Association of British Insurers (ABI)

Spotlight: Vehicle hire: What is best practice for today’s insurance market?

A positive customer experience is never more important than at the point of claim. James Roberts, business development director for insurance at Europcar UK, explains how following best practice in replacement car hire can create this.

Week in Post: Cancelled flights, closed doors and canned ads

My dad was one of 400,000 passengers affected this week by air traffic control delays, bad weather and a backlog in employee holidays for the delay, which lead to budget airline Ryanair cancelling 50 flights a day for the next six weeks.

The ABI's James Dalton on why the discount rate is not a job done yet

Insurers scored a victory on the discount rate but still have work to do, says James Dalton, director for general insurance policy at the Association of British Insurers.

Nicky Morgan urges Chancellor to make a decision on long-standing insurance contracts before Brexit

Chair of the Treasury Committee, Nicky Morgan MP, has written to Chancellor Philip Hammond on the issue of how cross-border insurance contracts will be managed after Brexit.

Insurers issue warning after Ryanair cancellations leave 400,000 grounded

Insurers have urged grounded Ryanair customers to seek compensation from the airline in the first instance rather than their travel insurance policies.

Motor claims costs hit £2bn in Q2

Motor insurers paid out £2bn in claims in Q2 2017, according to the Association of British Insurers.

Insurers prepare to tackle grey areas of GDPR as consultation opens

Concerns have been raised in the industry over grey areas regarding the implementation of the General Data Protection Regulation.

Covéa's Lisa Meigh on why the apprenticeship levy is not just another tax

Many companies have written off the apprenticeship levy that came into force in April as another tax but Lisa Meigh, director of HR and Learning at Covéa Insurance, sees a pot to further future generations of insurance workers.

Insurers rejoice at new Ogden formula on Twitter

Insurers took to Twitter to express their satisfaction with the new mode of calculation for the discount rate, which the government unveiled today.

Live blog: Ogden discount rate reform

Follow reactions to the draft reform to the Ogden discount rate reform in our live blog.

Industry welcomes draft reform on Ogden discount rate

Insurers have welcomed government plans to alter the way the discount rate is set in future.

Analysis: How data is changing pet insurance

Telematics and the use of Big Data has been commonplace in the young drivers’ segment of the motor insurance market. Now the same approach to data collection and analysis is being introduced to pet insurance

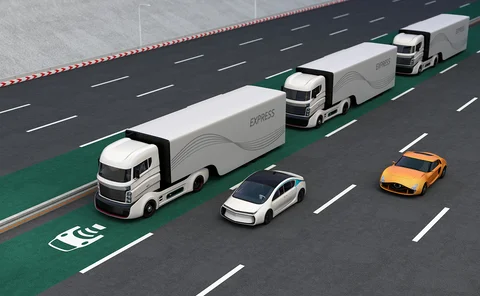

This Week in Post: Is there a driver on board this truck?

Living in South London, I’m in an on-off relationship with my broadband connection. My unreliable web access is irritating – although it is probably not as bad as in certain rural areas.

Vnuk ruling could lead to next hunting ground for CMCs, ABI warns

The Association of British Insurers has warned that the Vnuk ruling could lead to the next ‘lucrative hunting ground’ for claims management companies due to the vagueness of implications.

Analysis: Insurers want PI to be left out of the European services e-card

The European Commission wants to create a professional indemnity certificate for cross-border activities but insurers and brokers find the proposal unworkable.

BGL's Julia Walker-Smith on pooling intelligence and using data science to combat fraud

The insurance industry needs to share information about known fraud to prevent multiple teams from duplicating the same work, according to Julia Walker-Smith, associate director of fraud at BGL Group.

Driving test changes a 'missed opportunity' insurers say

Insurers have warned that planned updates to the driving test do not go far enough by not introducing graduated driver licensing.

Insurers throw cold water on regulator's reporting proposals

Insurers have criticised regulatory proposals which may increase reporting burdens for insurers.

Insurance Fraud Task Force calls on aggregators to use data sharing platforms

The Insurance Fraud Task Force has recommended that aggregators utilise software to weed out application fraud.

PRA to consider insurers' Brexit contingency plans

More than 400 banks and insurers have submitted Brexit contingency plans to the regulator, as the UK looks to negotiate a favourable exit deal from the European Union.

Businesses could face £17m fine for lack of cyber protection

Businesses that fail to protect their services from cyber attacks could face fines of up to £17 million, the Department for Digital, Culture, Media and Sport has warned.

Lord Justice Jackson scales back fixed recoverable costs proposal

Lord Justice Jackson has recommended extending fixed recoverable costs for fast-track legal cases and a new fixed cost intermediate track for claims worth up to £100,000.

Insurers in call for clarity over autonomous and assisted technology

Insurers have today highlighted the potential dangers of the ambiguities surrounding autonomous driving and driverless technology.

Analysis: The legacy of Grenfell Tower

How the blaze that killed at least 80 people promises to be one of the most complex claims in recent years