Legislation

What do insurers need before the UK goes driverless?

With the UK government moving full steam ahead with autonomous vehicle testing, Scott McGee asks how close we are to a driverless world, and what do insurance providers need before that becomes a reality.

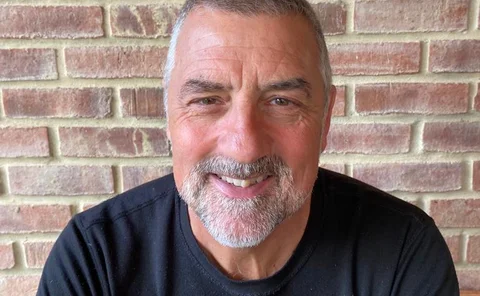

Big Interview: Graeme Trudgill, Biba

Graeme Trudgill, CEO of the British Insurance Brokers’ Association, talks to Insurance Post about volatility in the treasury, his thoughts on Rachel Reeves and why 2025 has been Biba’s “most successful year ever”.

Biba developing universal fair value assessment template

The British Insurance Brokers Association is collaborating with other trade bodies to produce a standard template for fair value assessments, CEO Graeme Trudgill has told Insurance Post.

Biba's Trudgill spots wins in government’s growth strategy

Trade Voice: Graeme Trudgill, CEO of the British Insurance Brokers’ Association, reflects on what more needs to be done in the wake of the government’s new financial services strategy.

Q&A: Gary Gallen, rradar

Gary Gallen, CEO and founder of Rradar, tells Insurance Post why he set up the firm, how he flipped the pricing model of law firms, and why others won't follow suit.

A standing ovation for fresh theatre rules?

Alex Nicoll, director and head of media and entertainment at Sedgwick, examines the risks facing theatres as the 2025 European Accessibility Act and Martyn's Law are implemented.

Q&A: Julian Tomlinson, Alps

Julian Tomlinson, chair and founder of Alps, talks to Insurance Post about the firm’s M&A appetite, delivering value in legal expenses coverage, and why artificial intelligence is like Tinder for claims.

Ardonagh’s rebrand; Google Cloud’s expansion; Insure Your Paws’ product

Friday Round-Up: Insurance Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Is ‘cancel culture’ creeping into insurance?

Following the launch of the UK’s first ‘cancel culture’ insurance product, Tom Luckham explores the effect that ‘culture war’ is having on the insurance industry.

Wave of cyber resilience legislation a boon to insurers

Forthcoming and recent legislation prescribing minimum cyber security standards for certain businesses and organisations will be welcomed by cyber insurers, experts have said.

How Brexit has affected the UK insurance market

Five years on from the UK exiting the European Union, David Worsfold examines if the insurance industry benefitted or received a blow from Brexit.

Treasury brands Civil Liability Act a success

HM Treasury has patted itself on the back for the impact of the Civil Liability Act 2018, claiming policyholders pay lower insurance premiums thanks to the legislation.

FCA scraps name and shame proposals

The Financial Conduct Authority has scrapped plans to name and shame firms it is investigating and revealed it has “no plans” to progress its diversity and inclusion proposals.

Government to review Civil Liability Act as cost of OIC portal is revealed

Almost seven years after the Civil Liability Act received Royal Assent, Insurance Post understands the government is scheduling to do a full review of the 2018 legislation.

UK pet insurance shifts from sales to process focus

August Von Sydow, chief commercial officer at pet claims automation insurtech Wisentic has said the UK pet insurance market has shifted from being sales-focused to process-focused due to increased adoption.

Big Interview: Steve Tooze, Extinction Rebellion

Steve Tooze, spokesperson for climate pressure group Extinction Rebellion, tells Damisola Sulaiman about the group’s motivations for targeting the insurance industry, responds to questions from the companies his organisation has targeted and shares plans…

Why PFAS is the greatest threat to insurance today

As “forever chemicals” become a growing focus of government regulation and a deluge of civil litigation, Emma Ann Hughes unpicks the potential impact of the manufacture and distribution of per and polyfluoroalkyl substances for the insurance industry.

What insurers should do to stop sexual harassment

Analysis: Damisola Sulaiman reviews the progress of trade bodies in responding to the Financial Conduct Authority’s findings on sexual harassment in the industry and explores what steps insurers and brokers can take to prevent abusive incidents and the…

What the Employment Rights Bill means for insurers

Zhaleh Hawkins, partner and deputy head of employment at law firm HF, explains how the government’s new rights for workers announcement around sick pay and parental leave will affect the insurance sector.

FCA CEO promises focus on growth in letter to prime minister

CEO of the Financial Conduct Authority, Nikhil Rathi, has written to prime minister Keir Starmer promising growth will be a “cornerstone” of the regulator’s strategy through to 2030.

Half of businesses have reported incidents with lithium batteries

A survey conducted by Aviva has revealed the proportion of firms that have experienced incidents involving devices that contain lithium-ion batteries.