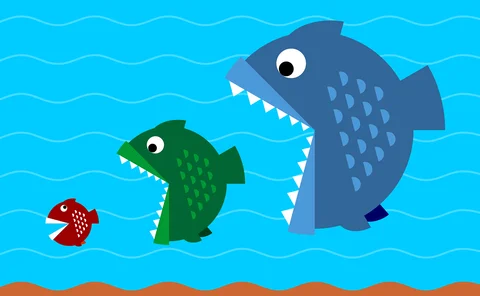

Consolidation

We can double again, says PIB boss Brendan McManus after Apax deal

PIB Group can double in size over the next five years, CEO Brendan McManus told Post after private equity firm Apax Partners became the firm’s lead investor taking over from The Carlyle Group which has retained a stake.

For the Record: The week in deals featuring Allianz, Clyde & Co, Convex, Gallagher, Howden, Kennedys, LV, New Dawn Risk and Woodgate & Clark

Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

Loss-making Markerstudy sniffing out investors as loan discussions continue post-deadline

Managing general agent Markerstudy made a loss in 2019, with discussions ongoing around its near £200m debt to Qatar Re.

Interview: Patrick Tiernan, International Underwriting Association

Newly appointed chair of the International Underwriting Association Patrick Tiernan sat down for a virtual chat with Pamela Kokoszka to discuss his plans as a chairman of the association, climate change and how the industry can overcome challenges…

Interview: Julian James, Sompo International

Sompo International’s international insurance CEO Julian James sat down for a ‘virtual chinwag’ with Harry Curtis to talk returning from retirement, the business’s Lloyd’s exit and brand ambitions, the hardening market and ‘Armageddon scenarios’.

GRP’s Mike Bruce on broker M&A speeding up in Covid-hit UK

The level of broker consolidation has risen again this year, says GRP’s group CEO Mike Bruce as he predicts more investments to come from long-term investors with vendors keen to sell due to pandemic uncertainty, rumoured tax changes, strong valuations…

180 years of Post: Loss adjusting after the heydays (part two)

As Post celebrates its 180th anniversary content director Jonathan Swift takes a look back at the highs and lows of loss adjusting through the 1980s and 1990s in the second of a two-part series.

Competition watchdog opens inquiry into Bupa’s CS Healthcare takeover

The Competition and Markets Authority has opened an inquiry into Bupa Insurance’s proposed merger with CS Healthcare, a Friendly Society with approximately 18,500 members originally set up in 1929 to provide health insurance cover for members of the UK…

Covid-19 an excuse not a reason for redundancies, say recruiters

Insurance recruiters told Post Covid-19 is being used as an excuse for companies to streamline their businesses.

R&Q reveals record profits as it unveils growth ambitions

Randall & Quilter Investment Holdings has reported a 180% rise in pre-tax profit from continuing operations to £40.1m for the year ended 31 December 2019.

Q&A: Joe Thelwell, Towergate

Joe Thelwell, CEO of Towergate Insurance Brokers, talks about organic growth, acquisitions and responding to the Covid-19 crisis as well as sharing how he started in insurance and what comes next for him and the business.

London Market report shows steady commercial share but reinsurance declines

The London Market was responsible for $110bn (£89.7bn) of premium in 2018 with 8.1% year on year core growth across property, casualty and financial lines, according to the latest research by the London Market Group.

Acturis reports 10% dip in platform use during pandemic as it picks up Partners& business

Activity across Acturis’ software platform has reduced by 10% during the coronavirus pandemic, Acturis co-CEO Theo Duchen told Post as he detailed the company's Partners& technology supplier win.

Insurance Covid-Cast episode 12: Newsmaker special with Partners& CEO Phil Barton and chair Stuart Reid

In the latest Insurance Post and Insurance Age video cast brought to you while our journalists are working from home, we present the latest in a series of newsmaker specials focusing on the people behind the lockdown headlines.

Interview: Partners&'s Barton & Reid

The easy answer to the question “when is a consolidator not a consolidator” is when nobody is being bought. Phil Barton and Stuart Reid spoke to Post senior reporter Emmanuel Kenning about their latest venture Partners&.

Barton plans to more than double Partners& headcount to hit five year £50m revenue target

Phil Barton, CEO of newly formed Partners&, has forecast that the business can grow from 140 staff and £65m in gross written premium to 350 people earning £50m of revenue within five years without further buys.

Analysis: Risk manager associations downbeat on Aon-Willis takeover

Post gathers feedback from across the industry on what Aon’s takeover of Willis – to create the biggest broker in the world – will mean for the market

'Disappointing' Aon/WTW merger could see risk managers turn backs on broking giants, warns Airmic CEO

The UK risk management association Airmic has voiced disappointment at Aon’s merger with Willis Towers Watson, warning that its members are prepared to turn to alternative modes of risk transfer if they feel they aren’t getting value for money.

Analysis: Broker M&A pace picks up again

Acquisitions in the UK distribution space rose 13% last year, according to research by Imas Corporate Finance. Post investigates what is driving the increase in consolidation and the challenges buyers are facing in their traditional hunting grounds

Interview: Aon’s Jane Kielty, Tracey Threlfall and James Fell

Just over two years since the takeover of Henderson by Aon its leaders met with Emmanuel Kenning to discuss how the deal came about, why now is the right time to rebrand after the heavy lifting of the integration has been completed and what comes next…

Q&A: Forum of Insurance Lawyers CEO Laurence Besemer

In 2009 Laurence Besemer became the first CEO of the Forum of Insurance Lawyers, the UK trade body for defendant law firms. A decade into the role he spoke to Jonathan Swift about its commitment to its members, a successful 2019 and why it is definitely…

Analysis: Whiplash and insurer demand driving claims sector consolidation

Following Davies' acquisition of Keoghs further consolidation is expected in the claims sector and it could push mid-sized firms out of the picture.

This Month: Looking forwards, listening back

Post’s new Motor Mouth Podcast series is proving quite the hit with listeners.

PE driving market consolidation but private ownership still dominates

Exclusive: Private equity houses and PE backed firms were behind more than 50% of UK insurance distribution mergers and acquisitions activity last year in the £5m plus category, Imas Corporate Finance has calculated.