Personal

Fraud: Organised crime - Bogus claims gangs cast a wider net

The profile of people targeted by gangs to make personal injury claims appears to be changing, with those involved becoming younger and more middle class. The link between youth unemployment and crime rates is hard to ignore.

Broker satisfaction with insurers on the rise in commercial lines

Satisfaction among brokers in terms of working with insurers has increased for commercial lines over the past five years, but remains 'stable' in the personal lines sphere.

Mapfre extends relationship with Dah Sing in China to road assistance

Road Assistance China has teamed up with Chinese insurance firm Dah Sing to offer its clients two new services.

The temporal scope of Rome II

Rome II was intended to bring about uniform choice of law rules but had left some uncertainty over when the regulation applied in cross border accidents. Tarek Uddin explains how the recent case of Homawoo has helped bring clarity.

Liberalising the Italian motor market

The Italian government is aiming to combat motor insurance fraud with its Decreee Cresci Italy. However, as Paolo Golinucci explains this might not be as straightforward as it seems.

Direct Line Italy selects provider for improved claims management system

Direct Line Italy is launching a claims management system to support the company's continuous growth and maintain customer satisfaction.

Axa UK CEO warns PM Cameron telematic rates are not a silver bullet for young drivers

The CEO of Axa UK & Ireland Paul Evans has warned PM David Cameron that telematics is not a silver bullet to sort out the issue of restrictive insurance prices for young drivers.

Zurich and Travelers plead guilty to data protection breaches

Zurich, Travelers and FBD have pleaded guilty to illegally using social welfare information on individuals obtained through a private investigator.

Zurich sees 19% drop in GI profits after US$1bn cat losses in 2011

Zurich recorded a general insurance business operating profit of US$2.3bn in 2011, a decrease of US$403m or by 15% in US dollar terms and 19% on a local currency basis.

Zurich sees 19% drop in GI profits after US$1bn cat losses in 2011

Zurich recorded a general insurance business operating profit of US$2.3bn in 2011, a decrease of US$403m or by 15% in US dollar terms and 19% on a local currency basis.

Axa UK returns to profit with 98.9% GI COR but still at a loss in motor

Axa returned to profit in 2011 reporting underlying earnings of £133m (2010: loss of £63m; restated to exclude the contribution from sold activities).

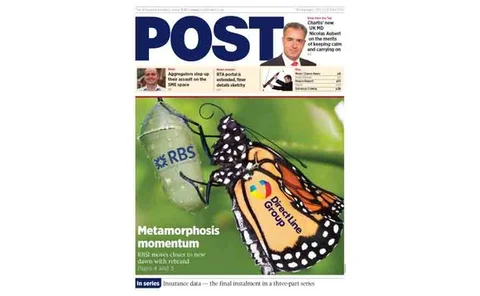

Editor's Comment: RBSI takes the Direct approach

The news that Royal Bank of Scotland Insurance is to use the Direct Line brand comes as little surprise.

Brokers issue retention rate warning over commercial insurance aggregation

Insurance firms looking to help aggregators target commercial insurance expansion in 2012 have been warned to check poor retention rates and increased fraud risks before over-committing themselves.

Market fears for unintended consequences as first ABS approval nears

The first alternative business structure could be greenlighted as early as next week.

In Series On Data: Bringing credit to the nation

Credit data is relied on to help decide if customers can repay monthly instalments but, as competition heats up, will insurers consider its use in APR calculations to give them an edge?

In Series On Data: A rounded opinion

While full credit data is not available for insurers to use for underwriting, are they missing a trick not using it for credit assessment?

Webinar: Closing the loop on records management and data security risk

In this video, Incisive Media’s group editorial services director David Worsfold chairs a lively discussion on records management and data security risk, including the challenges of managing records during the 2012 Olympic Games.

Post magazine – 16 February 2012

The latest issue of Post magazine is now available to subscribers as a digital and interactive e-book.

The Co-operative and Zurich keen to move on PM motor premium initiatives

The Co-operative is hopeful the insurance summit with Prime Minister David Cameron will lead to stamping out fraudulent personal injury claims while continuing to settle genuine ones.

Ingenie backs government's telematics measure

Telematics brand Ingenie has welcomed government plans to use technology to tackle spiralling motor insurance premiums.

Direct Line boss praises PM motor premiums meeting

Direct Line chief executive Paul Geddes hailed last night’s meeting with Prime Minister David Cameron as a “step in the right direction”.

PM and insurers unveil six point plan after motor premium summit

The Prime Minister has committed to tackling the compensation culture, reducing legal costs and cutting health and safety red tape.

Law firm accuses PM motor premium war of limiting access to justice

Spencers Solicitors fears the Prime Minister's approach to tackling the rising cost of motor insurance will "chip away at the public's right to justice under the law".

Broker shows support for PM and insurer motor premiums meeting

Wales-based Motaquote has highlighted the significance of telematics ahead of the Association of British Insurers' meeting with Prime Minister David Cameron on rising motor insurance premiums.