News

FCA warns of unauthorised motor broker

An unauthorised car insurance broker has been targeting customers in the UK, the regulator has warned.

Video: Data from motor crashes will help reduce fraudulent claims

Exclusive: Damage analysis from dozens of high speed car crashes could help traffic investigators spot fraudulent traffic collisions.

Lloyd's assembles industry leaders to guide modernising efforts

Lloyd’s of London has established two advisory committees featuring prominent industry figures to support its ongoing modernising strategy.

Seventeen Group buys Essex broker

Seventeen Group has bought Essex-based broker Graybrook, for an undisclosed sum.

ERS to launch underwriting academy in Swansea

Specialist motor insurer ERS will open an underwriting academy in its Swansea office.

Tokio Marine Kiln Insurance to enter run-off next month

Tokio Marine Kiln Insurance will enter run off, as the group refocuses its UK business on Lloyd’s.

Ecclesiastical warns of 27% surge in claims following £225,000 church roof theft

Ecclesiastical has warned of a surge in large-scale metal thefts from churches, following a major £225,000 theft from a church in Hertfordshire.

The Post Claims Awards 2019: Full list of winners

Who won what at last night's Post Claims Awards?

Direct Line motor head warns of 'dangerous' autonomous vehicle tipping point

The tipping point between level two and level three automation is a potentially dangerous place, according to the head of motor at Direct Line.

Zurich and Travelers discussed digital hype and legacy benefits during Post webinar

Given the hype around digital you might be excused for thinking that you need to re-platform everything, rip out what you currently have - and start again - to remain relevant in the modern insurance market.

Ardonagh boss joins Nexus group

Marc van der Veer has joined Nexus Group as CEO of European Ventures.

Insurers must work with the repairer sector to keep it from 'dying on its feet'

Motor insurers, manufacturers and repairers must tackle their “dysfunctional relationship” and work together if the sector is to remain relevant with increased technology being added to vehicles.

Insurers need to raise awareness on keyless car thefts

Insurers and manufactures have to educate customers on the risks of keyless car thefts, a conference heard.

Zurich UK CEO: Ban hands free phone use in vehicles

Strict laws to prevent drivers using mobile phones – even hands free – would have the biggest impact on vehicle collision numbers, the Zurich UK CEO told Post's Motor Insurance World event last week.

Insurers could face fines under plans to tackle dual pricing 'rip-off'

The Competition and Markets Authority could be given the power to impose fines on companies in breach of consumer law without going to court, under government proposals announced today.

Zego raises $42m in latest funding round

Zego has raised $42m (£33.52m) in a series B funding round led by Target Global, to fund its European expansion.

Fidelis investor takes majority stake in April

Private equity investor Andromeda has gained regulatory approval to take a majority stake in French health insurer April, which saw its UK arm pull out from the private medical market last year.

Axa XL appoints Christopher Read as COO

Christopher Read has been appointed as Axa XL’s UK chief operating officer, joining from EY, where he was an associate partner.

Insurtech Trov to close its UK app

Exclusive: Trov will no longer provide its on demand gadget and single item insurance to UK customers, as of 1 October 2019.

Insurers respond to flood claims from Lincolnshire

Insurers have begun responding to claims following the flooding in Lincolnshire.

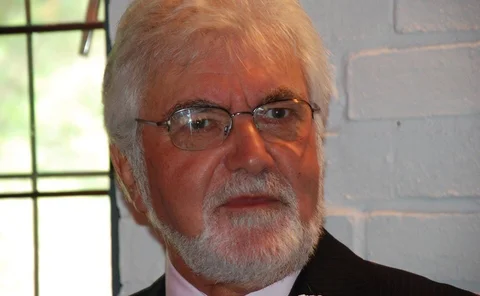

Industry pays tribute to former Lloyd’s executive Mike Wilson

Mike Wilson, the former head of Lloyd’s Policy Signing Office in Kent has died.

Three directors out as Policy Expert buys loss-making Sure Thing

Policy Expert has bought motor insurance business Sure Thing for an undisclosed sum.

GRP broker acquires Thomas Cook

GRP-owned broker Sagars has bought Lancashire-based engineering and entertainment broker Thomas Cook & Son.

Elite shoots for solvent scheme to avoid liquidation

Elite Insurance has proposed a solvent scheme of arrangement, in order to avoid a liquidator being appointed.