Flooding

An opportunity for better risk management and growth in India

As the Indian property and casualty market continues to evolve, Dr Vankayalapati Padmavathi explores how the market is now looking to develop solutions to cater for those who are exposed to catastrophic risks, but are too poor to afford insurance.

Overcapacity constraining cargo market

Soft market rates caused by overcapacity continue to act as a constraint on the global cargo insurance market, despite some significant losses.

Insured loss estimates from Hurricane Isaac up to $2bn

Risk Management Solutions has estimated that US insured losses from Hurricane Issac's wind and surge impacts on the US Gulf Coast will fall between $1bn and $2bn.

Asia View from the Top: Getting flood modelling right

The Intergovernmental Panel on Climate Change reported in 2007 that especially heavily populated mega-delta regions in south, east and south-east Asia will be at greatest risk owing to increased flooding from the sea and, in some mega-deltas, flooding…

Law report: Judge finds lack of scrutiny caused 'fatally flawed' claims

Law reports contributed by national law firm Berrymans Lace Mawer.

Yorkshire policyholders lose flood cover

Commercial policyholders in Yorkshire have accused insurers of jeopardising their futures by failing to provide them with flood cover.

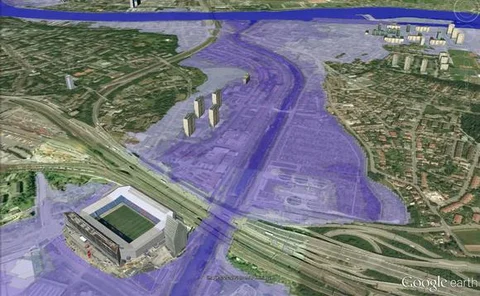

Perils AG to provide satellite-based flood footprints

Perils AG, a Zurich-based provider of European catastrophe insurance data, will make satellite-based flood footprints available during and after major flood events, as part of an initiative in collaboration with the insurance industry and the European…

Defra considers Statement of Principles replacement

The Department for Environment, Food and Rural Affairs has broken its silence about flood insurance and is still considering options for a replacement to the Statement of Principles.

Monte Carlo preview: The calm after the storm

With 2011 rocked by political uprisings and catastrophes, delegates at the Monte Carlo Rendez-vous had much to discuss. However, a year later, with the market beginning to settle, what will be on the agenda?

Flood losses more than doubled in past 10 years, study finds

Flood losses are increasing at an alarming rate and the insurability of floods provides unique challenges for the industry, according to Swiss Re's latest report.

Monte Carlo preview: The calm after the storm

With 2011 rocked by political uprisings and catastrophes, delegates at the Monte Carlo Rendez-vous had much to discuss. However, a year later, with the market beginning to settle, what will be on the agenda?

Claims Club 10th anniversary: A decade of debate

The Post Claims Club will mark its 10th anniversary next year, and the group's advisory board looks back on a decade of change.

Editor's comment: Rebuilding and reshuffling

Only last week, Zurich's personal lines chief Karl Bedlow was telling Post readers that agility is the difference between a gold medal and last place in his 'View from the top' column.

Industry to feel effects of Cabinet reshuffle after Treasury chief exit

The departure of Mark Hoban from his Treasury post as finance secretary will affect the progress of all areas of insurance-related issues, according to industry insiders.

Malta hit by deluge after thunderstorms

Thunderstorms brought heavy rain and flash flooding to Malta, southern Europe between Sunday, September 2 and Monday, September 3.

Insured loss estimates hit $2bn as Hurricane Isaac hits Louisiana a second time

Catastrophe experts have suggested that insured losses from Hurricane Isaac could total $2bn after the tropical storm made a second landfall in the US state of Louisiana.

Global warming to lead to stronger tropical cyclones

Scientists predict that global warming is likely to lead to stronger tropical cyclones, but that the overall global frequency of tropical storms and hurricanes is likely to decrease.

Fire and escape of water are most common commercial property claims

Water escaping from burst pipes or leaking taps is the most common commercial property claim, according to research by damage restoration business ServiceMaster Clean.

TMNF has superior rating as key earning source for Tokio Marine

Tokio Marine and Nichido Fire (Japan) has had its financial strength rating affirmed at A++ (Superior) and issuer credit rating at aa+.

Crawford boosts call centre services in Asia

Crawford & Company has entered into a joint venture with Call Centre Services to provide 24-hour access to an expanded call centre in a bid to respond to client needs in Asia-Pacific.

Cost of summer floods proves high as industry reports poor six-month results

This year's first-half results revealed a reverse in fortunes for Lloyd's and London market firms, while general insurers took a hit from the summer floods.

US property and catastrophe insurers to sustain largest Hurricane Isaac losses

Primary insurers including Liberty Mutual Group are likely to bear the brunt of any insured losses arising from Hurricane Isaac, Fitch Ratings has claimed.

Hurricane Isaac will not be a 'Katrina event'

Hurricane Isaac could cause up to £304m ($480m) in insured losses, experts have predicted.