United Kingdom (UK)

Blog: Are MGAs a desirable route to market for insurtechs?

There is so much talk about collaboration between insurtechs and insurers or managing general agents, but John Price, chief operating officer at Scheme Serve, asks is this collaboration out of design or necessity and are managing general agents a good…

Amanda Blanc to join Aviva board

Former Zurich and Axa boss Amanda Blanc is to join Aviva as a non-executive director on 2 January, the insurer has confirmed.

Axa achieves disability confident leader status

The Department for Work and Pensions has awarded Axa UK disability confident leader status.

Trov and Lloyds release renters' insurance app

Insurtech Trov has launched an end-to-end digital renters' insurance application, in partnership with Halifax Home Insurance, part of Lloyds Banking Group.

Foil expands cyber sector focus team to include technology

The Forum of Insurance Lawyers has expanded the remit of its cyber liabilities sector focus team to include insurers’ and law firms’ use of technology in claims handling, as well as claims law related to cyber cover and digital processing.

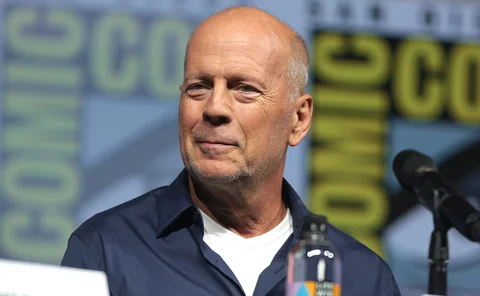

Blog: What do Norwich Union and John McClane have in common? They Die Hard

The general public might still be split on whether Die Hard is a Christmas movie or not. Jonathan Swift wonders if the resurrection of Norwich Union will prove just as divisive.

Editor's comment: Driving the message home

At 11-years-old my son is getting to the stage where I’m an embarrassment to him. A kiss goodbye at the playground is not cool, in fact he’d prefer to be dropped off out of sight of the school, if possible, and he can’t wait until he is allowed to walk…

Roundtable: Getting over the back office blockade

Digitalisation remains the juggernaut that insurers cannot sidestep if they are to remain relevant. However, they risk falling behind more agile rivals if they fail to modernise their back offices: the beating heart of the business which might be in need…

Cuvva aims to bypass PCWs and brokers as it raises £15m

UK-based insurtech startup Cuvva has raised £15m in series A funding round as it prepares to launch a pay-monthly product at the beginning of next year and disrupt the existing insurance status quo

Finch and ICB set to merge under Verlingue brand

Finch and ICB Group will merge and rebrand under the name of their French parent company, Verlingue.

Cobra’s Alto posts pre-sale loss as costs bite

Alto Insurance, the holding company for Cobra, has reported a pre-tax loss of £2.1m for the final year ahead of its sale to PIB.

A-Plan paid £16.5m for Endsleigh

Broker A-Plan paid Zurich £16.48m for Endsleigh when it completed the deal to buy the specialist broker in March last year.

A-Plan breaks £100m revenue barrier and set to open 100th office

A-Plan will be opening its 100th office within the next two months, CEO Carl Shuker told Post.

Blog: Future-proofing the broker model

The insurance market seems stuck on the idea that digitisation and a move to app-based insurance products, will negatively impact brokers. Inzura CEO Richard Jelbert explains why they should be seen as an opportunity instead.

Analysis: Discount rate disparity - will the Scottish market become unfavourable?

With the Ogden discount rate in Scotland set to remain at minus 0.75%, could insurers in the country start to feel squeezed, and begin to be squeezed out?

This week in Post: hanging by a thread

This week, Transport for London has revoked Uber’s licence to operate in London, causing fear among the capital residents who often rely on the app-based service to get them home safely after a night on the town.

Driving Out Distraction Pledge – Why is IAM Road Smart supporting this campaign?

Neil Greig, director of policy and research at IAM Road Smart, explains why multi-tasking at the wheel is a myth and urges employers to keep their staff safe on the road.

Trade Voice: Airmic's Julia Graham on being prepared

Preparation is key in the current harsh market says Julia Graham, Airmic’s deputy CEO and technical director, as she explains how timely planning, skill, good communication and transparency can demonstrate the real value of insurance.

Floods and dual pricing warnings push up home premiums: Consumer Intelligence

Average home insurance premiums have climbed at a rate higher than inflation over the past six months, Consumer Intelligence research has found.

Ex-Quindell shareholders gear up to take Watchstone to court

Watchstone has been served a letter before action by law firm Harcus Parker, on behalf of shareholders who suffered a loss when the company (then Quindell) was forced to revise its 2013 accounts.

Insurer claims bosses testify before child abuse inquiry

Insurers remain uncertain over how any change to limitation law surrounding child sexual abuse cases could affect claims levels, an inquiry heard.

Gallagher set to buy up Capsicum Re

Gallagher is poised to snap up the remaining 80% of Capsicum Reinsurance Brokers, having signed heads of terms with the business.

Interview: Jonathan Hewett, Thatcham CEO

Jonathan Hewett replaced Peter Shaw as CEO of Thatcham Research in January this year. He spoke to Post about Thatcham’s 50th anniversary, vehicle 2.0 and the trends in the motor industry.

Ex-Aviva director Russell launches 'Fit Bit for business' insurtech Brisk

An insurtech fronted by a former Aviva director is in negotiation with a trio of major insurers about adopting its solution, which co-founder and CEO James Russell describes as “Fit Bit for business”.