News

Beale calls for ‘urgent’ flood insurance reform

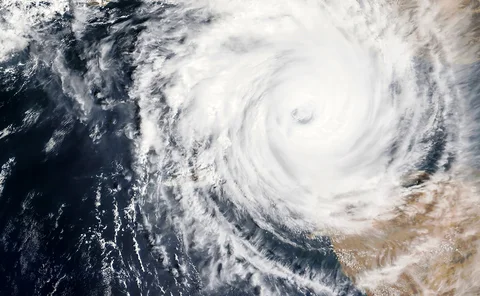

Hurricane Harvey and Irma both highlight the problem of inadequate flood insurance and need for reform in the United States, Inga Beale has said.

Report: Zhong An wins IPO approval in Hong Kong

Shanghai-headquartered Zhong An, China's largest internet general insurer, has gained approval for a listing on the Hong Kong Stock Exchange.

Lloyd’s catastrophe exposure driving ratings downgrade

The current catastrophe exposure of Lloyd’s has left the market vulnerable, Fitch Ratings has said.

ILS reform could be 'too little too late' for UK, says AM Best

The London Market may have missed its chance to become a centre for insurance-linked securities despite a working structure expected in the next few weeks, said AM Best’s head of Europe.

AIR pegs Irma insured losses at $20bn-$65bn

Hurricane Irma could result in insured losses of $20bn to $65bn, according to a preliminary estimate from AIR Worldwide.

150 jobs at risk in L&G's Hove office

As many as 150 jobs are reportedly at risk as Legal & General plans to move its GI unit from Hove to Birmingham.

Moorhouse appoints Asif John as group director of pricing

Moorhouse Group, which consists of online brokers Construct a Quote, Black & White and Xbroker, has hired Asif John as group director of pricing, actuarial and analytics.

Ogden decision to curb reinsurance pricing rises

Reinsurance pricing will only increase modestly at January renewals as a result of the government’s Ogden announcement.

Lloyd's report pegs Miami windstorm at $131bn as Irma heads for Florida

Hurricane Irma could see industry property losses of $131bn, according Lloyd's realistic disaster scenario analysis.

Government stands by level of broker regulation

The government has stood by the level of regulation levied on non-life insurance brokers in the UK.

Penny James succeeds John Reizenstein as Direct Line CFO

Direct Line has appointed Penny James to succeed John Reizenstein as chief financial officer.

This Month in Post: Discount, diversity and data

There was some good news and some bad news this week for the insurance industry.

LV commits to passing all Ogden savings onto motorists

LV has become the first insurer to commit to passing 100% of savings from the government’s Ogden legislation to motorists.

Aviva could see boost of up to £200m from Ogden discount rate reform

Aviva stands to make a one off gain of between £100m and £200m as a result of any future discount rate revision to 0-1%.

Legal & General partners with SSP to provide quoting platform for home insurance

Legal & General has partnered with SSP to develop a quoting process which uses big data to provide customers with a home insurance quote in 90 seconds.

Connected and autonomous vehicle testing hub receives £100m government investment

A co-ordination hub for connected autonomous vehicle testing has gained £100m in financial backing from the government's Connected Autonomous Vehicle investment programme in order to develop technology.

ERS launches agriculture operations unit

ERS has launched a 27-strong agriculture operations team as a result of increased demand.

Insurers rejoice at new Ogden formula on Twitter

Insurers took to Twitter to express their satisfaction with the new mode of calculation for the discount rate, which the government unveiled today.

Marsh restructures global management

Broking giant Marsh has unveiled a new global management structure, including new appointments to its executive management team as part of a global management shake-up, effective immediately.

Darag makes string of senior appointments

German run-off insurance company Darag has made a string of senior appointments.

Neos to provide home insurance quotes in under 30 seconds

Insurtech start-up Neos has introduced a propositions which it claims will provide customers with a home insurance quote in under 30 seconds.

Fintech continues to grow despite worries over attracting talent

Half of UK fintech firms are expecting revenue growth to more than double in the next year, with some expecting their next fund raising round to exceed £2.5bn.

Hurricane Irma insured losses to be 'significantly' higher than anticipated

Insured losses as a result of Hurricane Irma will be "significantly" higher than originally expected.

Live blog: Ogden discount rate reform

Follow reactions to the draft reform to the Ogden discount rate reform in our live blog.