Regulation

Blog: Global reinsurance market - what can we expect to see from 2020?

Very few people have 20/20 vision and there is no exception to this when looking forward to what impact the year 2020 will have on the reinsurance market writes Gavin Coull, London Forum of Insurance Lawyers executive committee member and partner at…

Trio of winter firm failures inflate insurer contributions to FSCS levy

General insurers will pay £8m more in Financial Services Compensation Scheme levy contributions than previously anticipated due to the recent failure of three firms.

Educating and representing during Covid-19: How insurance trade and training bodies are operating remotely

There has been a lot of focus on how different insurance companies have responded to the Covid-19 pandemic, but what about the representative and educational organisations that are part of the lifeblood of the sector? Post content director Jonathan Swift…

Premium finance bosses hail 'smooth' transition to latest guidance

The introduction of further guidance on premium finance by the Financial Conduct Authority including three month payment deferrals for customers hit by the economic impact of the coronavirus pandemic has gone well according to market players.

Regulator to require payment deferrals for insurance customers from Monday

The Financial Conduct authority has confirmed temporary measures aimed at helping insurance customers who find themselves in financial difficulty due to the coronavirus pandemic, including requiring payment deferrals.

Government urged to consider safety ahead of e-scooter trials

The UK government has been urged to “err on the side of caution” when dictating the rules of e-scooter trials next month.

Interview: Pool Re CEO Julian Enoizi

Pool Re boss Julian Enoizi spoke to Post senior reporter Emmanuel Kenning about Pandemic Re, the Office for National Statistics change in the terrorism reinsurer’s classification and using its funds to pay for business interruption claims in the…

Biba CEO Steve White on staying afloat

In an exclusive blog for Post on the day he was supposed to be giving his keynote speech at the 2020 British Insurance Brokers' Association conference, Biba CEO Steve White shares his thoughts on keeping lines of communication open during the coronavirus…

Government to introduce trade credit reinsurance scheme amid coronavirus pandemic

The UK government has pledged support for coronavirus-affected businesses which rely on trade credit insurance through a temporary reinsurance agreement.

Airmic warns insurers of long-term damage to trust from Covid-19 crisis

John Ludlow, CEO of Airmic, has warned that the insurance industry is at a “critical juncture” due to the coranvirus crisis with member surveys suggesting the hardening market is already forcing businesses to look at alternative risk transfer options.

Allianz and LV's £68m weather hit edges first quarter COR above 101%

Allianz Holdings, comprising of LV General Insurance and Allianz Insurance, saw £68m in claims relating to storms and flooding in the first quarter of 2020 as Allianz unveiled a global property and casualty €400m (£351m) Covid-19 hit.

Aon prepared to shed up to $1.8bn in revenues to get WTW deal done

Aon agreed to dispose of business and assets up to a cap of $1.8bn (£1.5bn) in 2019 revenues to satisfy competition regulators or else pay a $1bn fee to Willis Towers Watson in order to get its takeover of the rival broker across the line, filings with…

This Month: Putting the insurance industry under the microscope

This month we put the insurance industry under the microscope - looking into how much progress the Lloyd's market has made to bolster diversity and inclusion in the sector, the efforts taken to pay out business interruption claims and the industry's…

Experts warn of potential broker insolvencies due to premium finance proposals

The British Insurance Brokers’ Association and premium finance providers have warned of a possible hit to broker solvency in the event of bad debts under the proposed guidance issued by the Financial Conduct Authority last week.

SMEs face legal threats from same insurers that are not paying out on their BI policies

Exclusive: Insurers seeking to recoup losses from other classes, such as event cancellation and wedding insurance, are threatening policyholders involved in business interruption group actions against them with legal action.

FCA consults on insurance payment deferral guidance

Insurers, brokers, premium finance lenders and more have been told by the Financial Conduct Authority to consider giving payment deferrals and refunds as well as waiving cancellation fees to customers hit financially by the coronavirus epidemic.

FCA to put BI wordings before the courts to determine coronavirus cover

The Financial Conduct Authority will ask the courts to rule on whether a “representative sample of the most frequently used” business interruption policy wordings provide cover for Covid-19-related losses.

Interview: ABI's Huw Evans on not losing faith in insurance

It clearly is not great for the insurance industry’s reputation “to be in a position where it has so many unhappy customers,” Huw Evans, director general of the Association of British Insurers has admitted.

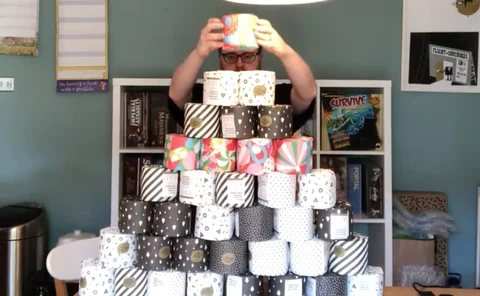

British Insurance Awards 2020: Shortlist Revealed

Let the good times [toilet] roll, it's British Insurance Awards shortlist time.

MP urges insurers to do more as public 'very, very angry' over BI payouts

Exclusive: The insurance industry is heading towards “considerable damage” to its public standing due to its handling of business interruption insurance claims during the ongoing coronavirus crisis, Jonathan Edwards MP has warned.

Admiral ploughs on with year end shareholder dividend

Admiral confirmed it will recommend a final dividend for the year to shareholders, as it suspended a special dividend.

British insurers expect £900m in coronavirus BI claim payouts

Insurers are expecting to payout £900m towards UK business interruption claims, latest figures from the Association of British Insurers show.

Ombudsman responds to loss adjuster calls to fast track Covid-19 BI test case

The Financial Ombudsman Service is prepared to progress a Covid-19 related complaint about business interruption cover as “quickly as possible” to help provide guidance to insurers and the growing number of disgruntled SME policyholders about what is -…

Whiplash reforms pushed back into 2021

Whiplash reforms, including the implementation of the claims portal, have been pushed back to April 2021 due to the coronavirus pandemic.