Association of British Insurers (ABI)

Cold calling ban on solicitors could be dropped by SRA

The rule which bans solicitors from cold-calling members of the public could be dropped as part of the Solicitors Regulation Authority handbook review, prompting lawyers and insurers to urge against the move.

One third of UK firms now buy cyber cover

UK firms are taking increasingly seriously the need for adequate cyber insurance, with 29% of businesses now in the process of buying cover.

DWF joins Aviva in urging the government forward on whiplash reforms

Law firm DWF has joined Aviva in urging the prime minister to progress the promises made in last year’s Autumn Statement on whiplash reforms and the raising of the small claims limit.

ABI fraud conference highlights the risk of cyber-fraud

Medium and expanding businesses have the most to fear from cyber-fraud, according to speakers at the Association of British Insurers Fraud Conference.

£25m worth of fraud uncovered by insurers every week

£25m of potential frauds are being uncovered every week by insurers, the Association of British Insurers has claimed.

Blog: Two perspectives on the He For She initiative

Insurance is the first industry to sign up to the UN Women's global He For She initiative. We sent two reporters, a man and a woman, to cover the event and invited them to offer their thoughts.

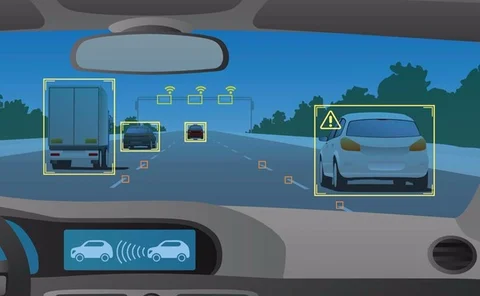

Insurers should not be liable for software faults in driverless cars, ABI warns

Insurers should have a right to recover claim costs when a mechanical or software defect within a driverless car causes a crash, the Association of British Insurers has said.

Hundreds of key sites across England still threatened by flooding as government releases flood review

As many as 530 key infrastructure sites across England are still under threat from flooding, according to a new report.

Industry concerns are top of the agenda at party conferences

Brexit, the cost of regulation, increased spending on flood defences and uninsured drivers will be the hot topics that the insurance industry wants addressed ahead of this year's political party conferences.

Interview: Dany Cotton, London Fire Brigade

As director of safety and assurance at the LFB, Dany Cotton talks to Stephanie Denton about diversity, technological advances and what insurers can do to help prevent fire loss

Editor's comment: Fire lessons

Humphrey the golden hamster, our most recent literary favourite, has just taught my son to ‘stop, drop and roll’ if he ever finds his clothes on fire, which has led to many impromptu practices at various locations… just in case.

Roundtable: Autonomous driving systems need standards

Can insurers keep up with the pace of change powered by Advanced Driver Assistance Systems – especially when it comes to repairs? Post, in association with Autoglass, hosted an industry roundtable to find out

Justice minister to speak on whiplash reform at ABI motor conference

Newly appointed justice minister Oliver Heald will give the keynote presentation at the Association of British Insurers’ Motor Conference.

Week in Post: trampolining, brokers in the dark and cake

I was reminded of the insurance industry this surprising sunny bank holiday weekend when I was required to sign a waiver to accept and acknowledge my participation in Gravity Force trampolining could entail "known and unknown risks that could result in…

ABI takes to ITV to discuss motor insurance fraud and premium rises

The Association of British Insurers’ director of general insurance policy James Dalton appeared on ITV Tonight yesterday discussing insurance fraud and motor premium rises.

Blog: Insurance for autonomous cars - from concept to reality

It has now been 11 years since a team from Stamford University won a $2m (£1.5m) prize for developing ‘Stanley’, a fully self-driving car.

ABI and Access to Justice go to war over motor premium rises

Access to Justice has called out the Association of British Insurers over its defence of motor premium rises in the face of falling whiplash claims.

Home insurance premium rises remain low despite flood costs

Increased competition is limiting annual home insurance price rises to just 1.6%, research has revealed.

Spotlight: Fraud at the vets

Pet claims fraud is on the rise and insurers are developing or contemplating new tools against it: a database, cross-referencing strategies and pet photographs on policy documents.

ABI rejects claim that insurers are 'profiteering' over savings on personal injury claims

The Association of British Insurers has defended the rise in motor premium costs, despite the insurance industry saving over half a billion pounds as a result of a drop in personal injury claims.

Are there too many roadblocks for rehabilitation to really work?

Getting injured people back on their feet through rehabilitation can be a win for claimants as well as insurer defendants but, when working within the naturally adversarial legal system, roadblocks can quickly spring up.

Home insurance premiums remain competitive despite extreme weather conditions

Despite extreme weather and flooding, the cost of combined buildings and contents insurance policies is at its lowest in four years.

Fire claims are getting more costly for insurers

Despite a continuing reduction in the number of fires, the cost of blazes is actually increasing. What can be done to educate the public about the risks involved?

ABI appoints Tim Harris to chair of PFT committee

Tim Harris, group finance director of Royal London, has been appointed as the new chair of the Prudential, Financial and Taxation Committee and is joining the the Association of British Insurers'board.