United Kingdom (UK)

Ageas and Ardonagh’s Uris extend deal with £200m contract

Ageas has signed a four year contract with Uris Group to provide cover for a number of specialist personal and commercial lines risks.

GFSC reveals incoming CEO as Samantha Barrass bows out early

Samantha Barrass had been set to serve her terms as Gibraltar Financial Services Commission CEO until August 2020, but the regulator’s incoming CEO will now take over at the start of next month.

Inshur appoints former Uber boss

Inshur has appointed Simon Logan, former RSA and Uber legal boss, as VP of commercial and legal.

Interview: Steven Wallace, McLarens

Newly appointed managing director for UK & Ireland Steven Wallace discusses expansion plans, consolidation within the market and Brexit

Sex discrimination a 'significant' insurance issue as claims and payouts increase

#MeToo is becoming a “significant” industry issue as harassment and discrimination claims rise, while in some countries the surge means claims are moving outside of traditional employment practices liability insurance, lawyers have warned.

Claims Consortium completes acquisition of Stream

Claims Consortium Group has completed its acquisition of Stream Claims Services.

Ed hires Simon Stovell as divisional director

Simon Stovell has joined Ed as divisional director for its risk solutions team.

Startupbootcamp's Sabine VanderLinden on inclusion in insurance

In June, I discussed the topic of ‘inclusion in insurance’ at The Women in Insurance Global Conference in New York, writes Startupbootcamp CEO Sabine VanderLinden. The topic is now taking centre stage in our industry as alongside their credit score,…

Blog: Lloyd's Delegated Authority Management Survey – how is the sector performing?

Mazars recently published its sixth Lloyd's Delegated Authority Management Survey designed to monitor development and changes in the specialised area of the Lloyd’s insurance market. Michael Campbell, director of delegated authority reviews at Mazars,…

Lamp liquidator disclaims further policies

Lamp Insurance’s liquidator has disclaimed health and guaranteed asset protection policies supplied through two brokers.

Keoghs swoops for Newcastle firm’s insurance practice

Keoghs has bought Newcastle-based Sintons’ defendant insurance business.

RSA appoints Ireland CEO

Kevin Thompson has been appointed as CEO of RSA Ireland, succeeding Ken Norgrove.

Tim Harris to join Direct Line as CFO

Direct Line Group has appointed Tim Harris as chief financial officer.

Analysis: Rash of cancelled cover highlights the role of the broker

A rise in the volume of UK businesses that have cancelled at least one type of insurance cover over the past few years has served to highlight the importance of the broker’s role in the insurance buying process

Leadership shakeup at Tokio Marine Kiln

Charles Franks has stepped down from his position as CEO at Tokio Marine Kiln, as he assumes new responsibilities within the Tokio Marine Group.

This week in Post: Culture vultures

At the Monte Carlo annual rendezvous this week, Lloyd’s chairman Bruce Carnegie-Brown said the corporation was ready to “hang” perpetrators of bad behaviour after its culture survey revealed some “sobering” results.

Zurich receives dressing down on small business payment practices

For the second time in less than two months an insurer has come under fire from the Small Business Commissioner, after the SBC looked into a vehicle repair specialist’s complaint and made recommendations to Zurich to improve its payment practices for…

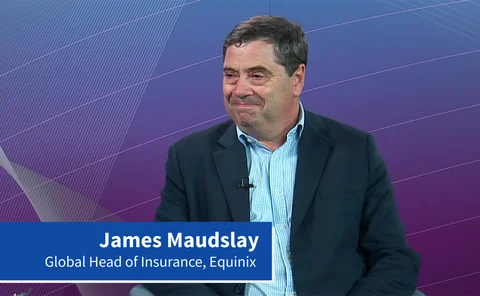

Insurance Technology Summit Q&A: Equinix global head of insurance James Maudslay

Ahead of the Post Insurance Technology Summit, Post editor Stephanie Denton sat down with Equinix global head of insurance James Maudslay to discuss the role inter connection and ecosystems play in giving insurers a digital edge.

Advertising Feature: Is a lack of expertise at bodyshops putting drivers at risk?

New technology can save lives, but Neil Atherton, sales and marketing director at Autoglass, fears a lack of expertise at bodyshops could put drivers at risk and lead to increased insurance claims.

Clear Insurance acquires Morrison Insurance Solutions

Clear Insurance Management has acquired Alcester-based Morrison Insurance Solutions, its largest acquisition to date.

Aspen appoints UK CEO

Clive Edwards will become CEO of Aspen UK and Aspen Managing Agency.

CRL ceases writing new business following Alpha collapse

CRL, which recently failed to rehome 20,500 Alpha Insurance structural and latent defects policies, is no longer writing new business.

Hyperion to merge RKH and Howden

Hyperion will bring Howden and RKH together under a single management structure.

Pool Re CEO predicts greater ILS diversification beyond US property-cat

Julian Enoizi, CEO of UK government-backed terrorism reinsurer Pool RE, has predicted that the insurance-linked securities market will diversify away from US property-catastrophe risks, into other “difficult to insure perils” such as terrorism.