Claims

LV reveals surge in flood claims where drains can’t cope

A report by LV General insurance has revealed there has been a 211% increase in the number of flood claims where drains were unable to cope over the last four years.

Judge gives go-ahead to BI appeals and awards Greggs 60% of costs

Parties in three business interruption disputes have been given the green light to appeal the findings of judgments handed down last month in relation to issues including the deduction of furlough payments and the aggregation of losses.

SME perspectives: Navigating change management within the SIU

Introducing AI to an insurer’s SIU may seem like an easy sell – investigators need to do less work to find more fraud – but this underestimates the potential drawbacks.

SME perspectives: Why legacy claim platforms can't handle subrogation

More insurers are now aware that subrogation increases the bottom line, lowering loss ratios and increasing revenue.

Video: Maximising loss ratio improvements

Every insurer wants to innovate and grow profitably. To do this, insurers must make better decisions across all aspects of the insurance lifecycle.

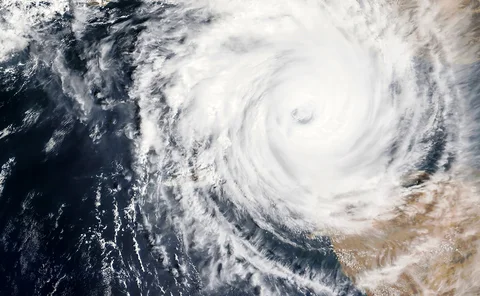

Stemming a rising tide: How insurers can close the flood protection gap

The role of insurers in closing the flood protection gap can be a crucial one, and the time to act is now.

Fixed recoverable costs regime extension delayed

Fixed recoverable costs will not be extended until October next year in move welcomed by legal sector.

Cop27: WTW collaborates with Unicef to provide climate protection to 15 million children

WTW has joined forces with The United Children’s Fund to protect millions of children and families from climate change

Automated, standardised criteria on simple repair cases allows greater efficiency as complexity increases

Standardising and automating the criteria of whether a damaged part in a motor vehicle has to be repaired and replaced on simple repair cases allows greater efficiency as complexity increases, according to BDEOs head of sales Sebastián González.

Three ways that AI can help special investigation units tackle fraud

Special investigation units play a valuable role in the claims lifecycle, but can act as a roadblock for claims if they can’t act at digital speed.

Early notification ‘key’ to avoid increasing property damage claims costs

Insurers could see higher claims costs and longer claims lifecycles as inflation creeps into the casualty and liability space, but educating policyholders on importance of early notification is ‘key’.

Roundtable: Digital claims - how can insurers best reap the benefits of digital claims for customers?

Digital claims processing offers significant benefits for both insurers and their customers. Based on this assumption, Post and PayPal held a roundtable to explore how the sector can keep up the momentum, and discuss what might be considered as a best-in…

Fraud detection: The impact of more and different data

When it comes to detecting fraud, insurers know that better data means better fraud decisions.

Data analysis: PI market continues to contract following whiplash reforms

Personal injury law firms are exiting the market at an alarming rate following whiplash reforms.

Analysis: What do the Resilience judgments mean for ongoing Covid BI claims cases?

After three major decisions were handed down in high-profile business interruption claims cases, Harry Curtis looks at those rulings, and asks what repercussions they could have for insurers and policyholders.

Hurricane Lisa causes first pay-out of Mesoamerican Reef Insurance Programme

The first pay-out has been made by the Mesoamerican Reef Insurance Programme when the Turneffe Atoll, off the coast of Belize, was hit by Hurricane Lisa on 2 November.

Court allows legal bodies to intervene in whiplash test cases

The Court of Appeal has given permission for the Association of Personal Injury Lawyers and Motor Accident Solicitors Society to intervene in two test cases that are set to help establish levels of compensation to be awarded for mixed whiplash injuries.

Analysis: Could PI receive clearer guidance on mixed injuries before year-end?

While there are no official test cases to provide guidance on handling mixed injury claims, defendant and claimant lawyers could see some much-needed clarity before the end of the year as two claims are leapfrogged to Court of Appeal.

Customer satisfaction as a driver for policyholder retention - how does it work?

Insurance premiums are rising due to inflation, which typically drives down policyholder satisfaction.

Interview: Gary Duggan, Tesco Underwriting

Tesco Underwriting CEO Gary Duggan sat down with Pamela Kokoszka to discuss the Ageas buyout, the plans for the business, meeting customer expectations, and his passion for improving diversity within the insurance industry.

Use AI to align complex claims with experienced adjusters

Claims handlers and adjusters have varying levels of experience and a range of specialties. This blog highlights how insurers can use AI to utilise these abilities most efficiently by aligning complex claims with experienced adjusters.

Marketplaces and exchanges: Ten ways they are reshaping insurance

The insurance industry is going to have to confront the fact that there are and will continue to be a myriad of marketplaces – those already established plus new marketplaces using innovative approaches.

Insurers facing claims from mini-Budget pension fallout

Law firm RPC warns insurers to expect claims from pension fund trustees that suffered losses as a result of the disastrous mini-Budget

Insurance Taskmaster Episode One: Insuring The Titanic [1912]

Insurance Post has teamed up with Verisk for a new video show in which we tasked six industry rising stars to solve some of the biggest historic challenges faced by the market over the past two centuries.