Flooding

Household: can no claims discounts be applied to household insurance?

With Axa set to offer no claims discounts to household customers, Amy Ellis reports on market reaction and whether others will follow suit.

Munich Re to revisit earnings target statement

Munich Re's stated objective to earn €2.4bn (£2.1bn) in 2011 may have to be revisited following the devastating earthquake in Japan.

Eqecat estimates up to $25bn of quake losses

Risk modelling firm Eqecat has predicted insured losses from the Japanese earthquake of between $12bn and $25bn (£15.5bn).

Japan economic losses “likely to exceed $100bn”

Losses from the earthquake which shook Japan last week could break the $100bn (£62.2bn) barrier, catastrophe modeling firm EQECAT has predicted.

Climate change – are insurers getting behind their own green policies?

With the general public becoming ‘bored’ by environmental issues, Veronica Cowan asks if insurers are really getting behind their own green policies.

Catastrophe losses hold back Hardy profits

Hardy Underwriting’s profits halved to £10m during 2010, after it faced a string of international catastrophe losses with a net value of £37m.

Chaucer profits fall due to cat exposure

Chaucer has attributed its fall in profit and property underwriting loss to its exposure to global catastrophes.

GAB launches claims training course

GAB Robins has launched a training scheme for its loss adjusters and claims handling staff designed to reduce the claims lifecycle and costs of fire and water damage property claims.

Escape of water claims: Trickle becoming a torrent

Escape of water now represents the same proportion of household claims as personal injury does for motor. Kevin Kiernan looks at this growing trend and how it can be addressed.

Quake sends insurers back to square one

Insurers' efforts in settling claims from the September earthquake in Canterbury, New Zealand are "back to square one" after this week's 6.3 magnitude earthquake, according to the chief executive of Cunningham Lindsey New Zealand.

Penny Black's insurance week

Penny was uncertain as to how her colleagues would fare when they turned their hands to cocktail-making at an Ace Europe masterclass in the City.

In Series - Geography & Solvency II: What are the risks for insurers?

With the implementation of Solvency II looming, Sam Barrett asks if insurers are forgetting to look inwards at the risks their own companies face.

Ex-flood chief warns UK could face Oz-type disaster

Investment in defences needs to be ongoing or the UK could face a situation as devastating as the recent flooding in Australia.

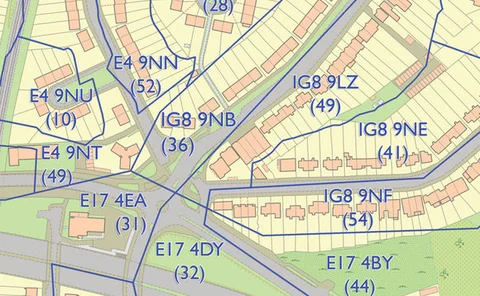

In Series - Geography & Solvency II: Using geographic information for contingency plans

Dr Marc Hobell explains how geographic information can help managers with contingency plans if an incident occurs.

RSA embroiled in legal row over ‘new credit hire’ – Insurance News Now – 17 February 2011

Post news editor Mairi MacDonald outlines this week’s major general insurance stories including how RSA has become embroiled in a legal spat with Provident over subrogated motor repair costs.

Claims Club news: Industry to take active role in the PAS 64 review

The Association of British insurers is to take an active role in the recently announced review of the standard for repairing flooded property — PAS 64 — after it was highlighted as an action point by one of the trade body's working parties.

In series - Geogaphy & Solvency II: National geographical risks

With 80% of business data having a geographical element, Sarah Adams looks at the way this insurers can improve their data.

APPG - 20 years in force: Representation for the industry

With its 20th anniversary just passed, David Worsfold looks at the success of the All Party Parliamentary Group on Insurance & Financial Services, detailing some key highlights from two decades of debate.

Claims Club news: Extra capacity demands place pressure on loss adjusters

The big freeze over the winter of 2010/2011 is the latest event to raise the issue of how loss adjusters and other service providers find extra capacity to meet insurer and policyholder demands.

Claims Club news: ABI rules out centralised flood response body

The Association of British Insurers is poised to reject the concept of having a centralised response to surge events, which could have seen streets allocated a specific loss adjusting firm to moderate claims.

Markel plays down losses from antipodean disasters

Markel International does not expect its future profits to be badly affected by the New Zealand earthquake and recent Queensland flooding, after previous catastrophe events added six points or $33m (£20.5m) to its 2010 full-year combined ratio.

Cyclone Yasi insured losses could reach A$1.5bn

AIR Worldwide has estimated the insured losses from Cyclone Yasi at between A$350m and A$1.5bn.

QBE reveals $245m weather hit, but profit in line with expectation

QBE has announced that its 2010 net profit after tax in line with market expectations after a record underwriting profit but a lower insurance margin from continuing low interest yields in the US and UK.

In series - Geography & Solvency II: Advice on getting data right

For the majority of insurers and to a certain extent brokers, data quality has consistently been an issue with reasons ranging from the ongoing problems of legacy systems to basic human error, as Sarah Adams explains.