Reinsurance

Hurricane Florence insured losses in the billions, flooding may still 'worsen'

Insured losses from Hurricane Florence are likely to be between $1.7bn and $4.6bn, Air Worldwide estimates.

Marsh group buys JLT for $5.6bn

Marsh & Mclennan will buy Jardine Lloyd Thompson for $5.6bn (£4.2bn) in a move that will shore up the company’s position as the largest broker in the world.

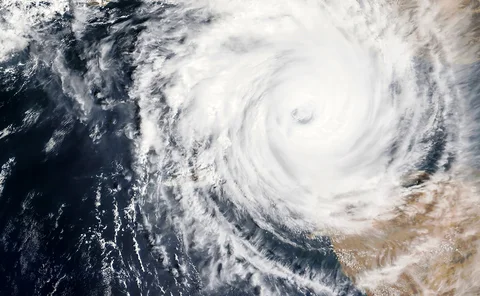

Insured losses for Typhoon Jebi could hit $5.5bn

Insured losses from Typhoon Jebi will be between $3bn (£2.3bn) and $5.5bn (£4.2bn), RMS estimates.

Swiss Re UK & Ireland CEO O’Neill steps down

Swiss Re UK & Ireland CEO Frank O’Neill is leaving the business to pursue another opportunity.

Markel snaps up Nephila in insurance-linked securities deal

Markel is to buy the world’s largest manager of insurance-linked securities, Nephila Holdings.

This week in Post: Do you know who's on the other end of the phone?

We have all experienced that heart-stopping moment when our phone rings and our eyes are greeted with the dreaded: "No caller ID."

Trans Re snaps up Maiden renewal rights as reinsurer plans to sell US arm

TransRe, the reinsurance arm of Transatlantic Holdings has acquired the exclusive renewal rights to all of Maiden Re's US treaty reinsurance underwriting business.

AM Best: Flooding not wind biggest Hurricane Lane concern for insurers

In addition to insurers exposed to property risk, AM Best expects that motor insurers will see claims resulting from heavy rainfall.

LMA names Navigators’ Cameron as CEO

The Lloyd’s Market Association has named Sheila Cameron, currently head of International Operations at Navigators Underwriting, as CEO.

Reinsurers turn to M&A to stay relevant as challenging market forces bite

Global reinsurers have turned to mergers and acquisition deals over the last year in order to remain relevant in the face of challenging market conditions, but S&P maintains a neutral view on this trend.

ABI calls for regulatory certainty as no-deal Brexit advice published by government

A regulatory deal is urgently needed to address Brexit contract issues for the insurance sector, the Association of British Insurers has said.

Losses expected as Hawaii bunkers down for cat 4 Hurricane

The insurance and reinsurance industry is braced for losses as category 4 Hurricane Lane continues to track towards the islands of Hawaii.

Analysis: Pricing climate risks

As climate change becomes tangible, insurers are feeling the heat. Their understanding of the risks could inform not just their underwriting but also their investment strategies.

Updated: Partner Re firms fined €1.5m for Solvency II breach

The Central Bank of Ireland has fined two Dublin-based subsidiaries of Partner Re €1.54m (£1.35m) for breaches of the European Union regulation on solvency requirements.

Hannover Re names Swiss Re's Henchoz to replace CEO Wallin

The CEO of Hannover Re, Ulrich Wallin, is to step down and retire from the reinsurance giant in 2019 and will be replaced by Swiss Re’s Jean-Jacques Henchoz.

Japanese flood losses pegged at $4bn

Insured losses from the June and July flooding in western Japan could total up to $4bn (£3.2bn), according to catastrophe modelling firm Air Worldwide.

2018 H1 insured disaster losses below average at $20bn

Global insured losses from natural catastrophes and man-made disasters during the first half of 2018 were $20bn, 33% below the ten-year average of $35bn, according to Swiss Re Institute's preliminary sigma report.

Lloyd’s managing agents call for greater ILS use

Some 80% of Lloyd’s managing agents would like to see insurance-linked securities become a permanent fixture in the reinsurance and insurance market.

Top 30 European insurers 2018: A year of steady growth for insurers

Overall, top-line growth for the 30 largest European insurers has been steady, reflecting the underlying economic conditions throughout Europe, explain Tim Prince and Yvette Essen, director of analytics and director of research at AM Best

XL Catlin's Nicola Harris on why insurers need to change their approach to the energy sector

Challenging times for the oil and gas industry call for a change in the way insurers address energy risks, writes Nicola Harris, head of energy for Europe, Middle East and Africa at XL Catlin.

JLT Specialty's Hamish Roberts on why insurers must continue insuring coal

The pressure on insurers to deny coal projects any form of cover may actually increase pollution, warns Hamish Roberts, head of JLT Specialty’s London-based power business.

Analysis: Military recruitment: A call to arms

As insurance tries to attract talent and adapt to emerging risks, the London market is increasingly turning towards the military for new recruits

Market must use consortium model to attack expense base, says Hiscox chair

Carriers in the London market must work together in consortiums to spread risk, combat rising expenses ratios and mitigate underwriting pressures, Hiscox chairman Robert Childs said.

Hiscox Retail helps drive 27% boost in group profit at H1

Hiscox saw pre-tax profit climb 27% to $164m (£125m) in the first half of 2018, with the insurer’s retail arm contributing more than half of that figure.