News

Ageas rolling out commercial and subsidence claims reviews in 2015

Ageas is set to follow the completion of a household claims review with an investigation into its commercial and subsidence panels next year, Post can reveal.

Liberty Insurance appointed lead underwriter for Hughes

Liberty Mutual's Irish subsidiary has agreed to become the lead underwriter of Hughes Insurance following its acquisition of the Northern Ireland broker announced yesterday.

Eiopa consults on Solvency II guidelines

The European Insurance and Occupational Pensions Authority is seeking responses to a consultation on the first set of guidelines for Solvency II legislation.

Ageas finalises household claims reshuffle

Ageas has completed a restructure of its household claims suppliers, appointing 21 members to its new panel.

Axa strikes data access deal with Callcredit

Axa has partnered with Callcredit Information Group giving the insurer better access to credit checking and behavioural data tools.

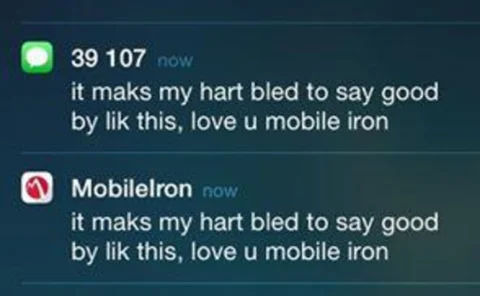

Aviva mobile phones hit by third-party cyber attack

Hundreds of Aviva staff were hit by a cyber attack on the insurer's mobile phone technology supplier last month.

Compton leaves KPMG to join Mapfre in China

KPMG's head of insurance consulting for Mainland China Tony Compton is leaving the consultancy to join Spanish insurer Mapfre's Chinese operations.

Hong Kong ferry crashes in Macau

A TurboJet ferry traveling from Hong Kong to Macau crashed into a breakwater in Macau harbour on Friday morning injuring 70 people.

England fans excluded from World Cup elimination insurance

Chinese insurer Ancheng Insurance is offering World Cup insurance for fans to compensate for the disappointment of being eliminated from the tournament.

Manchester City partners with Indonesian insurer

English Premiership football champions Manchester City are partnering with Indonesian insurer Jiwasraya.

Legal & General shuts Belfast office

Legal & General has confirmed the closure of its Belfast office with the claims and customer service work carried out at the branch moved to Birmingham and Ipswich.

Liberty Insurance acquires Northern Ireland broker Hughes

Liberty Insurance has acquired Northern Ireland broker Hughes Insurance, according to Post's sister publication Insurance Age.

Wunelli targets US after striking deal with Chinese insurer

UK telematics provider Wunelli has signalled its intention to launch into the American and Chinese insurance markets following its takeover by US firm Lexis Nexis.

19 staff impacted as Towergate shifts Leeds HNW business to Surrey

Towergate is shifting high net worth business carried out by Premier Home Solutions in Leeds to Surrey with up to 19 staff expected to be affected by the move.

Swinton promotes two to account exec roles

Swinton has made two promotions within its Manchester head office elevating Matthew Collings and Ben Travis to personal lines account executive roles.

Balbinot’s Insurance Europe presidency extended

The chief insurance officer of Generali will serve an additional year as president of Insurance Europe after a vote at the European insurance and reinsurance federation’s General Assembly in Malta.

Biba welcomes ‘encouraging’ competition proposals

The British Insurance Brokers’ Association has issued its support to proposals from the Competition and Markets Authority to improve the UK’s dysfunctional motor market.

CHO hails competition probe backing for modified GTA

The Credit Hire Organisation has welcomed the Competition Market Authority’s proposals this morning as a validation for the general terms of agreement held between insurers and credit hire firms.

ABI heralds credit hire cap plans

The Association of British Insurers has welcomed plans to limit the cost of providing a replacement vehicle as an at-fault insurer as part of package of reforms unveiled the Competition and Markets Authority.

Mass critical of CMA stance on repair networks

The Motor Accident Solicitors Society has condemned the findings from the Competition and Markets Authority, which said the watchdog would not investigate repair networks further.

CMA probe provides ‘little respite’ for insurers, says analyst

Proposals from the Competition and Markets Authority issued today will provide little support to the relief for insurers hoping to boost performance, according to Shore Capital analyst Eamonn Flanagan.

RSA names Bergander permanent Scandinavia CEO

RSA has handed the permanent leadership of its Scandinavian unit to interim chief executive Patrick Bergander.

Competition watchdog calls for credit hire cap and 'wide' MFN ban

The Competition and Markets Authority has today revealed proposed changes for the UK’s private motor insurance market in a bid to increase competition and reduce costs for drivers.

China Life in talks to buy Canary Wharf property

China's largest life insurer China Life is in talks to buy a Canary Wharf property which law firm Clifford Chance uses as its headquarters.