Driverless cars

LV's Martin Milliner on the future of vehicle technologies

Wtih the European Commission looking to mandate 19 vehicle technologies to be fitted as standard, Martin Milliner, director of claims at LV, asks how ready the public and insurers are for advanced driver assistance programmes.

More innovation to come from Axa as it looks towards driverless cars

Axa has said it will be looking to increase its involvement with insurtech and ‘lead the way’ on driverless cars, following recent insurtech partnerships.

Insurers in call for clarity over autonomous and assisted technology

Insurers have today highlighted the potential dangers of the ambiguities surrounding autonomous driving and driverless technology.

Public divided on driverless cars, study reveals

Over a third of the public are sceptical of driverless cars, with only four in 10 ready to embrace the technology.

Three out of four concerned over insurer use of driverless car data

Three out of four motorists are concerned that insurers will use data from driverless cars to justify raising premiums.

Effective use of Big Data is growing challenge for insurers, ABI warns

Using Big Data will be the biggest challenge to insurers James Dalton, director of general insurance policy at the Association of British Insurers has said.

Motor Report docu-video - Fraud, driverless cars, young drivers and claims

The Motor Report is out - but what do the experts think of the findings?

IBIS 2017: Connected cars will send first notice of loss 'as early as next year'

Connected cars will dispatch emergency services and send first notice of loss as early as next year, predicted Sean Carey, president of SCG Management Consultants.

IBIS 2017: GM not ruling out insuring its autonomous vehicles

US car manufacturer General Motors is not ruling out providing insurance for its future autonomous vehicles.

Aviva's Maurice Tulloch on all that insurtech hype

With technology reshaping the insurance industry, incumbents need to disrupt the very business models they helped create in order to meet fast-changing customer expectations, writes Maurice Tulloch, CEO, international insurance, Aviva.

This Month in Post: General election, summer holidays and expert opinions

With another General Election looming, the insurance industry will likely be holding its breath on what the incoming government will make of the insurance premium tax, the Ogden rate and whiplash reform.

Insurers ‘will need to assess’ safety of driverless cars handover systems

Driverless car manufacturers should consider installing ‘phased handover’ functions to minimise the disruption when vehicles switch from autonomous to manual driving.

Live blog: Motor Insurance World 2017

Post's Motor Insurance World, as it happened.

This Week: Menace, manifestos and managing general agents

There is a menace in my house in the form of water. First it caused problems in my kitchen (as many of you will remember) and now it's found its way out of the bathroom.

Blog: Driverless cars are just three chicanes away

Before driverless cars take to the road, the public needs to be reassured about their safety and cyber risks need to be mitigated, write Deloitte partners Gurpreet Johal and Nigel Walsh. But once liability is clarified, insurers stand to benefit.

Roundtable: ADAS and the next step to driverless cars

Autonomous vehicles, drones and cyber innovation have been hogging much of the discussions as to how insurers can prepare themselves for the technology of the future. What can easily be overlooked is the complex technology that already exists in the…

This Week in Post: Extinction and distinction

This week I took my toddler to see the roaring animated T-rex at the Natural History Museum. “Raaa!” she growled, before wimping into her father’s arms, unaware dinosaurs are actually extinct.

Europe: Insuring robots (and against robots)

Robots are becoming ubiquitous. Do we need specific insurance? And do they?

Blog: Driverless cars, potential for cyber mayhem?

Nothing is truly resilient against hacking. There’s always a trade-off between utility and the cost of protecting those systems according to Mark Hawksworth, technology specialist practice group leader at Cunningham Lindsey.

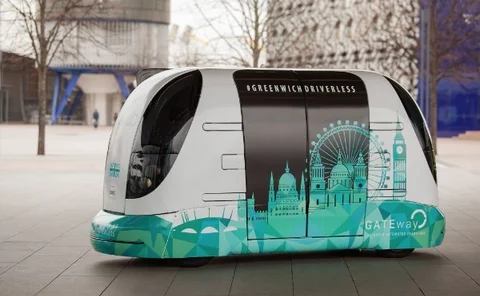

XL Catlin to participate in 30-month autonomous vehicle trial

XL Catlin is involved in a project that will trial a fleet of autonomous vehicles between Oxford and London alongside a consortium of partners.

Driverless cars law stalled by general election

The government’s driverless cars bill will have to be reintroduced from scratch in the next parliament after the general election.

Blog: Whiplash, discount rate, Vnuk and driverless cars on the road ahead

The Association of British Insurers’ announcement that motor insurance premiums hit their highest recorded levels at the end of last year is another reminder that change is long overdue in the personal motor market. That’s coming but will it be enough?

RSA takes part in study of autonomous vehicle prototype

RSA is taking part in a study of prototype autonomous vehicles as driverless shuttlebuses take to London roads.

This week in Post: highs, lows and running with the wolves

It has been a week of highs and lows in our household. My son went on his first Cub sleepover and earned the honour of becoming a Sixer. I, meanwhile, returned to the X-ray machine.