Claims

This Month In Post: Truth or dare on cyber

At the ABI annual dinner on Monday, as guests at my table predicted future insurance trends, I was struck by a suggestion. People will want to protect their most precious belongings and, in 10 years’ time, that will be their personal data, a KPMG partner…

Obituary: Stephen Fitzgerald, former DA Constable MD

Liability insurance heavyweight Stephen Fitzgerald passed away yesterday after a long battle against cancer.

Editor's comment: Media matters

My name is Stephanie Denton and I am a social media voyeur.

Roundtable: The pre-action protocol at 20

Over two decades ago, a quintet sat down to formulate the pre-action protocols for personal injury claims. Post gathered four [Nigel Tomkins, then of Thompsons could not make it] back together to reflect on their influence, lessons learned and the…

Claims - Indicative reading time: 50 minutes

A series of CPD knowledge learning opportunities that can be used to accrue reading time. The pass rate is 80%.

Insurers urged to not sweep internal staff fraud under the carpet, by LV investigations boss

Exclusive: 'Out-of-salary behaviour' and irregular work patterns have been identified as tell-tale factors for insurers to look out for in their efforts to identify potential theft of confidential data.

Admiral replaces panel of private eye firms

Exclusive: Admiral has replaced its panel of private detectives it uses to investigate claims.

Career File: Marshall Bailey

Bailey named as chair of the Financial Services Compensation Scheme

Blog: What does the first Insurtech Impact 25 listing say about the state of the sector?

“We have no doubt that we have missed some Fords and included some Tinchers. But who ends up a Ford and who ends up a Tincher is not pre-determined.”

Allianz Worldwide partners with digital payment platform to speed up claims payouts

Allianz Worldwide has partnered with digital payment platform Optal in a bid to pay claims easier to its supplier network.

Analysis: Insurers torched on Twitter over Liverpool Fire

How social media influenced the response of insurers to the Liverpool fire

The risks and regulations driving the Turkish insurance market's growth

Emerging risks as well as new and upcoming regulations are driving the growth of the Turkish insurance market, explain Pelin Paysal and Ilgaz Önder, partner and associate at Gün and Partners.

Ageas shakes off Ogden impact to return to profit

Ageas UK has seen a return to profit after a year of being hammered by the residual impact of the Ogden rate change.

Cyber Research 2018: The findings

Cyber has come a long way in the past 70 years, yet its meaning has essentially remained the same: it still encompasses the notions of control and communication. Post, in association with Cyberscout, surveyed the insurance market and consumers to find…

Cyber Research 2018: Cyber insurers will live and die on claims experience

As the cyber insurance market grows, a specialised process to support cyber claims could make or break insurers. Tom Spier, director of international business development at Cyberscout, reveals how insurers are doing in this market.

Interview: Mark Searles, AUB Group

Since packing up his life in London and flying half way across the world to Australia, Mark Searles, CEO of AUB Group, has transformed a broker into the leading equity-based broking, risk management, advice and solutions provider in Australasia.

Buzzvault announces long-term growth plans following Munich Re tie-up

Exclusive: Buzzvault Insurance has entered a five year strategic partnership with Munich Re Digital Partners with plans of releasing products to market by Q3 2018.

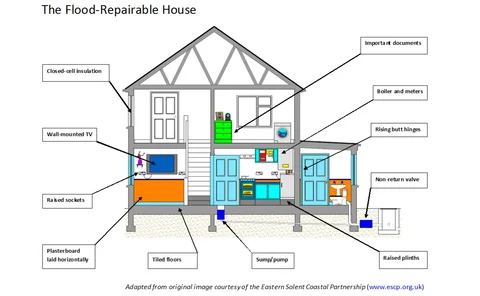

Blog: The 130 missed opportunities to make a flooded home resilient

Many opportunities are missed to make properties flood-resilient instead of just repairing them, write Dr Jessica Lamond and Dr Rotimi Joseph, respectively associate professor and visiting fellow at the University of the West of England Bristol. They…

Whiplash fraudster given two month prison sentence

A whiplash fraudster has been handed a two month prison sentence and been ordered to pay £14,000 in costs.

68% of homeowners think it’s acceptable to omit application information

Over half of UK homeowners believe it is acceptable to omit or adjust information in their application to keep their insurance premiums low, according to survey findings.

Insurers could face claims worth millions following British Steel Pensions Scheme transfers

Insurers could face millions of pounds worth of professional indemnity claims arising from negligent financial advice given to those transferring out of the British Steel Pensions Scheme last year.

Hiscox to use real time cyber attack data in 'first' for awareness campaign

Hiscox will display real-time cyber attacks to raise awareness of the threat that cyber crime poses to SME businesses, as part of its new ad campaign.

IFB appoints claims officers Nichols and Gibson to its board

The Insurance Fraud Bureau has appointed two claims officers from major insurers to its board.

Insurers to fund personal injury IT gateway

Exclusive: The government has accepted an offer in principle from the insurance industry to fund a new IT gateway to allow litigants in person access to the claims portal.