Legal

Legal Update: What insurers need to know about harassment claims

As the number of harassment claims increases, insurers should consider whether they're best covered under general liability policies or specialist employment policies, recommends Joe McManus, partner at Kennedys.

Blog: Brokers, spare no (legal) expense

When a legal expenses insurance claim is declined due to poor prospects of success, brokers can still give the policyholder some help and guidance, explains Jeremy Butler, managing director of Qdos Underwriting.

Interview: Stephen Hines, Forum of Insurance Lawyers

In November, the Forum of Insurance Lawyers appointed Stephen Hines as its 22nd president in its 25th anniversary year. Post sat down with him to discuss his aims and ambitions for the group.

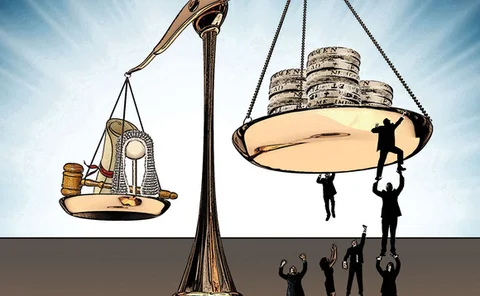

Analysis: Employment claims rising after unfair fees finished

Now the Supreme Court has ruled employment tribunal fees are unlawful, insurers are expecting a flow – but not a flood – of claims

Apil's Brett Dixon on flying solo in court

As the industry awaits news of the Civil Liability Bill, Brett Dixon, president of the Association of Personal Injury Lawyers, argues the courts are not the place for injured people flying solo.

Blog: When Christmas parties go wrong: avoiding liability claims

Christmas parties can result in claims against employers. Alistair Kinley, director of policy and government affairs at BLM, examines a recent case.

This Week in Post: Personal injuries and parenting fails

I felt very smug when my daughter tried on her first pair of slipper socks: she liked them! That meant I wouldn’t need to argue with her to keep her little feet warm – and she wouldn’t risk slipping on wooden floors. What I hadn’t foreseen though was…

Minster's Shirley Woolham on why robots won't replace lawyers

Artificial intelligence is taking over mundane legal functions but is not killing off lawyers, says Shirley Woolham, chief operating officer at Minster Law.

German D&O market marked by insured v insured claims

Ulrich Schaller, portfolio manager, financial & specialty markets, at QBE Insurance (Europe), explains the specificities of the German D&O market.

Legal Column: Huge changes ahead for PI claims in Scotland

The Civil Litigation Bill going through the Scottish Parliament could have a huge impact on personal injury claims, explains Kate Donachie, associate at Brodies.

Clyde and Co partners with Malaysia firm

Global law firm Clyde & Co has entered into an association with Malaysian firm Shaikh David & Co.

Underwriting Service Awards 2017: Winners

The leading lights of underwriting gathered last night at Post’s annual Underwriting Service Awards. The winners are below:

Analysis: NIHL: Make some noise

The fixed-cost regime proposed for noise-induced hearing loss claims is like music to insurers’ ears, although it comes way after the hubbub

Blog: Responsible robots?

Automated processes are feted to be the future of claims handling, but taking the process out of human hands is far from straightforward, as Ed Lewis, partner at Weightmans, explains.

Video: How the economy influences insurance claims

BLM partners Jennette Newman and Julian Smart explain how macroeconomic trends can be analysed to predict insurance claims.

Profile: Jon Turner, Pen Underwriting

After spending the past year hiving up a dozen entities under the Pen Underwriting roof, CEO Jon Turner talks to Will Kirkman about the managing general agent’s drive to be a ‘virtual insurer’ with the firepower to invest in data analytics and new…

Spotlight: Drones: Taking flight

Fast food and parcel deliveries by drones seemed a fantasy just a couple of years ago but it is now close to reality. Wherever you look, they are in the air. They are being flown by leisure users, the French police, UK lifeboats, Indian railways, oil rig…

International: Trade credit demand is up

European political instability and financial regulations are pushing demand for trade credit cover, especially from banks that are keen on optimising their capital.

Legal: Driverless cars, shifting liability

Kennedys partner Rachel Moore analyses the liability shift autonomous vehicles are operating in motor insurance.

Brightside's Mark Cliff on the impact of the discount rate for brokers

Insurers have been vocal about their feelings about the discount rate but Mark Cliff, executive chairman at Brightside Group, notes this has also affected brokers, who have been at the sharp end of market turmoil.

Analysis: Councils: Local challenges

Local government insurance has to deal with emerging risks. How is it adapting as competition increases?

Claims Club Blog: Cooperation can overcome conflict

There has been a long history of conflict between insurers and claimant lawyers. Shirley Woolham, chief operating officer at Minster Law, urges mutual understanding and cooperation.

Foil's Nigel Teasdale on engaging with Europe after Brexit

The UK's Brexit Withdrawal Bill is making its way through parliament but Nigel Teasdale, president of the Forum of Insurance Lawyers and partner at DWF, believes this will make interactions with the European Union even more important for the insurance…

Analysis: Intellectual property: Creative cover

The significance of intellectual property risks has not translated into a large demand for IP insurance policies - yet