Weightmans

Analysis: On the trail of e-scooter trials

Policymakers, retailers and environmentalists hope that e-scooters will be a green saviour. Trials to ascertain the risks are ongoing, as the insurance industry watches on with a wary eye.

Blog: Insurers must be prepared as careless drivers face new risk of custodial sentences

With the government announcing that careless driving will carry the possibility of a custodial sentence from 2021, Lili Oliver, Weightmans partner, explores the likely impact on the insurance industry.

Orient Express: What if the Supreme Court goes against precedent in the FCA BI test case?

During the High Court hearing of the Financial Conduct Authority’s business interruption test case, the regulator argued that reversing the judgment in the historic Orient Express case would “restore sanity”. If the Supreme Court chooses to overrule the…

Analysis: Lockdown legionella threat a public health and liability concern

Specialists across the insurance industry have voiced their concerns about the potential for a build-up of legionella bacteria in buildings left empty over lockdown.

Catastrophically injured claimant granted accommodation costs in landmark ruling

The Court of Appeal has rewritten the approach to calculating personal injury accommodation claims in a landmark judgment that awarded the claimant additional damages of £802,000 for the cost of special accommodation.

Coverholders upbeat despite lawyer warnings after BI case

Managing general agents and coverholder brokers remain optimistic about the sector’s prospects despite warnings from lawyers on the implications of the recent business interruption court case.

ALKS cannot be classified as 'fully automated' warn insurers as driver charged in Uber case

As the driver in a fatal autonomous Uber car crash from 2018 was charged with negligent homicide, the insurance industry has warned more needs to be done before introducing Automated Lane Keeping Systems onto UK roads next year.

Analysis: Why falling premiums do not mean clear cut savings for motorists

Falling average motor premiums may represent less significant savings for individual consumers than at first glance, experts have cautioned, while a swift return to pre-Covid motor premium levels is "not inevitable."

Blog: The legalisation of rental e-scooters and its impact on the insurance industry

The UK government recently took the decision to legalise the use of rental electric scooters on public roads. Glyn Thompson, head of the motor sector focus team at the Forum Of Insurance Lawyers and technical lead motor at Weightmans, looks at what the…

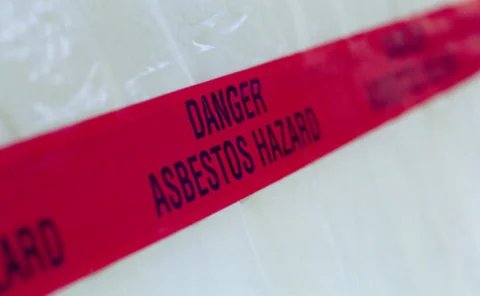

Blog: Preparing for the next asbestos - silicosis and insurance

With the All Party Parliamentary Group for Respiratory Health’s call to arms for the reform of workplace exposure limits to silica dust, Jim Byard, insurance partner at Weightmans, explores the likely impact on the insurance industry, and how it can…

Swift v Carpenter: Change needed if costs formula 'no longer fits' purpose, says Personal Injuries Bar Association

If the current formula for calculating serious injury accommodation costs is no longer fit for purpose then it should be improved, the Personal Injuries Bar Association's representative said on the third and final day of the Swift v Carpenter appeal.

Swift v Carpenter: Appeal Court hears arguments on whether market value of property is a fair measure

On the second day of the appeal to a 2018 judgment in Swift v Carpenter relating to serious injury claim accommodation costs, judges heard from further witnesses.

Swift v Carpenter: Court hears from expert witnesses on serious injury claim accommodation costs

On Tuesday the appeals court heard from expert witnesses testifying on the topic of additional accommodation costs in serious injury claims in appeal to Swift v Carpenter.

Government urged to consider safety ahead of e-scooter trials

The UK government has been urged to “err on the side of caution” when dictating the rules of e-scooter trials next month.

Analysis: Constructing Pandemic Re

The insurance industry stands ready to participate in the creation of a Pandemic Re vehicle but opinions differ on how it would work.

Analysis: Will lockdown car insurance profits trickle down to policyholders?

Quieter roads have led many to assume that car insurers are in for pandemic profits. Post investigates calls for lockdown windfalls to be re-gifted to motorists.

Microsoft data breach: Cyber experts warn of knock-on claims effect

Microsoft’s data breach, which saw details of a reported 250 million customers made available online, could leave insureds facing knock-on phishing attempts and the tech giant facing a fine.

Foil expands cyber sector focus team to include technology

The Forum of Insurance Lawyers has expanded the remit of its cyber liabilities sector focus team to include insurers’ and law firms’ use of technology in claims handling, as well as claims law related to cyber cover and digital processing.

Analysis: E-vehicles - A missed opportunity?

As people are increasingly switching to electric vehicles, are insurers taking the opportunity to explore this market?

Analysis: Should the FCA impose fee caps on CMCs?

The Financial Conduct Authority is working to limit charges for claims management companies’ services, but will new regulation actually be a double-edged sword for consumers?

Landmark court ruling could lead to surge in motor premiums

Exclusive: Motor insurance policyholders could see their premiums increase as a result of a six year landmark case against Motor Insurers’ Bureau.

British Insurance Awards at 25: The judges reflect on the changing market

With the deadline for entering the British Insurance Awards getting ever closer, what better time to introduce the judges who will be casting an eye over these years submissions? Post canvasses them for their favourite memories of previous BIAs and their…

Analysis: Will BA data breach open floodgates for future data group actions?

The British Airways data breach is the first major case since the General Data Protection Regulation became law. With the firm facing group legal action and the Information Commissioner’s Office testing its teeth for the first time, what might this mean…

Legal consultation launched into driverless cars

A wide-ranging consultation has been launched into the legal reforms surrounding driverless cars.