News

No immediate threat to Allianz Bristol claims team

Personal injury claims handlers in Allianz’s Bristol office will not be placed under employment consultation as part of the Allianz-LV merger.

GRP acquires majority stake in Camberford Law

Global Risk Partners has acquired a majority stake in Bromley-based specialist MGA, Camberford Law.

Professional services most at risk of fraudulent instruction as incidents quadruple in 2017

Professional services are most at risk of fraudulent instruction as incidents reported to Beazley quadruple in 2017.

Dual pricing hitting vulnerable customers, says consumer watchdog

Dual pricing is hitting vulnerable customers hardest and insurers are part of the problem, according to research from Consumer Advice.

XL Catlin sees profits fall $1.4bn from nat cats

XL Catlin has reported a 58.7% increase in its loss in underwriting profit of across its property and casualty business during Q4 2017 compared to 58% in the same period during the previous year.

Marsh and McLennan see revenue up 6% at full year

Marsh and McLennan Companies has reported a 6% boost in full year revenue.

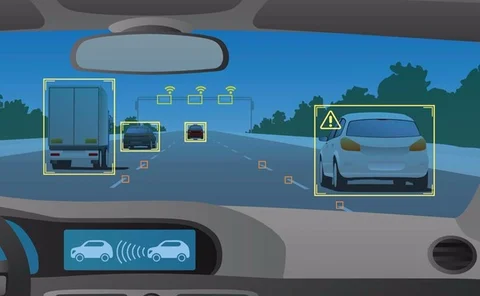

Driverless car data access a 'big priority' for ABI

Insurers need to have access to the accident data produced by connected cars, a conference heard.

Armour acquires Elite Insurance

Armour Group has completed its acquisition of Elite Insurance.

London market makes ‘significant step’ with new claims model

The London market has launched a claims model to simplify how claims are handled in an effort to improve client service and streamline claims agreement across the market.

Towergate Underwriting rebrands as Geo Underwriting

Towergate Underwriting has restructured and rebranded to become Geo Underwriting.

Clearer definition of autonomous driving needed: Thatcham

The government needs to clearly define what constitutes autonomous driving in order that insurers can properly determine liability, a conference heard.

Gang sentenced after £95,000 insurance scam

13 people have been sentenced for conspiracy to defraud insurance company 1st Central following an Ifed investigation.

MIB could help OEMs share accident data with insurers

The Motor Insurers’ Bureau could act as a platform for car manufacturers to share with insurers accident data generated by autonomous vehicles, a conference heard.

Investment by reinsurers into insurtech was highest in 2017

Reinsurers led the way in insurtech investment during Q4 2017, directly and through their corporate venture arms.

Axa's Williams warns motor insurers against becoming obsolete

Motor insurance is going to be "massively impacted” by the advent of autonomous vehicles, a senior Axa executive has warned.

Liiba chair calls for contract continuity post-Brexit

Contract continuity and cross-border market access will be essential post-Brexit, the London & International Insurance Brokers' Association chair said in a speech in Europe.

Volvo to launch autonomous cars in 2021

Volvo is “fairly confident” it can start selling autonomous vehicles to individual drivers in 2021, a conference heard.

Andrew Bailey and Canadian Astronaut confirmed to speak at Biba conference 2018

Andrew Bailey, CEO of the Financial Conduct Authority and Canadian astronaut Chris Hadfield are among the speakers confirmed for the British Insurance Brokers' Association's 2018 conference.

Urban Jungle develops API for home and contents insurance

Urban Jungle has developed an application programming interface which will be rolled out to partnering home insurers.

FSB launches broker venture following departure from Towergate deal

The Federation of Small Businesses is launching its own broker following the termination of its affinity deal with Towergate.

Penny Black's Social World - February 2018

Comfort, community, chorus and kung fu

Allianz to make up to 80 further redundancies in claims restructure

Allianz is placing a further 80 jobs at risk of redundancy amid a restructure of its claims operation.

LV prepares to overcome ‘challenges’ with re-entry to home market

LV has acknowledged it faces “challenges” in making profitable the home portfolio it acquired as a result of the Allianz personal lines merger.

400 jobs at risk following LV and Allianz merger

Up to 400 LV and Allianz employees are at risk of losing their jobs as a result of the companies’ strategic partnership.