Property

Howden’s climate practice, Ecclesiastical and Iprism partner and WTW’s claims chief

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Top 100 UK Insurers 2023: Personal lines insurers hardest hit by inflation

Valeria Ermakova, associate director for analytics at AM Best, reveals while reserving for claims inflation is shaking the nation's insurers, actions taken by the top 10 of this year's Insurance Post Top 100 UK Insurers List helped these providers hold…

McLarens aims to become the go-to adjuster for hospitality claims

Rebecca Webster, McLaren’s broker development lead, shares why the claims services provider has launched its hospitality offering and what challenges lie ahead.

BIA 2023: Winners Q&A with Crawford & Co’s Lisa Bartlett

In this Q&A, Insurance Post speaks with Lisa Bartlett, president for UK & Ireland at Crawford and Company, about its triple win earlier this year at the BIAs.

Diary of an Insurer: Brawdia’s James Goodlet

James Goodlet, building surveyor at Brawdia, is in Auckland to assist with the ongoing response to February’s cyclone damage and tries to explore all different manners of local cuisine and eateries.

FCA rules out banning broker commission

The Financial Conduct Authority has ruled out banning broker commission, despite being concerned by “high” 62% charges for arranging cladding insurance.

FCA promises action against overcharging brokers

The Financial Conduct Authority has warned brokers it will “take action” against those charging inflated commissions for arranging cladding cover, with some charging up to 62%.

Top 75 MGAs: PIB Group

PIB Group’s main MGA-MGU activities dealing in UK-based non-life risks in 2022 were Citynet Underwriting Services, Let Alliance, Q Underwriting, Thistle Insurance Services and UKInsuranceNET, according to Insuramore.

Top 75 MGAs: Gallagher

The performance of Gallagher’s Pen Underwriting business, which includes Manchester Underwriting Management and RMP, plus Vasek Insurance earned the group a place on Insurance Post's Top 75 MGAs 2023 list.

Top 75 MGAs: Howden Group

Howden Group’s MGAs - Dual and KGM Underwriting Services - generated revenue that places the business in the top 15 of this year’s Insurance Post Top 75 MGAs 2023 list.

Top 75 MGAs: Countrywide Legal Indemnities

Countrywide Legal Indemnities has been providing legal indemnity products for title defects affecting UK property for almost three decades.

Top 75 MGAs: Brown & Brown

Brown & Brown's main MGA-MGU activities dealing in UK-based non-life risks in 2022 earning the business a place on the Top 75 MGAs list were Camberford Underwriting, Decus, Mithras Underwriting and Plum Underwriting.

Insurance Post’s Top 75 MGAs revealed

Markerstudy and Policy Expert have been the named the country’s two biggest MGAs after achieving revenues of between £80m and £100m for UK-based non-life risks in 2022.

Insurers’ profitability to remain lower than cost of capital

Data analysis: General insurers are adjusting rapidly to the new higher interest rate era ushered in by the most intense monetary policy tightening since the 1980s but profitability is unlikely to soar back to pre-pandemic levels imminently.

Diary of an Insurer: Belfor UK’s Paul Anderson

Paul Anderson, operations director for restoration and reinstatement at Belfor UK, is hiring, reviews a surge and burst pipe event plus aims to shorten the claims process by managing the entire restoration and reinstatement process.

Aon unveils operational risks solution; Admiral launches PI policy; Clear inks another deal

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

FCA to hit brokers with fresh leasehold insurance reforms from 2024

The Financial Conduct Authority has issued a wave of reforms around leasehold buildings insurance, coming into force in the new year.

Property claim times to benefit from migrant construction worker influx

The government’s decision to relax the rules for construction workers to enter the UK from abroad, should increase the pool of skilled workers available for property repairs, said Verisk’s head of property Ben Blain, following the release of Verisk’s…

Ramifications of crumbling concrete for insurers

Rachael Murphy, senior associate at Browne Jacobson, considers the type of claims insurers can expect from issues with reinforced autoclaved aerated concrete.

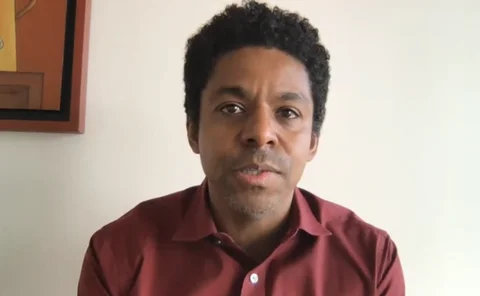

Q&A: Megan Bingham-Walker, Anansi & Sarah Wernér, Husmus

With less than 0.5% of venture capital funding going to Black-led start-ups, Frances Stebbing speaks to two recipients of the Black Founders Fund to find out why this initiative is so important and how it helped their business.

Cyber market edges towards systemic risk solutions

Participants in the quickly growing cyber insurance market are pushing for commonly held definitions of catastrophic or systemic events.

LMA launches ESG Academy; Brown & Brown's latest deal; MS Amlin appoints CFO

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.