Home insurance

Briefing: Compare the Market fine a fitting end to a sorry chapter

“Ridiculous”, “harmful”, “anti-competitive”. These were the words used by Money Supermarket managing director of financial services Graham Donoghue to describe wide ‘most favoured nation’ clauses during a Competition Commission hearing back in 2013.

Compare the Market fined £17.9m by competition watchdog

Compare the Market has been fined £17.9m for its use of most favoured nation clauses.

Amanda Blanc-led review finds flood cover dearth

A flood insurance review led by Aviva CEO Amanda Blanc has found that a significant proportion of households eligible for Flood Re supported policies are not offered flood cover.

Brightside to put MGA Kitsune into run-off

Brightside has decided to put car and van managing general agent Kitsune into run-off less than two years after it was launched, CEO Brendan McCafferty has revealed.

Analysis: FCA takes the ‘nuclear option’ on dual pricing

In September, the Financial Conduct Authority published its long-awaited final report on pricing practices in the home and motor insurance markets, putting forward a package of measures that its interim CEO described as “probably the most radical shake…

Ageas sells Tesco Underwriting stake for at least £125m

Tesco Bank will pay Ageas at least £125m for its 50.1% stake in Tesco Underwriting as it confirmed the deal first revealed by Post last year.

Ardonagh strikes deal for Lloyd Latchford

Ardonagh is buying specialist retail broker Lloyd Latchford Group for £15.3m, Post can reveal.

FCA defends predicted £1.06bn dual pricing compliance cost

The Financial Conduct Authority has estimated it will cost the insurance sector £1.06bn over 10 years to comply with its package of measures designed to tackle dual pricing in the general insurance market.

A-Plan buy cost 'approaching £700m', Howden confirms

Howden’s purchase of A-Plan for “approaching £700m” has created a business of scale that is a true “challenger broker”, according to David Howden, CEO of Hyperion Insurance Group.

Two potential bidders pull out of race for AA

Shares in the AA opened more than 17% down this morning as private equity firms Centrebridge Partners Europe and Platinum Equity both confirmed they would not be bidding for the business.

Dual pricing ban 'probably most radical shake-up of GI industry in years': FCA's Woolard

The Financial Conduct Authority has proposed banning retail motor and home insurance dual pricing in a package of measures designed to enhance competition, give fair value to customers and increase trust.

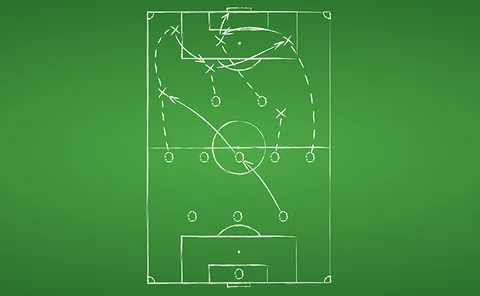

Analysis: Changing tactics - The strategy behind Aviva's aggregator push

In August, Aviva announced that it was aiming to roll out a motor insurance product under its main brand on price comparison websites this autumn.

FCA to issue insurance value data measures policy statement this autumn

The Financial Conduct Authority expects to publish a policy statement this autumn following its consultation on compelling firms to report value measures data on most general insurance products.

Interview: Ant Middle, Ageas

Ant Middle, UK CEO of Ageas, talks to Stephanie Denton about restructuring, refocusing and remaining positive throughout the challenges thrown up by 2020 so far

AA secures four week extension for takeover talks

The three groups eyeing up a takeover of the AA have been given an extra 28 days to make an offer for the business with the deadline moved back from today.

Insurer home and motor pledges to continue until end of October

Home and motor insurance pledges made by the Association of British Insurers to support customers during the Covid-19 crisis will remain in place until at least 31 October following an extension.

Interview: Craig Thornton, Lloyds Banking Group and ABI

In June, Craig Thornton, general insurance and protection director at Lloyds Banking Group, was announced as the chair of the Association of British Insurers’ General Insurance Council, replacing Andy Watson as he stood down as CEO of Ageas UK.

Abbey and Autoline merger to create £119m GWP acquisitive firm

The merger of Northern Ireland brokers Abbey Insurance and Autoline Insurance as Abbey Autoline on 1 September will create a £119m gross written premium growth focused firm that has an eye for striking takeover deals, managing director of the newly…

Flood Re's Andy Bord on how climate change will affect flood risk

After the floods last November, I visited Doncaster to see how the town was coping with the aftermath of the floods. While I was impressed by the swift recovery efforts of insurers, the local council and government agencies, I was also struck by just how…

Second quarter performance pushes Ageas UK COR below 100%

Ageas UK has reported a post-tax profit of £22.8m for the first half of 2020 reversing a loss of £2.7m in the first quarter.

Aviva planning aggregator motor roll out after Confused pilot

Aviva is targeting this autumn for the next stage of its move onto aggregators after a trial with Confused, Colm Holmes, Aviva CEO of general insurance, told Post.

Direct Line open to acquisitions and partnerships: CFO Tim Harris

Direct Line Group remains open to inorganic growth from acquisitions and partnerships despite the Covid-19 impact, DLG chief financial officer Tim Harris has confirmed.

PE firms circle AA for takeover talks

Motoring group The AA has confirmed holding takeover talks with three private equity parties as it discusses “a wide range of potential refinancing options”.

NFU Mutual rejects accusation it misbehaved by deducting government grants from payouts

NFU Mutual has defended itself against claims by self-catering accommodation businesses that it is unfairly deducting the value of government grants from coronavirus-related payouts.