Motor

Blog: Automotive technology must be managed to ensure it minimises risk on the road

By 2020, 40% of cars on the road will have some sort of advanced driver assistance systems installed, but Neil Atherton, sales and marketing director at Autoglass, asks if insurers are even aware if these systems are switched on and calibrated correctly…

Penny Black's Social World: December 2019

Diversity and Inclusion in Insurance Awards, keeping safe on the roads, and embracing flexible working

Amanda Blanc lands second NED role

Amanda Blanc will join specialist motor insurer ERS as a non-executive director on 2 January 2020.

Spotlight: Autonomous Vehicles: Is automation the answer to insurers’ nightmares or a dream come true for thieves?

At every trucking fair and trade publication and in each promotional video the industry is demonstrating the advances in autonomous commercial vehicles

Insurtech Wrisk launches 'new type of insurance' with BMW for Mini drivers

Insurtech Wrisk has unveiled the first fruits of its tie up with BMW Financial Services Group and Allianz Automotive by offering all new UK Mini owners three months free insurance underwritten by LV Broker.

Interview: William Stovin, Markel International

As Markel International gears up for more growth across its national markets business and looks to build on its presence in Europe, Jen Frost spoke to Markel International president William Stovin about the history of the business and why Brexit has…

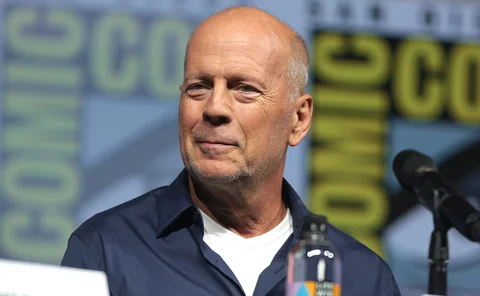

Blog: What do Norwich Union and John McClane have in common? They Die Hard

The general public might still be split on whether Die Hard is a Christmas movie or not. Jonathan Swift wonders if the resurrection of Norwich Union will prove just as divisive.

Editor's comment: Driving the message home

At 11-years-old my son is getting to the stage where I’m an embarrassment to him. A kiss goodbye at the playground is not cool, in fact he’d prefer to be dropped off out of sight of the school, if possible, and he can’t wait until he is allowed to walk…

Cuvva aims to bypass PCWs and brokers as it raises £15m

UK-based insurtech startup Cuvva has raised £15m in series A funding round as it prepares to launch a pay-monthly product at the beginning of next year and disrupt the existing insurance status quo

Blog: Future-proofing the broker model

The insurance market seems stuck on the idea that digitisation and a move to app-based insurance products, will negatively impact brokers. Inzura CEO Richard Jelbert explains why they should be seen as an opportunity instead.

Analysis: Discount rate disparity - will the Scottish market become unfavourable?

With the Ogden discount rate in Scotland set to remain at minus 0.75%, could insurers in the country start to feel squeezed, and begin to be squeezed out?

This week in Post: hanging by a thread

This week, Transport for London has revoked Uber’s licence to operate in London, causing fear among the capital residents who often rely on the app-based service to get them home safely after a night on the town.

First Central looks to raise external investment to fund “ambitious plans for the future”

First Central Group is seeking external investment which will see its founders reduce their stake in the Guernsey headquartered insurance group, Post can reveal.

Driving Out Distraction Pledge – Why is IAM Road Smart supporting this campaign?

Neil Greig, director of policy and research at IAM Road Smart, explains why multi-tasking at the wheel is a myth and urges employers to keep their staff safe on the road.

Driving out Distraction: Public would rather work for and deal with companies that ban distracted drivers

Of the two-thirds (69%) of UK adults who make hands free calls while driving, many of them (40%) continue to do it despite admitting it negatively impacts their driving ability, research from Consumer Intelligence, in support of Post’s Driving Out…

Allianz's Graham Gibson on embracing sustainability

As awareness of the damage we’re doing to our planet grows, sustainability is firmly on the corporate agenda, writes Graham Gibson, chief claims officer at Allianz Insurance. Finding ways to reduce our environmental footprint and safeguard the future for…

MoJ secrecy on small claims portal under fire

The Ministry of Justice faced criticism on secrecy around the development of the small claims portal at Post’s Insurance Claims and Fraud Summit in London yesterday.

Driving Out Distraction: The impact of mental state on driving

There can be many distractions when driving a car but Jo McGowan, human resources director at First Central Insurance & Technology Group, asks what happens when these are inside your own head?

Driving out Distraction: Is mobile phone use an addiction insurers should worry about?

On 10 August 2016 Tomasz Kroker was driving a truck on the A34 – ahead of him was a very visible long queue of traffic travelling uphill. The truck was travelling at 50mph, and Kroker made no attempt to reduce speed when he hit the first vehicle driven…

Driving out Distraction: 1st Central marks Road Safety Week with safety film

1st Central has unveiled a powerful new short movie to mark Road Safety Week, raising awareness of dangerous distractions on the road.

Analysis: Ageas and Tesco joint venture labelled success with separation on horizon

Experts have predicted an increase in partnerships in the insurance industry but do not see another joint venture on the horizon, as Tesco gears up to buy out Ageas' share of their Tesco Underwriting joint venture.

Q&A: Jeffrey Skelton, Lexis Nexis Risk Solutions

Jeffrey Skelton has worked for Lexis Nexis Risk Solutions for more than 17 years and in July was appointed as managing director for insurance for UK and Ireland. Harry Curtis spoke to him about his career to date and future plans.

Post launches Driving out Distraction Campaign

At the beginning of the month the current government confirmed it would seek to tighten the law around handheld mobile devices on the road, but will not extend a ban to hands-free use. While Post supports this initial step it believes that the government…

Blog: Flood-damaged cars - are insurers missing a trick?

Earlier this year parts of the UK were under water and serious flood warnings are becoming more commonplace, writes Jane Pocock, managing director, Copart UK.