News

AI that could hit insurers with wave of court cases wins backing

Artificial intelligence-driven claims technology capable of causing a surge in court-bound insurance disputes has won the financial backing of a law firm backing and is now being piloted with a major loss assessor, Insurance Post can exclusively reveal.

AI video tech three times better than telematics at predicting risk

Artificial intelligence-powered video telematics technology is three times better at risk prediction accuracy than traditional telematics inputs.

FSCS intervenes as Premier Insurance enters administration

The Financial Services Compensation Scheme has stepped in to protect the 16,000 UK customers of Premier Insurance Company after it entered administration yesterday (14 October).

Aviva acts to close business interruption protection gap

Aviva is applying an automatic uplift to a 24-month business interruption indemnity period for policies issued through its Fast Trade platform in order to tackle underinsurance.

Watchdog outlines vet reforms that could cut pet insurance costs

The Competition and Markets Authority has today published its provisional decision in its market investigation into veterinary services for household pets in the UK.

Staysure assembles specialist team for AI chatbot

Staysure has assembled a team of conversational artificial intelligence specialists to continuously monitor and refine its AI webchat assistant Susi.

Ports and terminals face down ‘geopolitical storm’

Volatile geopolitics is keeping ports and their insurers busy as they work to keep increased risks adequately covered, Markel’s Dean Johnson has told Post.

‘Predator’ jailed after fraud bust involving pregnant woman

A man who manipulated women he met on dating sites – including one who was seven months pregnant – into taking part in staged car crashes has been sentenced to 20 months in prison.

Flood Re calls for property flood resilience to be made mainstream

Flood Re has kicked off this year’s Flood Action Week with a call for government, insurers, lenders and homeowners to work together to make property flood resilience a mainstream part of protecting property across the UK.

How has Trump’s approach impacted Net Zero plans?

Insurance Post is inviting ESG and sustainability leads at insurance companies to take part in a short survey examining how US President Donald Trump’s approach to climate and energy policy has influenced Net Zero strategies over the last year.

Allianz UK creates head of AI role

Allianz UK has appointed Mansoor Reehana to the newly created head of artificial intelligence role.

Zurich looks to leverage capabilities of engineering arm

Zurich Engineering is increasingly working with the insurer’s other business units to cross-sell services, its head of inspection services Adrian Reeve has told Post.

Big Interview: Graeme Trudgill, Biba

Graeme Trudgill, CEO of the British Insurance Brokers’ Association, talks to Insurance Post about volatility in the treasury, his thoughts on Rachel Reeves and why 2025 has been Biba’s “most successful year ever”.

Axa Commercial CUO David Ovenden to retire

Axa Commercial chief underwriting officer David Ovenden is set to retire and leave the insurer in the new year, Post can reveal.

Biba hails progress on speeding up authorisations

British Insurance Brokers’ Association CEO Graeme Trudgill has told Insurance Post that its members have been reporting quicker authorisations following changes implemented by the regulator.

Ferma appoints Nihoul as CEO

The Federation of European Risk Management Associations has appointed Laurent Nihoul as its next CEO, effective 1 December.

FCA defends ‘awful lot’ of work done amid Which? super complaint

The Financial Conduct Authority has said it has already done an “awful lot” of insurance work, in response questions about the Which? super complaint.

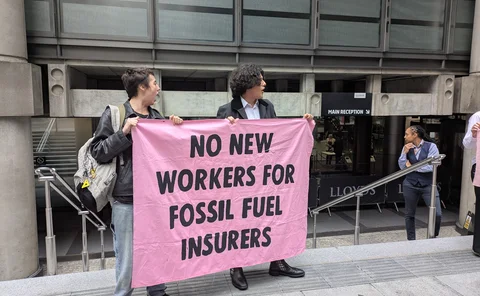

Protesters target Lloyd's careers event

Protesters have targeted the Dive Into Careers Conference at Lloyd’s today (10 October).

PIB buys Ross Gower Group; Zego x Clearspeed; Miller's head of P&I

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

IFB highlights policy fraud hotspots

The UK’s worst-affected areas for policy fraud have been revealed to help protect people at risk, following record-high cases of identity theft.

Biba developing universal fair value assessment template

The British Insurance Brokers Association is collaborating with other trade bodies to produce a standard template for fair value assessments, CEO Graeme Trudgill has told Insurance Post.

FCA warns against snap judgments on motor finance redress scheme

The Financial Conduct Authority has called for firms and individuals to “not rush to judgement” on its motor finance compensation scheme.

Sky-high car insurance premiums driving customers to break the law

Millions of drivers in the UK admit to getting behind the wheel without insurance due to the recent rise in premium costs, new research has found.

Motor market softening puts spotlight on service

Allianz is putting greater emphasis on service and claims delivery in commercial motor amid market softening, Mike Thomas, broker distribution director has told Insurance Post.