Liability

Blog: Importance of robust agency arrangements in insurance sales and supply chains

With Axa suing Santander for £624m over its payment protection insurance policies, Caroline Harbord, partner, and Charlie Paddock, trainee solicitor at law firm Forsters, discuss the importance of robust agency arrangements in insurance sales and supply…

LV, Axa and Keoghs smash fraud ring; Flood Re launches Build Back Better; Howden buys SPF; Go Insur backs start-up Insuristic

For the record: Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Blog: Ocean investment is critical to protect the welfare of ecosystems

As Axa and WTW join a new global finance ecosystem designed to channel funds into coastal and ocean natural capital by 2030, Chip Cunliffe, biodiversity director at Axa XL and co-chair of Ocean Risk and Resilience Action Alliance, takes a deep dive into…

Insurers to save £2bn as Vnuk law set to be axed by the end of June

The controversial Vnuk law, which could have created an extra £2bn a year of costs for the insurance sector, is expected to be axed by the end of June as Motor Vehicles Bill passes through House of Lords’ committee stage with no amendments.

Revolut in Allianz tie-up; AUB confirms Tysers talks; QBE poses resilience challenge; and Rear’s SPAC Financials Acquisition Corp to raise £150m via listing

For the record: Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

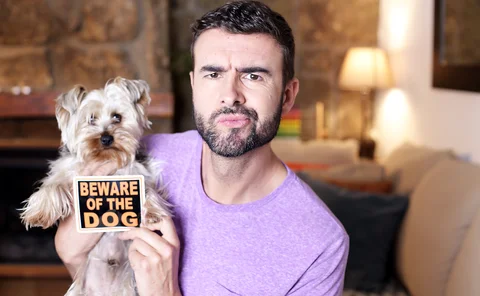

Blog: The curious incident of the dog and the bite crime

Rebecca Conway, chief legal officer at Arc Legal Assistance, reflects on the increase of pets in households in the UK during lockdown, and what route policyholders can pursue if they are bitten by a dog that has not been trained or socialised enough.

Robust e-scooter regulation needed at 'earliest opportunity', sector urges Shapps

Four insurance industry trade associations have called on the government to bring in 'robust' legislation around the use of e-scooters as soon as possible if they are to be permitted beyond current trials.

Judgment closing dental liability loophole could herald insurance step change

A Court of Appeal judgment has closed a legal loophole that meant dental practices were not liable for injuries caused by individual dentists during treatment, potentially further opening up the market to commercial insurers.

Inside Out: A former BI insider looks at what the insurance industry should have learnt in the past two years

Post invites industry insiders affected by key issues they believe insurance is getting ‘inside out’ to share their perspective and state their case for change. Here, a former business interruption insider talks about how the recent Corbin & King v Axa…

HSBC extends Marsh deal; Zurich to set up transformation Centre of Excellence; Pool Re completes expanded terrorism placement; and Howden acquires again

For the record: Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Beazley cautious on property business as it works to 'get arms around' climate change

Beazley has said that it will not seek to increase exposure in its property book in the immediate term, as it takes measures to enhance its ability to assess and price for the effects of climate change.

Analysis: Illegal e-scooters hit insurer claims reserves to tune of 'hundreds of thousands'

Insurers are already reserving ‘hundreds of thousands’ of pounds for collisions involving third-party private e-scooters – but the vehicles aren’t legal on public roads yet.

EY: investor confidence in UK FS hits new high; James Hallam backs broker start-up; Lloyd's approves insurtech Syndicate and Pen inks £300m QBE deal

For the record: Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Allianz: cyber usurps BI as biggest risk; Direct Commercial gets PE investment; Ford and ADT reveal JV Canopy; and Tractable launches AI Property

For the record: Post wraps up the major insurance deals, launches and investments of the week.

Aviva to boost regional underwriting headcount by 10%

Aviva has started a recruitment drive to add at least 40 underwriters working on regional mid-market business, chief distribution officer Gareth Hemming told Post.

Allianz in regional commercial restructure; GRS extends global reach with adjuster tie-up; Movo buys three; and Tractable strikes two new deals

For the record: Post wraps up the major insurance deals, launches and investments of the week.

Analysis: Loss adjusters’ BI avalanche experience – from portals to what comes next

Loss adjusters have praised the use of technology to meet Covid-19 related business interruption claims and called for more enhancements as the market adapts its systems and approaches.

Review of the Year 2021 – Insurers

Post spoke to major insurers to get their thoughts on the highs and lows of 2021.

SRG launches MX Underwriting MGA with £100m target for 2022

Specialist Risk Group has unveiled managing general agent MX Underwriting bringing together GB Underwriting, CLS Risk Solutions and Blackrock Insurance Solutions with Lime Insurance.

Podcast: What next for the OIC portal?

In the second of a two-part podcast series Insurance Post reflects on the initial Official Injury Claim data covering the period from 31 May to 31 August.

Podcast: Reflections on the initial OIC portal data

In the first of a two-part podcast series Insurance Post reflects on the initial Official Injury Claim data covering the first three-month period.

HMRC's IPT decision hailed as good news for brokers

Her Majesty’s Revenue & Customs has opted against making brokers liable for any unpaid Insurance Premium Tax where they used IPT unregistered insurers and against introducing IPT on brokers’ administration fees.

Analysis: Astroworld - liability and legacy

The Astroworld tragedy could have a lasting impact on US legislation, experts have predicted, as a liability battle around the fatal event emerges.

Zurich launches 'industry first' resilient property drive; Alan & Thomas acquires Aquilla; two Lloyd's syndicates approved; and Aviva reports uptick in commitments to net zero target

Post wraps up the major insurance deals, launches, investments and strategic moves of the week.