paul Stanley, 360Globalnet

Paul Stanley, CEO & founder of 360Globalnet, speaks to Insurance Post about the software firm’s growth, digital claims, and the benefits of no-code systems.

How insurers can up their claims game

Insurers love to talk about claims exaggeration, but David Worsfold asks: are they guilty of some exaggeration of their own?

Sedgwick reveals how carbon neutrality was achieved in the UK

Insurers have approached Sedgwick for guidance on lowering their carbon footprints, after the loss adjusters achieved carbon neutrality in the UK.

Mounting dissatisfaction with home insurance as premiums increase

Data analysis: NFU Mutual, Bank of Scotland, Nationwide, Saga, and Co-operative Insurance have the most satisfied home insurance customers, according to research by Fairer Finance.

Diary of an Insurer: Clear Group’s Neil Grimes

Neil Grimes, claims director of Clear Group, gets out on the track to experience a demonstration of autonomous driving and catches up with the claims team of a recent acquisition.

Vehicle damage claims drop following Welsh speed limit law

Wales has seen a 20% drop in vehicle damage claims since the implementation of a nationwide 20mph speed limit, according to Esure.

What does Winslow’s hiring splurge say about DLG’s future?

Content Director’s View: Jonathan Swift takes stock of Direct Line Group CEO Adam Winslow’s new look executive team and asks whether it has the attributes to succeed.

Reminder: Claims and Fraud Awards deadline is 14 June

With a deadline of 14 June you have just over a week left to get your entries in for the 2024 Insurance Post Claims and Fraud Awards.

Insurance’s problem with a shrinking pool of arbitrators

Mark Everiss, partner in insurance and reinsurance at Eversheds Sutherland, explores the practicalities of, and difficulties in, finding a competent impartial tribunal of arbitrators to determine insurance and reinsurance disputes.

How is insurance stepping up amid election uncertainty?

With a record number of elections in 2024 set to introduce substantial unpredictability into an already volatile risk environment, Edmund Tirbutt examines how insurance is engendering resilience amidst unrelenting geoeconomic uncertainty.

Safeguarding construction plant and equipment: A guide to loss prevention

This document aims to provide a guide to the prevention of damage or theft of construction plant and equipment (CPE), raising awareness of some of the practical measures that can be implemented to ensure CPE is operated safely and stored securely.

60 Seconds With... HF’s Jennette Newman

Jennette Newman, partner and head of London markets at HF, would love to be ‘Somewhere over the Rainbow’ after learning lots from trial and error.

Understanding flood resilience – one garden and brick at a time

Editor’s View: Emma Ann Hughes considers ways the insurance industry can help make the world more resilient to climate change by being more innovative in how it inspires adapting homes and gardens.

Impact of fraud reaches unprecedented UK levels

In the UK, the impact of fraud on individuals, businesses and the public sector has reached unprecedented levels.

Three examples of intelligent automation in insurance

Intelligent automation in insurance is a powerful tool that reduces human error and the need to perform repetitive tasks manually.

Inflation issues remain despite drop in rate

Speaking at the Insurance Post Claims Club, Allianz’s chief claims officer Graham Gibson stated that the latest inflation figures seen this week will not trickle down to insurance any time soon.

How can ESG data help insurers reduce climate risk?

Climate change is one of the greatest, long-term risks facing the insurance sector. Fortunately, insurers can play a pivotal role in the transition to a greener economy.

Allianz’s Fletcher on fraud prevention in the age of technology

View from the Top: Ben Fletcher, director of financial crime at Allianz Personal, calls for the industry to prioritise prevention over reaction in the fight against fraud.

How Labour could reduce the cost of motor insurance

Analysis: Emma Ann Hughes examines efforts by the industry to push down motor insurance premiums and whether politicians could force providers to take more extreme action.