Commercial

Eldon intending to rebrand as Somerset Bridge

Arron Banks' Eldon Insurance Services is planning to rebrand as Somerset Bridge by the end of the year, Post can reveal.

Insurers brace for some sizeable losses as UK barraged by floods

UK flooding is expected to continue, as insurers and loss adjusters have warned of a "spike" in both personal and commercial lines claims as a result.

Analysis: Reservoir dams - a water-tight insurance risk?

With almost 3000 dams supplying drinking water to towns and cities they are a common feature in the UK countryside. However, when heavy rain in August threatened the integrity of the emergency spillway at Toddbrook Reservoir an emergency evacuation of…

Ageas' Andy Watson cautions motor premium levels are ‘unsustainable’

Ageas UK CEO Andy Watson has cautioned that amid the Ogden rate change and inflationary pressures, current motor rates are “surprisingly low and unsustainable”.

Iprism group restructures with holding co pre-pack administration

Bowmark Capital-backed Iprism Underwriting Agency has completed a group restructuring including a pre-pack administration of its holding company for £329,300, writing off tens of millions of debt.

Ogden rate, large losses and claims inflation knock Allianz UK COR in Q3

Allianz reported operating profit of £100m for the year to date in its Q3 results, with its combined operating ratio slipping to 96.5% from 95.7% at the half year.

This month in Post: Thomas Cook-up

In a week that was dominated by personal injury fracas, the revelation that Thomas Cook self-insured against all but the “very largest” PI claims may well take the cake for biggest botch up.

Insurers should embrace cloud technology to transform their businesses: Guidewire CEO

The insurance industry needs to change “decades-old habits” and use cloud-based systems to effectively manage risk, inform people and make decisions, a conference heard.

Lancashire appoints UK chief underwriting officer

Lancashire has appointed its UK chief underwriting officer from within, with incumbent Hayley Johnston set to become CEO of its Bermuda arm.

RSA UK reveals £8m restructuring for Q3 amid cost cutting

RSA UK has booked £8m in restructuring charges for the third quarter, as overall the group reported its operating profit was up.

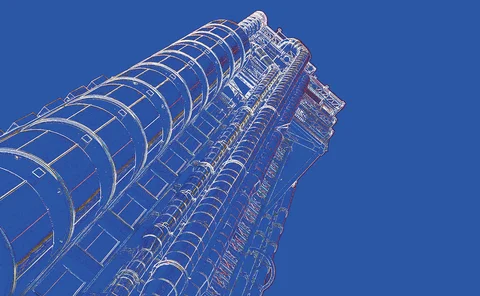

Analysis: Under the skin of Lloyd's Blueprint One

Lloyd’s has published Blueprint One: the first of a number of ‘blueprints’ it intends to produce over the coming years as it overhauls the market for the 21st century

Roundtable: Cyber - the next big opportunity in personal lines

Cyber has been long-touted as offering insurers and brokers a huge opportunity in commercial lines – from SMEs to corporates. But as individual consumers become ever more aware of their vulnerability to data breaches and cyber attacks, an equally large…

Top 30 Asia Insurers: A volatile year

2018 was a volatile year for Asian insurers with the majority of them posting declines in gross written premium or sluggish growth. Christie Lee, senior director of analytics for Asia-Pacific at AM Best, explains the challenges they are facing.

Blog: The unrated conundrum - cover at all costs, but who pays the price?

There is a growing list of failed unrated insurers that continue to hit the headlines. Dean Bedford, underwriting director at CLS Risk Solutions, asks what is the answer to the unrated conundrum? Is unrated always bad, who is responsible and who pays the…

Interview: David Walsh, CFC Underwriting

A child of the dot-com boom, CFC Underwriting has now left its teenage years behind as it enters its twentieth year as one of the pre-eminent specialist managing general agents in the London market. CEO David Walsh spoke to Jonathan Swift about the …

Fire Protection Association calls for a quick ban on combustible cladding in all high risk residencies

The government must work quickly to make changes to building regulations and ban combustible cladding in all high risk residencies, the Fire Protection Association has urged.

Radius buys majority stake in The Burley Group

Radius Payment Solutions has bought a majority stake in transport specialist The Burley Group for an undisclosed sum.

Hiscox reserved $165m to cover Dorian, Faxai and Hagibis claims

Hiscox has reserved $165m to cover claims from Hurricane Dorian and Typhoons Faxai and Hagibis, while reporting it expects to see fees and profit commissions dip $25m this year.

This week in Post: Carnival spooks

This week, some Post colleagues and I attended CFC Underwriting's annual Halloween party. The theme this year was carnival, and accordingly, the party was full of clowns, fortune tellers and more than the odd Joker.

Claims Apprentice 2020 – sign up now to take part in series two

After a phenomenally successful first series Insurance Post is delighted to say that we have teamed up with law firm Kennedys again for a second series of The Claims Apprentice in 2020.

Blog: Are insurers effectively engaging with SMEs?

The SME market represents a major area of growth for insurers but Sara Costantini, managing director of Crif Decision Solutions, asks what providers are doing to capitalise on this opportunity?

MGA CFC mulls entering personal lines with cyber for HNW individuals

CFC is exploring the possibility of entering the personal cyber market.

Munich Re, Allianz and Zurich discussed the management of unstructured data in claims during Post webinar

Insurance companies are dealing with increasing volumes of digital media associated with claims initiation and claims investigation processes.

This week in Post: Ardonagh in the clear

A long-awaited judgment in the legal wrangle between Ardonagh and Gallagher came today, clearing Ardonagh of wrongdoing.