Climate change

Britain’s future subsidence hotspots revealed

British Geological Survey and Ordnance Survey data analysis, produced exclusively for Insurance Post, shows where climate change is set to intensify subsidence hazard exposure and pose growing challenges for property insurers over the coming decades.

Insurers Forecast of 2026

Insurers are heading into 2026 well-capitalised, technologically accelerated and increasingly data-driven but softening markets, geopolitical volatility and emerging risks are set to test their resilience in the year ahead.

Claims and Legal Forecast of 2026

The claims and legal sectors stand on the cusp of transformation as we hurtle towards 2026, facing policy reform, accelerating innovation and rising customer expectations in the year ahead.

Insurers Review of the Year 2025

Insurers managed to post profits amid a softening market in 2025, invested in technology and pushed to reaffirm the industry’s vital role in protecting society with the Labour government and regulators.

Broker Review of the Year 2025

A softening market put downward pressure on brokers revenue in 2025 but businesses that embraced digital breakthroughs and delivered exceptional service have succeeded in holding on to their clients in a competitive market.

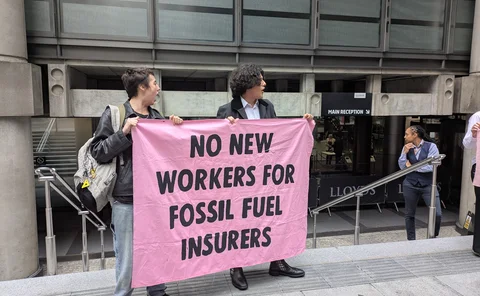

Charges dropped over climate protesters’ Royal Exchange stunt

Two climate protesters have had all charges against them dismissed by the Crown Prosecution Service for lack of evidence after they climbed a 10-metre column at the Royal Exchange.

Q&A: Julian Roberts, WTW

As climate volatility disrupts long-established farming traditions, Julian Roberts, managing director of risk and analytics (alternative risk transfer solutions) at WTW, explains why parametric insurance could be the tool that helps farmers plus the…

ESG that stands up in tougher times

At a recent Insurance Post roundtable in partnership with CRIF, leading insurers and ESG specialists explored how the industry is translating sustainability goals into measurable progress – and what it will take to keep that momentum in tougher times.

Property insurance pay-outs hit record £4.6bn

Association of British Insurers members paid out a record £4.6bn in property insurance claims during the first nine months of the year.

Davies ties half of leadership pay to sustainability goals

Insurance Post can exclusively reveal half of Davies’ group executive committee now have their renumeration linked to the firm’s responsible business goals.

Insurers must go beyond traditional remit to meet society’s big challenges

View from the Top: Alain Zweibrucker, CEO of Axa Retail, argues issues like road safety and climate change demand insurers strengthen their relationships with customers.

How insurance fuels the global shift to cleaner energy

As governments and activists call for faster climate action, Damisola Sulaiman digs deep into how the insurance industry is quietly enabling the net zero transition by unlocking investment, managing emerging risks, and helping high-emission sectors go…

Lloyd's grows fossil fuel premiums

Lloyd’s of London is continuing to grow its fossil fuel business, according to analysis from non-governmental research and campaigning organisation Reclaim Finance.

Can insurers keep their climate promises?

Whether insurers are truly delivering on their climate commitments or just talking a good game is explored in the latest episode of the Insurance Post Podcast.

Swiss Re CEO urges ‘prevention over cure’ for climate risk

Swiss Re group CEO Andreas Berger has called for an industry-wide shift in the approach to climate risk.

Belfor calls for clarity in claims data collection

Managing director of Belfor UK Hein Hemke has argued insurers must communicate the purpose of added data collection as they make the claims process more data-driven.

CEO voices – A Sollers interview series: Interview with Ken Norgrove, CEO of Intact Insurance

Climate change is the top challenge. Reinsurance, nature-based solutions, and AI in pricing and claims are key. Success lies in blending tech and people. This article explores how digital claims, broker ties, and commercial lines can boost UK market…

Is home insurance fit for the future?

How the growing number of claims from floods, fires, and faulty technology has put traditional home insurance policies to the test is the focus of the latest Insurance Post Podcast.

Banks, insurers and their lawyers face climate reckoning

The Prudential Regulation Authority is tightening expectations on how banks and insurers manage climate risk, which Laurence Besemer, CEO of the Forum of Insurance Lawyers, claims will reshape what they demand from their legal advisers.

Protesters target Lloyd's careers event

Protesters have targeted the Dive Into Careers Conference at Lloyd’s today (10 October).

The camper van and motorhome insurance risks we never saw coming

The world of motorhoming has rapidly evolved since Comfort Insurance started 1995. Here It highlights some of the surprising risks the provider didn’t see coming, showing the evolving nature of risks and the need to always be looking ahead.