Motor

Millions are multiple manipulators when seeking car insurance

More than a third of UK motorists are altering five or more pieces of information when obtaining a car insurance quote, new data from Percayso Inform has revealed.

Access deal; Clearspeed’s work with 1st Central; Lockton’s risk lead

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Treasury brands Civil Liability Act a success

HM Treasury has patted itself on the back for the impact of the Civil Liability Act 2018, claiming policyholders pay lower insurance premiums thanks to the legislation.

Aviva aims to double regional PL broker GWP

Jonathan Santer, managing director of broker and affinity at Aviva, has said he wants to double the firm’s regional gross written premium in personal lines over the next 18 months.

Why Aviva’s takeover of Direct Line is bad news

James Daley, managing director of Fairer Finance, shares his thoughts on Aviva’s £3.7bn takeover of Direct Line Group and raises concerns about the impact of mega mergers on customer service.

Throwback Thursday: Kwik Fit gets fitter; Aon’s warning

Insurance Post’s Throwback Thursday steps back in time to March 1998 to remind you what was going on this week in insurance history when Kwik Fit Insurance was expanding and Aon’s CEO warned against lawyers.

Spring Statement 2025: What insurers should know

Chancellor Rachel Reeves delivered her 2025 Spring Statement today (26 March) with a mix of spending cuts, investment pledges, and economic forecasts.

London motor premiums fall by a fifth

The latest data released by WTW and Confused has revealed significant reductions in the average comprehensive motor premium, with London benefitting the most.

Fresh calls to scrap IPT surface after record receipts

Ahead of the Spring Statement later this week, there have been renewed calls for the government to reduce or totally scrap insurance premium tax in certain areas of the market.

Zego CEO predicts fully autonomous motoring ‘within 40 years’

Sten Saar, CEO of Zego, has said a “fully autonomous world is coming”, and that it will be here in 40 years as a “worst-case scenario”.

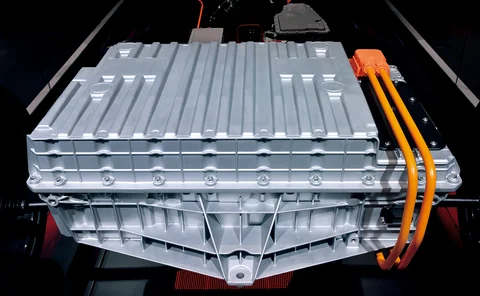

Axa calls for EV battery health certificates

Axa has published a report calling for the introduction of EV battery health certificates, arguing it could stimulate the UK’s used EV market by quantifying battery health and making vehicles easier to price for sale.

Stella’s White calls for rivals to add domestic abuse cover

Stella Insurance CEO Sam White is in talks with other motor insurance providers to add independent legal advice for women who experienced domestic abuse to their policies.

Is the OIC portal a success after one million claims?

With one million claims submitted over four years at a cost of £47m to the insurance industry, Scott McGee asks: Has the Official Injury Claim portal been a success?

Sabre CEO calls for radical pricing changes

Geoff Carter, CEO of Sabre, has said two areas of business in which it operates are under-priced, and expects the market to increase prices soon.

Sabre doubles profit with improved COR

Sabre has doubled its pre-tax profit for 2024 compared with the year before, despite only increasing gross written premium by 5%.

Confronting the challenges in our EV evolution

Trade Voice: Jonathan Fong, manager of general insurance policy at the Association of British Insurers, sets out the challenges the UK faces around increased adoption of electric vehicles.

Which? uncovers continued levels of ‘extortionate’ premium finance

Some car and home insurers are still charging high interest rates to pay monthly, research from Which? has found.

IFB members to vote on expanding membership criteria

Members of the Insurance Fraud Bureau are to vote in early April on whether to expand its criteria for membership, Insurance Post can reveal.

Ageas CEO reveals plan to become top three personal lines player

Ant Middle, CEO of Ageas UK, has revealed how he intends to turn the provider into a top three personal lines player and shared whether he will buy another rival to achieve that goal.

Government to review Civil Liability Act as cost of OIC portal is revealed

Almost seven years after the Civil Liability Act received Royal Assent, Insurance Post understands the government is scheduling to do a full review of the 2018 legislation.

Why telematics is far from dead and buried

Liam Parker, Winn Group’s telematics and electric vehicle first notification of loss manager, shares why telematics far from being on the wane should be at the heart of modern motor claims handling.

Big Interview: Mike Lloyd, Acorn Group

Mike Lloyd, CEO of the Acorn Group, shares how he intends to grow the non-standard motor and home insurer and responds to rumours the business is up for sale.

Ghost brokers ordered to pay back £376,000

A court has granted confiscation orders against two men who were convicted for their roles in a ‘ghost broking’ motor insurance scheme.

Access to affordable insurance cover

Mark Shepherd, head of general insurance for the Association of British Insurers, Ken Norgrove, deputy chair of the ABI and CEO of RSA UK&I, and Laura Evans, chief actuary of Flood Re, explain how insurers are tackling the challenges associated with both…