Claims

Driverless cars: How close are we?

UK roads could see self-driving vehicles rolled out by 2025 following the announcement of new government plans which will prioritise safety through new laws.

Ex-McLarens and GAB exec Trevor Latimer passes away

Trevor Latimer, the man who helped spearhead McLarens major push into the UK and Irish markets, has passed away.

Insurance account handler turned fraudster caught after climbing Sydney Harbour Bridge

Lois Cartridge, an insurance account handler who exaggerated the severity of her whiplash claim while posting photos on Facebook of her climbing the Sydney Harbour Bridge, has received a suspended prison sentence.

Infographic: The future of claims

An integrated claims process can add value for your customers and build stronger relationships. This infographic highlights how insurance companies can design seamless claim experiences along the four moments that matter to your customers.

LV reveals surge in flood claims where drains can’t cope

A report by LV General insurance has revealed there has been a 211% increase in the number of flood claims where drains were unable to cope over the last four years.

Judge gives go-ahead to BI appeals and awards Greggs 60% of costs

Parties in three business interruption disputes have been given the green light to appeal the findings of judgments handed down last month in relation to issues including the deduction of furlough payments and the aggregation of losses.

SME perspectives: Navigating change management within the SIU

Introducing AI to an insurer’s SIU may seem like an easy sell – investigators need to do less work to find more fraud – but this underestimates the potential drawbacks.

SME perspectives: Why legacy claim platforms can't handle subrogation

More insurers are now aware that subrogation increases the bottom line, lowering loss ratios and increasing revenue.

Video: Maximising loss ratio improvements

Every insurer wants to innovate and grow profitably. To do this, insurers must make better decisions across all aspects of the insurance lifecycle.

Stemming a rising tide: How insurers can close the flood protection gap

The role of insurers in closing the flood protection gap can be a crucial one, and the time to act is now.

Fixed recoverable costs regime extension delayed

Fixed recoverable costs will not be extended until October next year in move welcomed by legal sector.

Cop27: WTW collaborates with Unicef to provide climate protection to 15 million children

WTW has joined forces with The United Children’s Fund to protect millions of children and families from climate change

Automated, standardised criteria on simple repair cases allows greater efficiency as complexity increases

Standardising and automating the criteria of whether a damaged part in a motor vehicle has to be repaired and replaced on simple repair cases allows greater efficiency as complexity increases, according to BDEOs head of sales Sebastián González.

Three ways that AI can help special investigation units tackle fraud

Special investigation units play a valuable role in the claims lifecycle, but can act as a roadblock for claims if they can’t act at digital speed.

Early notification ‘key’ to avoid increasing property damage claims costs

Insurers could see higher claims costs and longer claims lifecycles as inflation creeps into the casualty and liability space, but educating policyholders on importance of early notification is ‘key’.

Roundtable: Digital claims - how can insurers best reap the benefits of digital claims for customers?

Digital claims processing offers significant benefits for both insurers and their customers. Based on this assumption, Post and PayPal held a roundtable to explore how the sector can keep up the momentum, and discuss what might be considered as a best-in…

Fraud detection: The impact of more and different data

When it comes to detecting fraud, insurers know that better data means better fraud decisions.

Data analysis: PI market continues to contract following whiplash reforms

Personal injury law firms are exiting the market at an alarming rate following whiplash reforms.

Analysis: What do the Resilience judgments mean for ongoing Covid BI claims cases?

After three major decisions were handed down in high-profile business interruption claims cases, Harry Curtis looks at those rulings, and asks what repercussions they could have for insurers and policyholders.

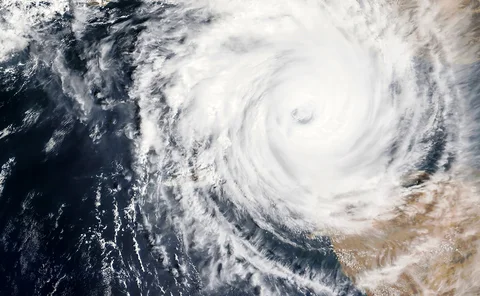

Hurricane Lisa causes first pay-out of Mesoamerican Reef Insurance Programme

The first pay-out has been made by the Mesoamerican Reef Insurance Programme when the Turneffe Atoll, off the coast of Belize, was hit by Hurricane Lisa on 2 November.

Court allows legal bodies to intervene in whiplash test cases

The Court of Appeal has given permission for the Association of Personal Injury Lawyers and Motor Accident Solicitors Society to intervene in two test cases that are set to help establish levels of compensation to be awarded for mixed whiplash injuries.

Analysis: Could PI receive clearer guidance on mixed injuries before year-end?

While there are no official test cases to provide guidance on handling mixed injury claims, defendant and claimant lawyers could see some much-needed clarity before the end of the year as two claims are leapfrogged to Court of Appeal.

Customer satisfaction as a driver for policyholder retention - how does it work?

Insurance premiums are rising due to inflation, which typically drives down policyholder satisfaction.

Interview: Gary Duggan, Tesco Underwriting

Tesco Underwriting CEO Gary Duggan sat down with Pamela Kokoszka to discuss the Ageas buyout, the plans for the business, meeting customer expectations, and his passion for improving diversity within the insurance industry.