News

Cop27: WTW collaborates with Unicef to provide climate protection to 15 million children

WTW has joined forces with The United Children’s Fund to protect millions of children and families from climate change

Automated, standardised criteria on simple repair cases allows greater efficiency as complexity increases

Standardising and automating the criteria of whether a damaged part in a motor vehicle has to be repaired and replaced on simple repair cases allows greater efficiency as complexity increases, according to BDEOs head of sales Sebastián González.

Bank of England director calls for end to elite institutions

Bank of England executive director Victoria Saporta has warned financial services companies they need to do more to understand why women were impacted by the Covid-19 pandemic.

Consumer Duty success will be measured against number of complaints going to FOS

Financial Conduct Authority CEO Nikhil Rathi has said that the regulator has set itself a target to reduce the number of complaints going to the Financial Ombudsman Service on the back of the incoming Consumer Duty measures.

Cost of dated technology preventing rate changes revealed

The majority of insurers are at risk of prolonged financial losses due to the time taken to implement a significant rate change to their systems, according to research by Earnix.

Q&A: Dan Martin, Markel International

Markel International recently appointed Dan Martin as managing director of distribution strategies and business development. He speaks to Post about supporting Markel’s long-term ambitions of sustainable growth, and operational effectiveness by working…

Early notification ‘key’ to avoid increasing property damage claims costs

Insurers could see higher claims costs and longer claims lifecycles as inflation creeps into the casualty and liability space, but educating policyholders on importance of early notification is ‘key’.

'Off the shelf' products and 'ridiculous' coverage components driving up insurance prices: Aurora's Finn

Aurora, a digital commercial insurance platform for micro, small and medium-sized businesses, has gone live with the launch of its initial offering.

Roundtable: Digital claims - how can insurers best reap the benefits of digital claims for customers?

Digital claims processing offers significant benefits for both insurers and their customers. Based on this assumption, Post and PayPal held a roundtable to explore how the sector can keep up the momentum, and discuss what might be considered as a best-in…

Cop27: Three more insurers join Flood Re's 'Build Back Better' scheme

Flood Re CEO Andy Bord has announced that three more insurers have joined the Build Back Better Scheme, speaking at the COP27 climate summit in Sharm El-Sheikh on Monday.

Airmic tips parametrics for key role as members label traditional policies' nat cat coverage inadequate

Over three quarters of corporate insurance buyers think that traditional property damage and business interruption policies do not adequately cover natural perils, according to a survey by Airmic.

DWF’s Nicola Critchley elected Foil president

Partner at law firm DWF Nicola Critchley has been appointed president of Forum of Insurance Lawyers.

Analysis: What do the Resilience judgments mean for ongoing Covid BI claims cases?

After three major decisions were handed down in high-profile business interruption claims cases, Harry Curtis looks at those rulings, and asks what repercussions they could have for insurers and policyholders.

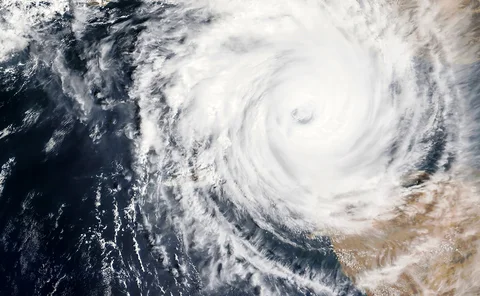

Hurricane Lisa causes first pay-out of Mesoamerican Reef Insurance Programme

The first pay-out has been made by the Mesoamerican Reef Insurance Programme when the Turneffe Atoll, off the coast of Belize, was hit by Hurricane Lisa on 2 November.

Court allows legal bodies to intervene in whiplash test cases

The Court of Appeal has given permission for the Association of Personal Injury Lawyers and Motor Accident Solicitors Society to intervene in two test cases that are set to help establish levels of compensation to be awarded for mixed whiplash injuries.

Questgates acquires CP Adjusting; Pen UW rolls out cyber risk management suite; Brokerbility shakes up leadership team

For the record: Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Underwriters and brokers to face post-Protect Duty learning curve, says Aon's Bolton

Consensus on how to underwrite casualty programmes affected by the proposed counterterrorism Protect Duty will take time to develop, Aon’s director of GBC crisis solutions Scott Bolton has told Post.

Insurers facing claims from mini-Budget pension fallout

Law firm RPC warns insurers to expect claims from pension fund trustees that suffered losses as a result of the disastrous mini-Budget

Axa XL's McGovern to take up LMG chairmanship

Axa XL CEO for the UK & Lloyd’s Sean McGovern is set to become chair of the London Market Group from the start of next year.

Ageas 5% away from target to triple green parts use by 2023

Ageas’ claims director Robin Challand told Post that the insurer is on track to triple its green parts use in its repairs by 2023.

Aercap hits back at argument that $3.5bn claim is barred by a war exclusion

Aercap has hit back at AIG’s argument that a $3.5bn claim in relation to planes seized by Russian airlines is barred by a war exclusion.

Amazon entry into UK insurance not the threat it was expected to be: Guidewire's Ryu

Guidewire’s co-founder and chairman Marcus Ryu believes UK insurance companies are much more “sophisticated” and “better placed” than they were 30 years ago, and new entrants such as Amazon are not a threat they were once expected to be.

Analysis: Will firms be up to speed in time for the FCA’s new regulations on consumer duty and protection?

The Financial Conduct Authority’s new four-outcome consumer duty rules set higher and clearer standards of protection across financial services and requires firms to put their customers’ needs first. However, as Frances Stebbing discovers, the transition…

BI claims roll on as law firm builds new case against Allianz

Law firm Mishcon de Reya is appealing for Allianz policyholders to come forward and join a group action lawsuit against the insurer in a new Covid BI claims case.