Flooding

Environment Secretary opens review into insurance cover after recent Yorkshire floods

The government is set to investigate the extent to which those affected by the recent flooding in Yorkshire did not have sufficient insurance cover.

Analysis: Revisiting 'Flood Re Plus' for businesses

The idea of a Flood Re Plus scheme has been mooted by Airmic as a solution for those businesses that struggled to obtain flood cover

Covea's Adrian Furness on pursuing a career in insurance

Historically people have 'fallen' into insurance rather than seeking it as a career. Adrian Furness, chief operating officer at Covéa Insurance, asks if this is changing.

Blog: Event cancellation - the role of the loss adjuster

Last month’s torrential rain that saw hundreds of homes and businesses in Yorkshire and the Midlands devastated by flood water served as a stark reminder of the destructive impact that the weather can have. But this can also have a severe impact on…

Q&A: Graham Smart, The Chartered Institute of Loss Adjusters

Graham Smart has replaced Luke Exford as president of the Chartered Institute of Loss Adjusters. He spoke to Hiriyti Bairu about how loss adjusting has evolved over the years and the challenges facing the sector.

Airmic moots possibility of 'Flood Re Plus' to cover commercial properties

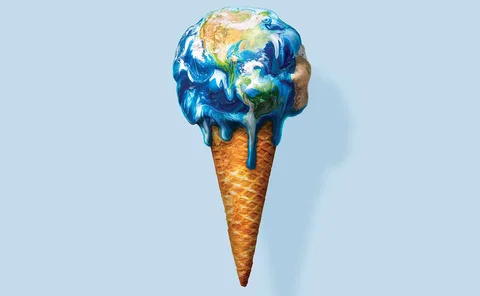

The onset of climate change and the increased risk of flooding that comes with it could necessitate a ‘Flood Re Plus’ covering commercial properties, the UK risk management association Airmic told Post.

This week in Post: hanging by a thread

This week, Transport for London has revoked Uber’s licence to operate in London, causing fear among the capital residents who often rely on the app-based service to get them home safely after a night on the town.

Flood damage payouts from Yorkshire and the Midlands set to top £100m

Insurance payouts to people affected by recent floods in Yorkshire and the Midlands are expected to reach £110m, the Association of British Insurers has estimated.

Analysis: Review of the Year 2019

It feels as if 2019 was an uncomfortable year for the general insurance market as it never quite seemed to grasp control of its own destiny. Wherever you look, carefully laid plans were derailed by the unexpected – and often unwanted – intervention of…

Scrap target times and frivolous bureaucracy to help vulnerable customers, suggests DLG claims head

Insurers need to ditch standard practices like target times in contact centres and avoid unnecessary bureaucracy if they are to meet the needs of vulnerable customers, according to Direct Line Group managing director of claims Jessie Burrows.

This week in Post: Driving out distraction

Road Safety Week marked the launch of Post’s Driving out Distraction campaign, in which we are urging the industry to pay attention and pull over rather than using hands-free devices while driving.

Direct Line predicts £10m hit from November floods

Direct Line Group will see £10m in claims from flooding in the North of England, its early estimates suggested.

This week in Post: Deluge, diversity and misdemeanours

More than 800 houses have been evacuated due to flooding and many of those families won't be back in their home for Christmas. Flood warnings are still in place and there are reports that flood defence equipment is being stolen.

Flood forecasting insurtech launches nationwide

Insurtech Previsico has launched nationwide, aiming to support insurers, brokers and their customers across the whole of the UK with live actionable flood warnings.

ABI and Biba at odds over ring-fencing insurance taxes for flood defences

Insurance trade bodies have found themselves at loggerheads over whether part of insurance premium tax should be ring-fenced for flood defences.

North of England floods could cost industry £80m to £120m: PWC

Flooding in the north of England could cost insurers between £80m and £120m, PWC has estimated, though this could rise.

Blog: Flood-damaged cars - are insurers missing a trick?

Earlier this year parts of the UK were under water and serious flood warnings are becoming more commonplace, writes Jane Pocock, managing director, Copart UK.

Insurers brace for some sizeable losses as UK barraged by floods

UK flooding is expected to continue, as insurers and loss adjusters have warned of a "spike" in both personal and commercial lines claims as a result.

Analysis: Reservoir dams - a water-tight insurance risk?

With almost 3000 dams supplying drinking water to towns and cities they are a common feature in the UK countryside. However, when heavy rain in August threatened the integrity of the emergency spillway at Toddbrook Reservoir an emergency evacuation of…

Lloyd’s supports Habitat for Humanity to aid cyclone hit Malawi

Lloyd’s Charities Trust has joined forces with Habitat for Humanity Great Britain as part of its ongoing response to emerging risks to communities around the world.

Analysis: How far has the insurance industry evolved to respond to natural catastrophes?

Sedgwick loss adjusters arrived on Great Abaco Island in the wake of Hurricane Dorian aboard a Black Hawk helicopter on 6 September.

This week: All at sea

The fraudulent claims we’re used to hearing about involve banged-up cars and invented cases of whiplash. Ones involving oil tankers, pirates, the Admiralty Judge, and statements given in places as far-flung as Aden and Manila are somewhat harder to come…

Insurers respond to Finsbury Park flood claims

Insurers have begun responding to claims after a burst pipe led to flooding in Finsbury Park.

How climate change is impacting the risk profiles of financial institutions

A closer look at how board-level considerations of climate change must shift, and the potential consequences if they do not