Post Blog: Upwardly Mobile

How can insurers make the most of mobile technology? Sachin Khatri explains.

Mobile technology has transformed how companies conduct business. Whether it's start-ups hoping to gain traction in a new market or global enterprises growing their customer base, mobile has allowed businesses to reach customers at any time and any place. Despite this, the insurance sector has lagged behind and failed to embrace all that mobile has to offer.

It's understandable why insurers have put mobile on the back burner. Limited budgets, a difficulty to know where to start and confusion around what mobile projects to start with, has left insurers hesitant and somewhat confused. Possibly the biggest mistakes insurers have made is to assume all consumers are the same and rush into implementations without having a strategy in place.

Consumers are not all the same, and creating generic mobile platforms and apps is a recipe for disaster. Before they begin, insurers must establish not only their target audience but how best to interact with them. Without this, mobile adoption in insurance will never get off the ground.

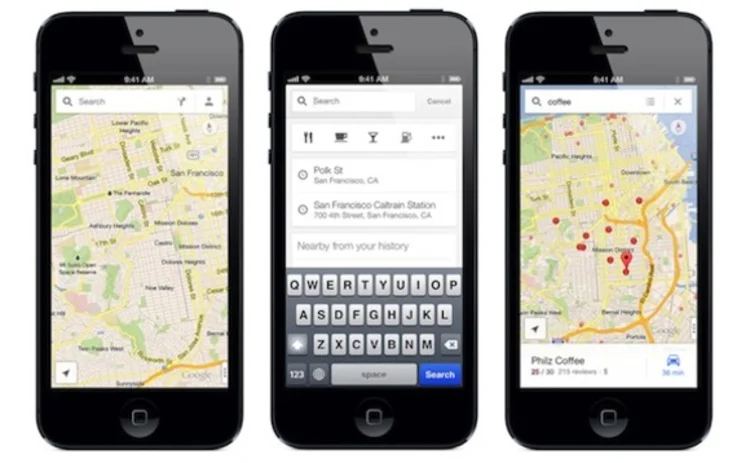

There are multiple ways to reach customers: transactional correspondence (address change, payment renewals and claims), information updates (fund reports, alerts and locate agents), traditional and social marketing. However, this multitude of tools is also the problem, with customers bombarded with corporate messages. Mobile can help insurers cut through this noise and reach customers in new and exciting ways. For example, mobile apps enabled with GPS can provide relevant offers and discounts to consumers based on location or need. A person travelling to the Alps to ski could be targeted with recommendations for insurance cover and places to visit.

In addition, mobile isn't just for targeting customers, but can also improve internal processes through employee engagement. In a claims processing department providing adjusters with mobile tools can provide access to policy and customer details and shorten claims settlement times. Meanwhile, sales personnel can interact more effectively with customers through shop-floor tablets.

This is not to say that there has been no progress within the insurance sector when it comes to mobility. Brokers, spurred by regulations, such as Retail Distribution Review, which require intermediaries to be able to justify advisor charging to customers, have embraced mobile tools that have given them easy access to information.

However, more needs to be done. Insurers must use mobile technology or they risk being left behind. Insurers must engage with their customer base to find out what services they need and would find useful. In addition, they should take inspiration from other industries that have already rolled out mobile programmes, such as the retail sector. Retailers send deals or information to consumers depending on their social media conversations. Why can't insurers do the same, such as sending them a car insurance special offer if they tweet they are buying a new car?

Mobile adoption has the potential to revolutionise the insurance industry, but it won't happen unless insurers focus on the customer segments that will generate sustainable, long-term gains. If other sectors can successfully do this, why not insurance?

Sachin Khatri, financial services and insurance client services lead, Infosys UK

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@postonline.co.uk or view our subscription options here: https://subscriptions.postonline.co.uk/subscribe

You are currently unable to print this content. Please contact info@postonline.co.uk to find out more.

You are currently unable to copy this content. Please contact info@postonline.co.uk to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@postonline.co.uk

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@postonline.co.uk