News

Howden ‘doubles employee benefits’ business with Barnett Waddingham buy

Howden has struck a deal to buy Barnett Waddingham, a UK professional services consultancy across risk, pensions, investment and insurance.

Blueprint Two’s first phase pushed back to 2026

Lloyd’s and Velonetic have confirmed the phase one cutover for the London market’s Blueprint Two modernisation programme will not take place this year.

Zurich’s Clayton says let tech guide your fraud teams

Zurich’s head of fraud Scott Clayton has urged the industry to keep counter fraud a “people business”, but to allow technology to act as a guide.

London motor premiums fall by a fifth

The latest data released by WTW and Confused has revealed significant reductions in the average comprehensive motor premium, with London benefitting the most.

Fresh calls to scrap IPT surface after record receipts

Ahead of the Spring Statement later this week, there have been renewed calls for the government to reduce or totally scrap insurance premium tax in certain areas of the market.

Zego CEO predicts fully autonomous motoring ‘within 40 years’

Sten Saar, CEO of Zego, has said a “fully autonomous world is coming”, and that it will be here in 40 years as a “worst-case scenario”.

Howden cyber chief blames brokers for cyber insurance adoption lag

Shay Simkin, global head of cyber at Howden, has argued that brokers are to blame for the lack of adoption of cyber insurance.

Allianz x Volvo; Howden buys broker; Clear Group’s COO

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Ecclesiastical enjoys ‘record new business’ in 2024

Ecclesiastical’s expansion into new sectors helped it achieve “record new business wins” in 2024, as it nearly doubled its pre-tax profit from the previous year.

Insurers should not fear being called ‘woke’

Insurers shouldn’t fear accusations of virtue signalling when publicising their diversity policies due to the benefits it carries for employees, an audience heard.

Heathrow blaze sees insurers brace for claims

A fire at a substation near Heathrow airport this morning (21 March) has left more than 1000 flights cancelled, meaning insurers are prepping for an influx of claims.

Miller flags Trump’s impact on parametrics

Alice Glenister, head of parametrics at Miller, has called for the market to develop more data sources outside the US due to President Donald Trump’s cuts to federal scientific research bodies.

Lloyd’s CFO urges market not to get ‘carried away’

Lloyd’s chief financial officer Burkhard Keese has warned the market that it is not yet out of the woods, as it posted pre-tax profits of £9.6bn for 2024.

ABI Fire Safety Reinsurance Facility’s impact revealed

One year on from the launch of its Fire Safety Reinsurance Facility, the Association of British Insurers has provided an update on its impact.

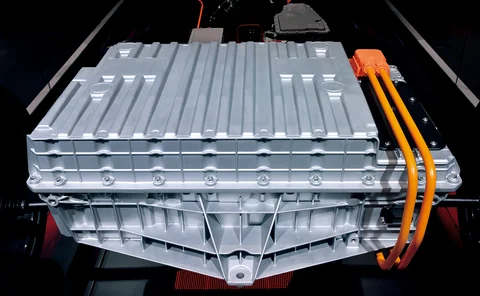

Axa calls for EV battery health certificates

Axa has published a report calling for the introduction of EV battery health certificates, arguing it could stimulate the UK’s used EV market by quantifying battery health and making vehicles easier to price for sale.

ManyPets back in growth mode after pull backs

ManyPets group CEO Luisa Barile has revealed the pet insurance provider is “back in growth mode” following a period of scale backs.

Hiscox offers update on plan for genAI underwriting

Hiscox and Google Cloud have shared plans to introduce generative artificial underwriting to more lines of business and explained what it took to get it working last year for terrorism cover.

IUA announces Matcham successor

Dave Matcham, the long-serving CEO of the International Underwriting Association, will step down at the end of the next month and is set to be succeeded by Chris Jones.

Stella’s White calls for rivals to add domestic abuse cover

Stella Insurance CEO Sam White is in talks with other motor insurance providers to add independent legal advice for women who experienced domestic abuse to their policies.

Lemonade CEO sees AI replacing engineers and actuaries soon

Lemonade CEO Daniel Schrieber has shared that artificial intelligence might be used to replace employees in engineering, actuarial, legal and compliance functions at the insurtech in the next few years.

Instanda teases ‘moonshot’ AI commercial lines product

Tim Hardcastle, CEO and co-founder of Instanda, has revealed plans for a “moonshot” complex commercial lines product later this year.

Sabre CEO calls for radical pricing changes

Geoff Carter, CEO of Sabre, has said two areas of business in which it operates are under-priced, and expects the market to increase prices soon.

Jensten Group launches broker network

Jensten Group has launched a new network headed up by director Jordan Maskell and designed to help brokers grow their businesses.

Sabre doubles profit with improved COR

Sabre has doubled its pre-tax profit for 2024 compared with the year before, despite only increasing gross written premium by 5%.