Regulation

Solvency II - Cost V opportunity: A cost worth paying

After complaints over the amount of management time needed to comply with Solvency II and the costs associated with this, Rachel Gordon asks if the grumbles are justified.

New regulator must understand differences

The insurance industry has claimed it must be distinguished from the wider financial services sector under the coalition government's widespread regulatory reform.

Regulatory reform will not hamper Solvency II

Financial Secretary to the Treasury Mark Hoban has denied suggestions the government's regulatory reform will hamper the UK's implementation of Solvency II.

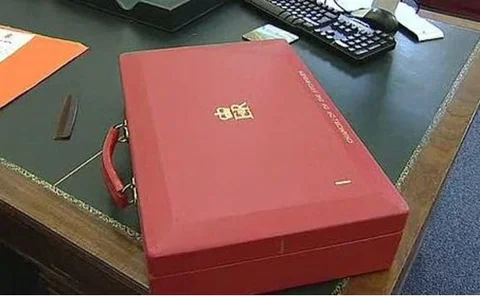

BUDGET 2010: Osborne pledges to consult on CFC rules

Chancellor George Osborne has announced plans to launch a consultation into the reform of Controlled Foreign Company rules this summer.

BUDGET 2010: ABI: IPT rises “regrettable”

The Association of British Insurers has warned the government that the increase to Insurance Premium Tax outlined in today’s budget could have unintended consequences.

BUDGET 2010: PwC: Budget delivers some positives

Pricewaterhouse Coopers claims the emergency budget has delivered a number of positives for the insurance industry.

BUDGET 2010: FSB critical of Osborne NIC plans

The Federation of Small Businesses has expressed its concern at the Chancellor George Osborne’s failure to reverse the rises in Employer National Insurance Contributions.

BUDGET 2010: PwC: Budget delivers some positives

Pricewaterhouse Coopers claims the emergency budget has delivered a number of positives for the insurance industry.

BUDGET 2010: Chancellor reveals corporation tax cuts

Chancellor of the Exchequer George Osborne has pledged to cut corporation tax by one percent for the start of the next financial year.

Aviva chair joins Cable's business advisory group

The members of the Business Advisory Group established last month have been confirmed. The group will act as an informal advisory board to the Secretary of State, Business, Innovation and Skills, Vince Cable.

Mexican body joins international trading agreement

The International Association of Insurance Supervisors has admitted Comision Nacional de Seguros y Fianzas, Mexico to the list of signatories of the IAIS Multilateral Memorandum of Understanding.

Mexican body joins international trading agreement

The International Association of Insurance Supervisors has admitted Comision Nacional de Seguros y Fianzas, Mexico to the list of signatories of the IAIS Multilateral Memorandum of Understanding.

Reduced US collateral requirements to benefit reinsurers – Moody’s

While most counterparty security procedures are getting stricter, global reinsurers are poised to benefit from reduced collateral requirements, which will be credit positive for their bondholders, according to the ratings agency.

Deregulation of health and safety legislation is going to be "challenging"

This is according to Garwyn, who has responded to Lord Young's announcement that he will be conducting a review of health and safety legislation to crack down on the compensation culture in the UK.

CBG issues IPT warning

CBG Group has warned that increasing the level of insurance premium tax is likely to deter customers from buying adequate cover.

IUA calls for "well informed" insurance regulator

The International Underwriting Association has called on the coalition government to ensure that there is a strong insurance prudential regulator as part of its shake-up of the financial services industry.

China regulator aims to open more investment channels for insurers

The China Insurance Regulatory Commission (CRIC) is discussing loosening the investment channels of insurance companies, according to newswire the Xinhua News Agency.

XL Re becomes first Bermudan reinsurer to qualify as eligible in Florida

XL Re, the global reinsurance operations of XL Capital has announced that it has received approval from the Florida Office of Insurance Regulation (FIR) to qualify as an “Eligible Reinsurer” in Florida, pursuant to requirements set forth by the Florida…

Hoban outlines regulation plans

Mark Hoban, financial secretary to the Treasury, has addressed the House of Commons following George Osborne's Mansion House speach last night on the breaking up of the FSA.

Compliance firm urges industry to work together for regulatory change

Wolters Kluwer Financial Services UK managing director Dean Curtis has urged the financial services sector to pull together to ensure the Chancellor George Osborne’s regulatory changes are effective.

Personal injury disputes jump 32% in two years

The number of personal injury claims continues to surge despite reforms to regulate claims handling companies, according to statistics obtained by Sweet & Maxwell.

FSA break-up: What's your view?

The Chancellor of the Exchequer has sounded the death knell for the Financial Services Authority.

US targets two insurers, banks, shipping and energy sector in new Iran sanctions

The US Treasury on Wednesday blacklisted more companies – putting them off limits to US businesses - including two insurers.