Motor

RUP Commercial rebrands to Century Underwriting

Motor managing general agent RUP Commercial Risks has changed its name to Century Underwriting as it looks to expand into liability and property insurance.

Motor premiums still falling says ABI

The Association of British Insurers has reported further decreases in the prices paid for motor policies, despite other trackers reporting hardening prices.

C-Suite - Broker: Look on the bright side of motor

“More pain predicted’, ‘Motor sector faces fresh scrutiny’, ‘Not seeing sustained recovery’... A quick search for motor insurance stories on the internet is far from cheerful reading.

LV's O'Roarke says motor book has shrunk to ‘optimal' level

LV's private motor book has shrunk to near-optimal size, according to general insurance managing director John O'Roarke, who said the firm will continue to seek growth in commercial and household lines.

Innovation Group signs deal with Zurich's German business

Innovation Group has agreed a business processing contract with Zurich's German business giving the insurer access to its motor repair network.

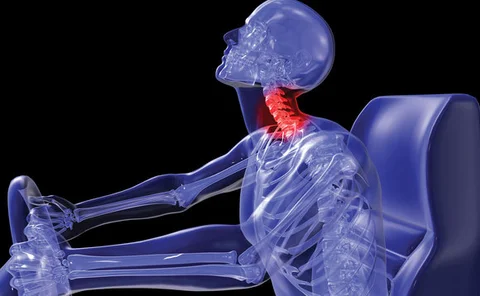

Speed of whiplash reforms criticised following TSC report

The speed of the government’s implementation of reforms to tackle motor fraud has been criticised by the AA, following the publication of the Transport Select Committee's latest motor insurance report.

Blog: Top 5 TV insurance claims

How much would the insurance claim for the Downton Abbey fire have been? Would JR Ewing's demand following the destruction of Southfork have resulted in a $40,000 monthly hotel bill? Crawford & Company's UK Major Loss team calculates the cost of these…

Motor sector set to report loss for 2014 as claims return to pre-Jackson levels

Towers Watson report says reserve releases unlikely to continue

Motor premiums ‘bounce’ to 1.2% increase says AA

Average motor premiums have increased by 1.2% according to the latest figures from the AA, which described the increase as rebound "off the bottom".

Driverless cars could be mandatory within two generations predicts Teradata chief

Autonomous cars will be the norm within two generations according to experts speaking at the Teradata Partners conference.

Road Safety Foundation demands tax cut on telematics policies

The Road Safety Foundation has called for reductions on premium taxes on telematics-backed motor insurance policies for young drivers.

Third party injury claims down 10% say actuaries

Insurers have benefited from a 10% reduction in the frequency of third-party injury claims according to figures released by the Institute and Faculty of Actuaries.

IFB set for a busy 2015 as it looks to fill details in five-year plan

The Insurance Fraud Bureau has unveiled a five-year plan to extend its remit beyond motor fraud and facilitate data sharing with lawyers and private investigators.

Comprehensive motor prices inching upwards says Towers Watson

The average cost of a new comprehensive motor policy in the UK has increased for the first time since 2011, according to Towers Watson, rising £3 to £582 in the third quarter of 2014.

Government's road safety approach criticised as insurers probe 'grey fleet' challenge

The current government is “not ambitious about road safety”, according to the Parliamentary Advisory Council For Transport Safety executive director David Davies.

Europe: Q&A with Bart de Smet, Ageas

Ageas is committed to the UK's motor sector despite its volatility, according to group chief executive Bart de Smet, who adds that the firm is always keen to gain from consolidation elsewhere.

Biba prioritising sharing economy as 2015 manifesto issue

The British Insurance Brokers' Association has confirmed its support for the sharing economy by its intention to include it in its 2015 manifesto.

Sharing Society: A problem shared

The sharing economy has seen enormous growth in recent years but it still poses many challenges for the insurance industry – not least in terms of the vast array of risks the sector poses

28% of consumers cutting back on insurance because of cost

Almost a third of Britons have cut back on their insurance purchasing because they could not afford it, according to figures from Close Brothers Premium Finance.

UK General boosts East of England presence with schemes deal

Leeds-based managing general agent UK General has partnered with Cambridge broker 2gether Insurance on an excess protection ancillary schemes deal.

ABI refuses to 'take lectures' from CHOs on credit hire portal

The Association of British Insurers has lashed out at the Credit Hire Organisation following its plea for insurers to back an electronic portal.

LV adds quads, trikes and buggies cover to Open GI

LV Broker’s highway quads, trikes and buggies product is now available on Open GI.

DfT tipped to focus on telematics in announcement on young driver safety

Government thought to have sought reports from three telematics providers

CMA private motor market report: Mooted ‘wide’ MFN clause ban could offset rate rises resulting from CMA inaction

Authority’s decision not to intervene on credit hire costs ‘a bitter pill to swallow’