Analysis

Matthew Crummack, Domestic & General

Matthew Crummack was appointed CEO of the Domestic & General Group in October 2021 and is leading the transformation of the 113-year-old business.

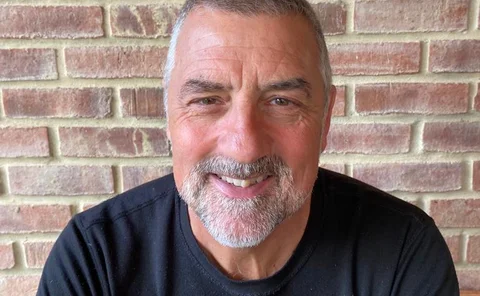

Paul Jewell, Bridgehaven

Bridgehaven CEO Paul Jewell launched the UK’s first hybrid fronting insurer in the summer of 2023 and his business is already on track to achieve £400m to £500m of gross written premium by the end of 2025.

Chris Lay, Marsh McLennan

Chris Lay, CEO of Marsh McLennan UK, isn’t afraid of taking the regulators to task over the disproportionate amount of red tape restricting the growth of broking businesses.

Neil Galjaard, Markel UK

Neil Galjaard, Markel’s managing director in the UK, leads its retail business across insurance, tax, and legal services, collaborating with brokers, accountants and lawyers.

Paul Morden, Munich Re

Paul Morden is CEO of Munich Re’s life reinsurance strategy in the UK and Ireland.

Steve Tooze, Extinction Rebellion

Steve Tooze, spokesperson for climate pressure group Extinction Rebellion, is a man with a plan for direct action against insurance companies. His approach has made the other movers and shakers on Insurance Post's Power List 2025 sit up and take notice.

Hannah Gurga, ABI and Graeme Trudgill, Biba

In joint 21st place on Insurance Post's Power List 2025 is Hannah Gurga, director general of the Association of British Insurers, and Graeme Trudgill, CEO of the British Insurance Brokers’ Association, who have both fought tirelessly to slash the amount…

Nick Turner, NFU Mutual

Unlike Labour chancellor Rachel Reeves, NFU Mutual Group CEO Nick Turner understands what it takes to satisfy the farming community.

Jason Harris, QBE

Jason Harris is an underwriter by background who started his career in offshore energy and joined QBE as CEO for international in October 2020.

Ant Middle, Ageas

Ant Middle became CEO at Ageas UK in June 2020 and launched a four-year strategy focused on personal lines insurance, accelerating the provider's profitable growth.

Adam Winslow, Direct Line

Since becoming CEO of Direct Line Group, Adam Winslow has dealt with two rivals bidding for his business, produced a plan to return the insurer to profit, and launched new personal lines products.

Jason Storah, Aviva UK

Jason Storah was appointed CEO of UK and Ireland general insurance in August 2023 and has swiftly managed to shake up the market with takeover talks.

Jason Richards, Swiss Re

Jason Richards is responsible for managing Swiss Re’s property and casualty reinsurance business in the UK and Ireland.

Drazen Jaksic, Zurich UK

Drazen Jaksic, who became CEO of Zurich UK in January, replaces Tim Bailey on Insurance Post’s Power List after his move to become CEO of Zurich’s global life protection business.

Matt Brewis, FCA

The Financial Conduct Authority’s director of insurance, Matt Brewis, has the power to move the market but he hasn't shaken up the rules much – for better or worse – in the last 12 months.

Jane Kielty, Aon UK

Jane Kielty became Aon’s UK CEO at the start of 2024 and is spearheading the organisation’s ambitious growth plans.

Aki Hussain, Hiscox

Aki Hussain, CEO of Hiscox Group, has accelerated innovation and created an inclusive culture to keep the insurance business in pole position in the market.

David Ross, Ardonagh Group

David Ross, CEO of The Ardonagh Group, is a man with a growing global reach who continues to shun social media.

Kevin Spencer, Markerstudy

Founder of Markerstudy Kevin Spencer considers the creation of the group, one of the fastest growing companies in the UK, to be his proudest achievement.

Colm Holmes, Allianz UK

Colm Holmes joined Allianz in December 2021 and is a man with a mission: to make his business the number one insurer in the UK.

Alistair Hargreaves, Admiral

Alistair Hargreaves replaces Cristina Nestares on Insurance Post’s Power List after succeeding her as UK insurance CEO at Admiral Group in 2024.

Michael Rea, Gallagher

Michael Rea was appointed CEO of Gallagher’s UK & Ireland broking business in January 2024 and leads more than 6000 colleagues.

Tara Foley, Axa

Tara Foley was appointed CEO of Axa UK & Ireland in September 2023 and used her first full year in the top job to ensure the sector continues to become more diverse and inclusive, plus she pushed for the UK government to increase the country’s resilience…

Ken Norgrove, RSA

Ken Norgrove has more than 35 years’ experience in the insurance industry and a history with RSA that dates back to 1986, but it is how he is shaping the business today that earned him fourth place on Insurance Post’s 2025 Power List.