Regulation

Tulsi Naidu appointed chair of FCA practioner panel

Zurich UK CEO Tulsi Naidu has been appointed as chair of the Financial Conduct Authority’s practitioner panel.

Lamp customers see first FSCS pay outs

The Financial Services Compensation Scheme has today made its first payments to policyholders affected by the collapse of Lamp Insurance.

CRL identifes potential alternative insurer to take on Alpha policyholders after missed deadline

BCR Legal Group appointed representative CRL failed to find an insurer to take on its Alpha policies by the May deadline set by the Financial Services Compensation Scheme, but it has been given more time as the firm has a replacement in its sights.

ABI accuses consumer panel of 'overlooking practicalities' in dual pricing automatic upgrade recommendation

The Association of British Insurers has criticised a proposal from the Financial Services Consumer Panel for an automatic upgrade rule to tackle dual pricing, saying it “overlooks the practicalities of underwriting and product choice.”

ABI backs review on child sexual abuse claims limitation law

Exclusive: The Association of British Insurers believes that there is a need to review limitation law surrounding cases of child sexual abuse and has pledged to engage with the Independent Inquiry into Child Sexual Abuse, survivors and lawyers.

Financial services Brexit bill approaches £4bn as preparations slow

Major financial services firms had spent nearly £4bn preparing for life after Brexit as of 31 May, according to EY.

CMA price cap proposals could put pressure on 'weak profitability' in insurance

A proposal by the Competition and Markets Authority to place targeted price caps could change pricing and marketing models and put pressure on profitability in the insurance sector, Fitch Ratings has warned.

Brexit: UK motorists unlikely to get compensation from hit and runs in France

Exclusive: Motorists driving in France will not be able to claim compensation if they are struck by an uninsured or untraced vehicle after Brexit.

FCA warns of unauthorised motor broker

An unauthorised car insurance broker has been targeting customers in the UK, the regulator has warned.

Allianz's Stephanie Smith on cultural transformation in the industry

One year on from the introduction of the General Data Protection Regulation and most companies have successfully adopted the new requirements. But Stephanie Smith, chief operating officer at Allianz, says while hefty fines and the risk of reputational…

This week: Court's adjourned?

Arnold Schwarzenegger’s decapitated head kicked off its last outing on our television screens this week as the FCA counts down to the PPI deadline on 29 August. However, as one battle comes to an end, another may be just beginning.

Insurers could face fines under plans to tackle dual pricing 'rip-off'

The Competition and Markets Authority could be given the power to impose fines on companies in breach of consumer law without going to court, under government proposals announced today.

Fee caps for CMCs could lead to 'clear consumer detriment'

The Association of Consumer Support Organisations has urged the Financial Conduct Authority to consider how the market adapts to regulatory change before considering fee caps on claims management companies.

Home premiums could rise 22% if FCA acts on dual pricing

Home insurance premiums could rise 22% for new customers if the regulator moves to axe dual pricing, analysts have warned.

Insurtech Gateway targets up to £30m of investments with insurer fund

Incubator Insurtech Gateway has launched a new investment fund today backed by insurance companies that is aiming to raise and inject up to £30m in start-ups between now and 2023.

CII launches historic website as Insurance Museum project gathers momentum

Exclusive: The working group looking into the feasibility of an insurance museum in the Square Mile has rejected the idea of hosting exhibits within the new Museum of London in favour of a stand-alone site, should there be enough interest.

FCA issues warning over clone broker

A clone broker is operating under the name Wentworth Insurance Brokers, the Financial Conduct Authority has warned.

Blog: MoJ fixed costs consultation is whack-a-mole for policymakers

The government’s plan for fixed recoverable costs to be applied to most civil cases - including personaI injury - might fix some problem areas in claims. Minster Law's legal services director Rachel Di Clemente asks if it will create more.

Insurers call for compulsory sprinklers in schools

Automatic fire sprinklers should be compulsory in all new build schools, insurers have warned.

Lawyers issue warning over fixed recoverable costs proposals

Extending Fixed Recoverable Costs could lead to claimants playing the system, lawyers warn.

FSCS will assist policyholders following Lamp collapse

The Financial Services Compensation Scheme will protect customers of Lamp Insurance following the unrated insurer’s demise.

Government launches review into 'fairness' of IPT

HM Revenue & Customs has published a call for evidence on the operation of Insurance Premium Tax to ensure it continues to operate “fairly and efficiently”.

Interview: Airmic board members

In March, Airmic appointed four new board members. Post spoke to them about how risk management has changed during their time in the profession, what they need insurers to deliver and emerging risks

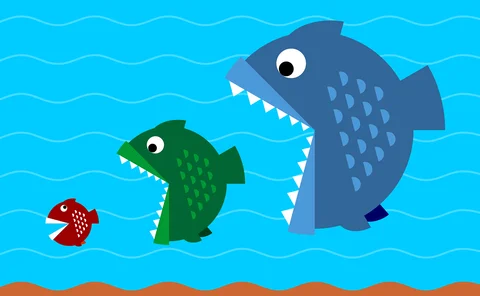

This week in Post: Big fish, little fish, cardboard box?

It might be the name, but this week I’ve spotted some similarities between Gibraltarian unrated insurer-facing-liquidation Lamp Insurance and an angler fish, sparking some strange and slippery debate in the office.