Review of the Year: Legal

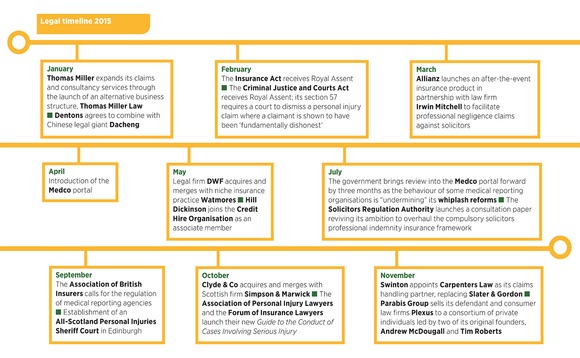

For insurance lawyers, 2015 has been marked by the Medco portal going live in a sustained effort to reform whiplash claims. But the year has also seen major rulings regarding aggregation, costs and rates, all expected to have wide-ranging implications.

For this Legal Review of the Year, Post got in touch with both insurance and personal injury lawyers.

They reflected on the latest anti-fraud initiatives, and pointed out how technological trends may be affecting the sector in the longer term – such as what impact driverless cars will have on motor policies and liability and cyber risks how can be covered.

Respondents have a lot to look forward to in 2016. Flood Re should launch in April; the Insurance Act will come into force in August; and the Enterprise Bill will continue its progress through parliament. Several reports are due on fraud and claims management companies.

And insurance lawyers will be monitoring whether the UK government does introduce measures to end the right to cash compensation for minor whiplash injuries, as Chancellor of the Exchequer George Osborne recently promised in his Autumn Statement.

Some of them will also be watching whether HM Treasury allocates funds to develop online dispute resolution.

Which court case of the last 12 months will have the widest ramifications for the insurance industry? Duncan Rutter, president of the Forum of Insurance Lawyers and partner at DAC Beachcroft: The Court of Appeal in Hayward v Zurich Insurance Company, while finding for the claimant, nevertheless made it clear that exaggeration could amount to fraud, an indication that will have profound implications for the interpretation of fundamental dishonesty.

Duncan Rutter, president of the Forum of Insurance Lawyers and partner at DAC Beachcroft: The Court of Appeal in Hayward v Zurich Insurance Company, while finding for the claimant, nevertheless made it clear that exaggeration could amount to fraud, an indication that will have profound implications for the interpretation of fundamental dishonesty. Paul Berry, partner at DWF: The Supreme Court case Zurich Insurance PLC v International Energy Group was truly a defining moment for insurers. The ruling created brand new equitable contribution rights between insurers and their insureds. It will have wide-reaching ramifications by shaping the treatment of mesothelioma claims and setting an important precedent in the fields of policy coverage and equitable rights.

Paul Berry, partner at DWF: The Supreme Court case Zurich Insurance PLC v International Energy Group was truly a defining moment for insurers. The ruling created brand new equitable contribution rights between insurers and their insureds. It will have wide-reaching ramifications by shaping the treatment of mesothelioma claims and setting an important precedent in the fields of policy coverage and equitable rights. Neil Trayhurn, global head of legal at Triton Global: The decision regarding aggregation in AIG Europe v OC320301 (formerly International Law Partnership) & 5 ORS. There is an appeal pending but if the decision is upheld, it will narrow the ability of insurers to aggregate claims under the Law Society’s minimum terms and conditions and, therefore, potentially increase their exposure where there are multiple claims.

Neil Trayhurn, global head of legal at Triton Global: The decision regarding aggregation in AIG Europe v OC320301 (formerly International Law Partnership) & 5 ORS. There is an appeal pending but if the decision is upheld, it will narrow the ability of insurers to aggregate claims under the Law Society’s minimum terms and conditions and, therefore, potentially increase their exposure where there are multiple claims. Kieran Jones, partner at Weightmans: In order of importance: Damijan Vnuk v Zavarovalnica Trigalev; Zurich v IEG; Vidal-Hall v Google.

Kieran Jones, partner at Weightmans: In order of importance: Damijan Vnuk v Zavarovalnica Trigalev; Zurich v IEG; Vidal-Hall v Google. Nicola Critchley, partner at Horwich Farrelly: It has to be Stevens v Equity. This highlighted how the Court of Appeal has a real appetite to simplify the assessment of the basic hire rate. The ruling is still having ramifications many months later, reducing the cost of credit hire claims to insurers.

Nicola Critchley, partner at Horwich Farrelly: It has to be Stevens v Equity. This highlighted how the Court of Appeal has a real appetite to simplify the assessment of the basic hire rate. The ruling is still having ramifications many months later, reducing the cost of credit hire claims to insurers.

Representatives from the British Insurance Law Association: Three cases polled equal top: AIG Europe v OC320301 – on aggregation, currently on appeal; Zurich v EIG – the Supreme Court mesothelioma case; and Rathbone v Novae – on subrogation in a co-insurance context, decided at the very end of 2014. Mike Brown, senior partner, BLM: In respect of volume injury claims, either Bird v Acorn or Qader v Esure; both of which concern the scope of the fixed cost regimes for claims under £25,000.

Mike Brown, senior partner, BLM: In respect of volume injury claims, either Bird v Acorn or Qader v Esure; both of which concern the scope of the fixed cost regimes for claims under £25,000. Timothy Goodger, partner at Elborne Mitchell: Maccaferri v Zurich Insurance, in which the court assessed the obligation of a policyholder to notify insurers where there is an event “likely to give rise to a claim”. Insurers will need to review their wordings to ensure they reflect what they want policyholders to notify.

Timothy Goodger, partner at Elborne Mitchell: Maccaferri v Zurich Insurance, in which the court assessed the obligation of a policyholder to notify insurers where there is an event “likely to give rise to a claim”. Insurers will need to review their wordings to ensure they reflect what they want policyholders to notify. Elena Fry, head of insurance and risk team at Brodies: Personal liability for employees always grabs the attention. In Bell v Alliance Medical, a medical error by a radiologist led to a claim against her employer. The employer successfully sued the employee, who thankfully was insured, reminding us that, save for exclusion clauses in employment contracts or insurance policies, an employee has only limited protection against an employer’s claim.

Elena Fry, head of insurance and risk team at Brodies: Personal liability for employees always grabs the attention. In Bell v Alliance Medical, a medical error by a radiologist led to a claim against her employer. The employer successfully sued the employee, who thankfully was insured, reminding us that, save for exclusion clauses in employment contracts or insurance policies, an employee has only limited protection against an employer’s claim. (Click for larger image)

(Click for larger image)

How did technology impact your sector in 2015?

Jones: Medco for promoting the independence of medicolegal experts and thereby improving the lot of insurers when it comes to addressing personal injury claims; the continued march towards driverless technology, throwing up real strategic challenges for the insurance industry to work out what motor policies and claims are going to look like 10 years from now; and the growing spectre of cyber risks.

Berry: Driverless car technology is raising numerous questions around ethics, regulations and safety, and insurers are incredibly attuned to these issues as they consider the inevitably wide-reaching implications on liability and the transfer of risk. Then there is predictive analytics, which are used to drive operational performance for our clients by predicting the outcome of live cases or partially informing decision making. Deborah Evans, chief executive of the Association of Personal Injury Lawyers: It’s fair to say it was a bumpy start for Medco, with sluggish IT and a lot of extra administrative work created for claimant law firms. The IT is now performing better, and the admin grows less over time, but Medco has still yet to deliver the objective of improving the quality of medical reporting.

Deborah Evans, chief executive of the Association of Personal Injury Lawyers: It’s fair to say it was a bumpy start for Medco, with sluggish IT and a lot of extra administrative work created for claimant law firms. The IT is now performing better, and the admin grows less over time, but Medco has still yet to deliver the objective of improving the quality of medical reporting. Andrew Parker, partner at DAC Beachcroft: The courts have been generally more ready to accept telematics or other electronic evidence, although there is still a reluctance on the part of judges to move away from forming their own impression of live evidence in court.

Andrew Parker, partner at DAC Beachcroft: The courts have been generally more ready to accept telematics or other electronic evidence, although there is still a reluctance on the part of judges to move away from forming their own impression of live evidence in court.

Brown: We could finally see an evolution in the use of technology in courts. Most of the very senior judiciary and Secretary of State for Justice Michael Gove seem to be on side. But the implementation of something like Her Majesty’s Online Court probably depends on the spending settlement that the MoJ secures at the end of November. Ruth Lawrence, head of insurance at Hill Dickinson: Cyber losses like Talk Talk continued to dominate the headlines while the Court of Appeal in Vidal-Hall v Google changed the landscape for cyber claims by holding that the definition of ‘damage’ should be interpreted broadly and confer a right to compensation for distress, and not be limited to financial loss. Cyber losses are becoming a foreseeable risk for businesses and whether or how to insure against them is a much discussed topic.

Ruth Lawrence, head of insurance at Hill Dickinson: Cyber losses like Talk Talk continued to dominate the headlines while the Court of Appeal in Vidal-Hall v Google changed the landscape for cyber claims by holding that the definition of ‘damage’ should be interpreted broadly and confer a right to compensation for distress, and not be limited to financial loss. Cyber losses are becoming a foreseeable risk for businesses and whether or how to insure against them is a much discussed topic.

(Click for larger image)

What are you most looking forward to in 2016?

Brown: Definitely the Insurance Act 2015 finally coming into force. Also, the report of the Insurance Fraud Task Force due early 2016 is eagerly awaited.

Rutter: The development of the definition of fundamental dishonesty to include

significant exaggeration. Jones: The opportunity to get further to grips with noise-induced hearing loss claims, particularly if fixed costs regime is brought into play.

Jones: The opportunity to get further to grips with noise-induced hearing loss claims, particularly if fixed costs regime is brought into play.

Goodger: The implementation of the Insurance Act 2015, and seeing how the market responds to Flood Re.

Parker: The third anniversary of the Jackson reforms on 1 April 2016, because then there can be no doubt that we have worked through all those stockpiled cases in which it is claimed that the claimant signed up to a collective conditional fee agreement with a success fee and a recoverable after-the-event premium.

Lawrence: There is considerable movement afoot for the development of artificial intelligence. This ties in with the thoughts developing on online resolution but envisages a brave new world where a computer may well make some judicial decisions. At the same time, the Fraud Taskforce is expected to produce its final report and the outcome of the review on claims management companies is also due.

Evans: 2016 will be a hotbed of debate on legal reform. We await the results of the Medco consultation, but are confused now about the overlap between this review and the mooted reforms on the small claims limit and the removal of general damages in whiplash cases, which could wipe out the need for Medco. Perhaps we will at least get clarity at the start of the year.

(Click for larger image)

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@postonline.co.uk or view our subscription options here: https://subscriptions.postonline.co.uk/subscribe

You are currently unable to print this content. Please contact info@postonline.co.uk to find out more.

You are currently unable to copy this content. Please contact info@postonline.co.uk to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@postonline.co.uk

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@postonline.co.uk