Analysis

Australia: Disaster averted?

Australian insurers facing possible requests from the government to help fund mitigation projects say it is not a cost they should bear and that any funding will eventually be paid for by policyholders.

Hacking: One step ahead

The problems caused by the question of making company systems more secure from hacking continues to prey on the industry’s mind. But just how can they stop unauthorised people from breaking down their digital doors?

Hong Kong's radical health insurance overhaul

Hong Kong’s health insurers are concerned as the government prepares its Voluntary Health Insurance Scheme writes Nicky Burridge.

Legal Update: Ping-pong - it's not table tennis

Andrew Parker anticipates amendments to unfinished legislation as this parliament draws to a close

Neuro-rehabilitation: Fit for purpose

With changes afoot for the Rehabilitation Code, it is vital that all parties go back to basics and understand how best to navigate the issue

In Series: Corporate Risk: Threats on the radar

Insurers can help companies with their risk management strategies by offering products that anticipate the challenges of the future

Insurance CEOs: Picking the perfect candidate

Hiring a new CEO can be a problem for an insurance company, with standards of demonstrated experience continually rising and the regulator wielding its influence over appointments. So, how do they pick the right person for the job?

Europe: Investing in creating digital value

Accenture's Roy Jubraj and Thomas Meyer examine how European insurers can create effective digital transformation strategies.

In Series: Corporate risk: Upping the pace

How can commerical insurance industry innovation better keep up with the ever-increasing speed of technological advancement and changing demands from UK businesses?

Digital Distribution Strategies: Walking with dinosaurs?

The challenges insurers face as customers embrace the ‘omnichannel experience’ are enormous. How can they move from a disconnected multichannel approach to a genuinely integrated service before they face extinction?

Europe: Q&A with German risk managers

Walter Minnik speaks to German risk managers Christian Boehm of Freudenberg Group and Lutz Kalkofen of Hochtief, about current issues surrounding the European market

Historic Child Abuse: Ensuring justice

The increasing number of historic child abuse cases is placing new demands on public authorities, insurers and liability adjusters seeking the truth

Legal update: Mitigation actions could cut your losses

Michael Burns welcomes a court ruling on the effect of a claimant’s action in mitigation of their loss

Unoccupied Properties: Building an unoccupied checklist

Unoccupied properties are a growing problem for insurers so what should brokers bear in mind when presenting information to underwriters?

Floods: One year on

After the government announced properties in council tax bands H and I would be eligible for Flood Re, how are insurers prepared for future flood events and what have they learned since 2014?

Five trends for 2015: Looking to the future

With 2014 receding into the distance, Post took a moment to consider which – if any – of the trends that emerged in 2014 will reach fruition in the next 12 months. Will Back to the Future’s vision of streets awash with hover boards become a reality? Will…

China's changing motor market

China is introducing more flexibility to its motor insurance market, creating opportunities for foreign insurers to differentiate on price and product design, writes Nicky Burridge

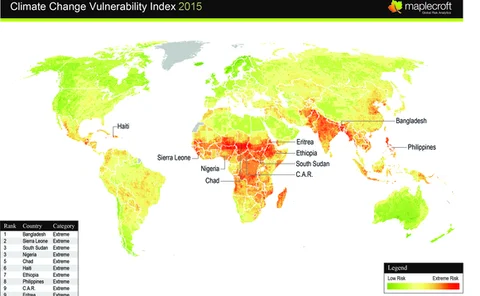

Climate: How does climate change cause food insecurity and conflict?

As weather patterns change and temperatures rise, issues such as climate-induced food insecurity are destined to become an increasingly important driver of conflict and social unrest

Russian Roundup: Q4 2014

Insurance companies Allianz and AIG closed their business arms in Russia while Rosgosstrakh closed its Belarusian subdivision and continued to receive fines for breaching the law for selling compulsory motor third party liability insurance certificates

Review of the Year: Broking

Post’s annual review of the broking market gathered thoughts from Ten, Brokability, Yutree, UIB and Arthur J Gallagher to reflect on 2014 and predict what 2015 will bring in terms of regulation and consolidation

Review of the Year: General Insurance

General insurers including Ageas, Aviva, Direct Line, Axa and LV reflect on a year that started with immense flood claims, saw the Competition and Markets Authority’s final report into motor insurance and ended with a warning by the regulator on the use…

Legal Update: Disabled Claimants: Compensation for the disabled

Chris Gambs on a recent case ruling on future loss of earnings claims for partially disabled claimants

Charities: Charity begins at home

Charities require business interruption cover like any other business – but how can they make sure they aren’t paying too much?

Roundtable: Customer retention: How to use data to keep hold of customers

Can the way data is used and analysed in the insurance industry pave the way to customer loyalty?