Renewable energy: An ill wind?

If a recent Swiss Re report is to be believed, investment in renewable energy is set to skyrocket in the coming years – so why do insurers seem wary of taking on the sector’s risks?

Billions of dollars are up for grabs as demand for insurance in the renewable energy sector grows. By 2020, investment in renewable energy will have increased by 50%, according to Swiss Re – which also claims this is likely to more than double the insurance spend for renewable energy projects.

In a study conducted with Bloomberg New Energy Finance – Profiling the risks in solar and wind – Swiss Re said: “As the renewable energy sector continues to grow, so will its demand for risk management services. By the end of this decade, a 50% increase in renewable energy investment is likely to produce more than a doubling of insurance spending in six of the world’s leading energy markets alone.

“Depending on the scenario, annual expenditure on risk management services – including conventional insurance, derivatives and structured products – could reach between $1.5bn [£930m] to $2.8bn by 2020.”

Such figures present a mouth-watering opportunity for the insurance industry – as long as it can negotiate the challenges thrown up by the different renewable energy technologies in use, the vast array of territories in which they are located and the changing political landscape in each.

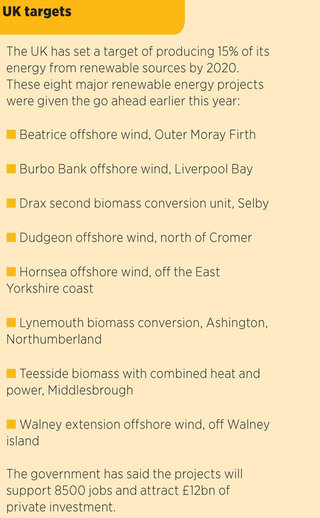

In the UK, onshore wind has established itself as a reliable source of renewable energy, with more than 160 wind farms in Scotland alone. But despite the fact that onshore wind is a tried and tested technology, it continues to present challenges for insurers. “There are probably half a dozen insurers with the capacity and appetite to underwrite onshore wind projects,” says Derek Skinner, head of renewable energy at broker Bruce Stevenson.

Although it has been almost 25 years since the first wind farm in the UK became operational – in Cornwall in 1991 – Skinner says there are still issues when it comes to placing the required professional indemnity cover. He explains: “PI underwriters have not invested in understanding the renewable energy sector, and when they get the risk they do not always understand what it involves, so there is an issue there at the moment.”

Once insurance is in place, there are then the challenges associated with handling claims – particularly in relation to providing a fast and efficient response to onshore wind turbines that are often in remote areas, with poor access and difficult weather conditions to be overcome.

“Breakdown is the biggest cause of loss,” says Stephen Morris, underwriting manager at HSB Engineering Insurance. “It is mechanical and electrical breakdown that is the main issue for wind. Almost 70% of our losses come from this.”

Given the nature of the technology, the stresses it is under and the harsh environment in which it operates, understanding exactly what wind turbines can cope with is essential if underwriters want to make a return.

Steve Kingshott, RSA’s global director for renewable energy, says this technical understanding is what the insurer has built its portfolio on. He comments: “It is around the engineering and the technology, as well as understanding the fail rates and knowing how prone they are to problems.”

Modelling weather patterns, understanding contractor capabilities and assessing logistical issues are all important, but Kingshott believes insurers need to differentiate themselves via their technical understanding of the technology if they want to write profitable business in the renewable energy sector over the long term.

Major challenges

This level of understanding becomes more important as the scale of the challenges rises – and in the offshore wind sector there are some major issues to contend with. Turbines are bigger and more numerous, and the logistical issues around construction and maintenance get magnified by the deep-water environment.

As a result, placing some cover can be problematic – as Michael Kingston, partner at law firm DWF, explains: “In offshore, in deeper water it is very difficult to insure for business interruption cover. Delay in start-up cover is also a problem because of supply chain complexities and the availability of vessels if something goes wrong.”

Other offshore renewable energy technologies – such as wave and tidal – also remain beyond the bounds of most insurers’ appetites. Despite pilot projects ranging from the Pentland Firth to Ramsey Sound off the coast of Wales, they are still in the research and development phase and have not yet gone into commercial power generation.

Insurer appetites are also limited in terms of how much they are willing to cover. Some underwriters avoid any renewable technology that is not generating power commercially, while others may offer cover for external hazards related to a project such as weather but avoid the internal risks like the machinery and its efficacy.

Away from wind and back on dry land, the biomass and anaerobic digestion sector plays host to a number of unique issues with which underwriters continue to wrestle. In the main, the problem is that no single design has come to the fore – so projects and operating plants tend to be individual in their nature.

Kingshott outlines the problem: “The issue on biomass is there are many different technologies. There are also many different things being burned, including wood pellets, domestic waste and animal waste, and there are lots of different plants involved in burning it.”

Many of these plants have been converted from fossil fuels, while there are also purpose-built plants in this sector – which is problematic in terms of assessing risk. As Kingshott says: “There is not yet a single technology or a single set of standards.”

Many of these plants have been converted from fossil fuels, while there are also purpose-built plants in this sector – which is problematic in terms of assessing risk. As Kingshott says: “There is not yet a single technology or a single set of standards.”

From an insurance point of view this diversity creates problems, and demands each individual plant is assessed in detail. But where insurers can be involved at an early stage, their intervention makes these projects more insurable.

A case in point was the Runcorn Thermal Power Station, which is the biggest waste-to-energy plant in the UK. “We got involved in the design of the thermal plant in Runcorn, and design changes were made to the plant to make it insurable,” explains Kingshott.

This early engagement is not something that always happens in the design phases of a renewable energy project but, where it does, it helps avoid issues that will potentially leave underwriters unable to offer cover. It also means effective risk management measures on everything from security to fire prevention can be installed as part of the build.

At the moment there are a number of developers trying to get biomass projects off the ground so that they can have them completed before the subsidy rate is changed in March 2017, when the current system of subsidies will no longer be available to new generators. These plants take two or three years to build, so unless they start now and finish soon enough to take advantage of the current subsidy rate, the finances of the project may not add up.

The politics surrounding renewable energy are a massive issue for developers. Investor uncertainty over the long-term support for particular types of renewable projects also makes life very difficult for insurers. “The energy sector relies on certainty,” says Kingston. “These projects are capital-intensive and they need stability, but unfortunately the energy sector has turned into a little bit of a political football. It is of such critical importance to society in the UK that there should almost be an unwritten convention that there is a consensus in energy policy.”

Unfortunately this is not the case – and with a general election looming there are many questions around what future support will look like, where it will be most generously applied and what sort of format it will take.

Increased competition

Despite the ongoing technical challenges and changing environment, the renewable energy sector in the UK has become increasingly competitive – and there are some who have decided to pull in their horns as a result.

“Onshore wind in the UK has become ridiculously competitive,” says Fraser McLachlan, chief operating officer at managing general agent G Cube. “The cost per megawatt has gone down, the market is soft and people are writing for income. We have been around this business for long enough to know where our burn price is and in the UK we have withdrawn from quite a lot of the business.”

McLachlan says he has just completed a due diligence project on the Middle East and points to the large number of solar projects – many in excess of $1bn – that are currently in the planning stages. Similarly, he says G Cube has a lot of interest in South Africa and Latin America, where it can get better premiums and higher deductibles and can write business on a sustainable basis.

Although international and emerging markets may offer exciting opportunities in the renewables sector, they do not come without their own risks. Underwriters who have previously focused on the UK should not think their skills are immediately transferable to other territories.

Ian Harris is a senior underwriter at Ace whose focus is on the UK and Ireland. He comments: “With the best will in the world, and even with the best catastrophe modelling, you are not going to know everything about the local market. You are not going to know, for example, if a specific area is prone to windstorms, or if the reason no one wants to write certain sorts of risks is that there is an enhanced malicious damage risk. If you write risks outside of your business environment then you are adding an extra peril, which is your lack of intimate knowledge of that local market.”

Where insurers are looking to get involved in these international projects, one of the major issues will be getting a handle on the ability of local contractors to undertake and complete the work. Investigating the level of contingency planning they have in place is essential, given that any large project is going to run into a certain number of problems to overcome.

“You get a lot of very high-profile contractors and on paper they could all do the job,” says McLachlan. “But the trick is then being able to manage a problem when something goes wrong and having the infrastructure and resource to do so. If they do not, it can lead into massive exposures for delay in start-up and advance loss-of-profit claims.

“For us, labour control and due diligence on contractors – and the original equipment manufacturers – is going to be absolutely critical when it comes to getting it right in the Middle East.”

Even with this cautious approach, G Cube will not be prepared to write more than 10% of the large solar risks McLachlan has been looking at, given how high the potential losses could be.

Whether Swiss Re is right in its forecast for the sector is, in some ways, a moot point. The fact is the renewable energy sector will continue to see huge levels of investment at a global level and in an array of technologies.

For insurers the challenge will be not only in understanding the risks associated with those technologies in each of the territories in which they are deployed, but also in assessing their appetite and pricing points to ensure they can make a profitable return from renewable energy in the long term.

This article was published in the 16 October edition of Post magazine.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@postonline.co.uk or view our subscription options here: https://subscriptions.postonline.co.uk/subscribe

You are currently unable to print this content. Please contact info@postonline.co.uk to find out more.

You are currently unable to copy this content. Please contact info@postonline.co.uk to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@postonline.co.uk

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@postonline.co.uk