Commercial

RSA moves back to underwriting profit in UK

RSA has delivered an underwriting profit of £3m in the UK for 2019, reversing the underwriting loss of £93m the year before.

Tractable targets SE Asia and mulls property diversification after $25m raise

Insurtech Tractable is targeting new clients in South East Asia, the Middle East and Latin America after unveiling a $25m (£19.2m) Series C investment, led by Georgian Partners

Direct Line to cut 800 jobs

Direct Line Group is cutting 800 jobs over the next two years, the insurer has confirmed.

Kennedys spins out inhouse innovation team as stand-alone business

Law firm Kennedys has spun out part of its innovation function as a separate wholly-owned limited company in order to speed up product development and attract staff more suited to its technology/software focus.

FSCS declares CBL Insurance Europe in default

The Financial Services Compensation Scheme is now stepping in to protect the majority of policies sold in the UK to individuals and small businesses by CBL Insurance Europe having declared the insurer to be in default.

UKGI CEOs want to fix the loyalty penalty: Penny James

General insurance CEOs want to tackle dual pricing and support further regulatory intervention, a conference heard.

ABI calls for annual government flood defence spending to rise to £1.2bn

Jon Dye, the chair of the Association of British Insurers, has called for government flood defence investment to rise to at least £1.2bn a year.

Arch to pay £400m for Coface minority stake

Arch Capital Group has agreed to pay Natixis €480m (£401.8m) for a 29.5% stake in France-based trade credit insurer Coface.

Deliveroo investors back £3.3m raise for ex-Aviva innovation head's gig economy insurtech

Insurtech start-up Collective Benefits has closed a £3.3m seed funding round involving Stride VC alongside existing investors Delin Ventures and Insurtech Gateway.

Flood impact driving on claims surge after storms Dennis and Ciara

The "significant" impact of river flooding is expected to persist over the next few days, the Environment Agency confirmed, as insurers continue to receive a surge of claims on the back of storms Dennis and Ciara.

Allianz UK operating profit drop driven by 'large number of factors': Jon Dye

There was “a very large number of factors” behind the significant drop in operating profit at Allianz UK in 2019, according to CEO Jon Dye.

Operating profit down one third at Allianz UK

Allianz UK has reported profit of £138.1m for 2019 supported by investment gains as operating profit fell.

Analysis: The expansion of the global space market: What opportunities does this present to insurers?

It is 55 years since underwriters at Lloyd’s penned the first space insurance policy, covering the Intelsat I ‘Early Bird’ satellite. Today there are more than 2000 active satellites orbiting the planet and the accelerating commercialisation of space is…

This week in Post: Do or delay

The government is likely to make an announcement delaying the much-awaited whiplash claims portal in a matter of days, sources close to the project told Post this week.

Blog: How insurers and brokers should engage with insurtechs

Insurers and brokers ask the most ridiculous, irrelevant questions, which starkly highlights how out of touch they are when it comes to IT procurement today, Inzura CEO Richard Jelbert argues as he looks at the current process and some of the questions…

London market chief disputes ‘disappointing’ FCA findings

The London Market Group has expressed its disappointment with the Financial Conduct Authority’s latest sector views report and requested a meeting with the regulator to discuss its findings.

Gunter replaces Hendrick as Axa XL CEO

Scott Gunter has been appointed as CEO of Axa XL joining from Chubb to replace Greg Hendrick who is leaving to pursue other opportunities.

Call Connection creditors set to share £246,000 as claims hit £4.7m

Call Connection creditors will share a payout of around £246,000 as claims from secured and unsecured creditors total £4.7m, administrators BDO have estimated.

RSA's John Dawe on how schemes offer an attractive growth opportunity for brokers

A bespoke insurance product for a niche group of customers gives brokers a unique selling point and according to John Dawe, partnership director at RSA it enables them to target gaps in the market, diversify their business or create a new revenue stream.

Storms Dennis and Ciara could cause greater claims surge than the Beast from the East

Storm Dennis has caused a second weekend of claims surges across the UK, and together with last weekend’s Storm Ciara, could be on track to exceed the impact on claims volumes of 2018’s Beast from the East.

Bollington still offering all lines after Gefion suspension, Patterson confirms

Bollington’s decision to stop trading with unrated Danish insurer Gefion has not changed the firm’s insurance footprint, group managing director Chris Patterson told Post.

Bollington ceases trading with Gefion

Bollington has suspended trading with Danish unrated insurer Gefion, Post can reveal.

Insurers and organisers count cost of events cancelled by coronavirus

Organisers and event insurers face uncertainty over what cancellations stemming from the ongoing Covid-19 coronavirus outbreak will cost them, as wordings are pored over and new policies have cover for the virus stripped out.

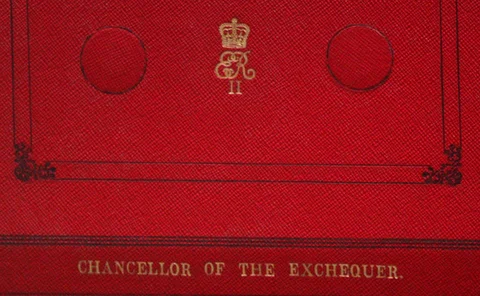

Blog: A quick-fire reshuffle

Post news editor Jen Frost reflects on Sajid Javid’s shock exit as Chancellor and what this could mean for insurance premium tax and the budget.