Financial Conduct Authority (FCA)

The future of pricing - how can insurers use data and technology to remain competitive?

Insurance organisations need to develop new ways of pricing if they want to remain competitive in today’s market. But whilst data enables insurers to make the most informed pricing decisions; governing and processing this data across siloed databases and…

Analysis: The importance of diversity and inclusion in claims

Post spoke to senior claims figures on the role of diversity and inclusion in supporting customers' needs.

Intelligence: White labelling – are partnerships the way of the future?

White labelled insurance as sold by big brands is seeing lot of the action in terms of growth and innovation. But, is it because these are simply good products or is it all about the trust factor? Post investigates.

AR consultation prompts stifling innovation concerns

A Financial Conduct Authority consultation on appointed representatives will tackle firms "circumventing" requirements, compliance consultants told Post, though concerns have been raised around barriers to entry and innovation.

FCA pledges more accountability after recent parliamentary criticism

The Financial Conduct Authority committed to becoming a more ‘innovative, adaptive and assertive regulator’ as it published its annual business plan.

Regulators mull targets, disclosures and individual accountability to spur on D&I at financial services firms

Regulators are considering a range of policy options to boost diversity and inclusion in the financial services sector, including the use of representation targets and making senior managers directly responsible for D&I within their firms.

Lloyds Bank fined £90.7m for misleading customers in home insurance renewal letters

Lloyds Bank has been fined £90.7m by the Financial Conduct Authority for failures in home insurance renewal letters between 2009 and 2017.

Stuart Forsyth describes 'hellish experience' as Upper Tribunal overturns fine and ban by ruling against FCA and PRA

Stuart Forsyth, the former CEO of Scottish Boatowners Mutual Insurance, has called on regulators to “learn from the errors they made in my case and work to restore the faith of regulated professionals” as the Upper Tribunal overturned his fine and ban.

FCA delays to approving c-suite broker roles slammed as outrageous

Compliance experts have advised brokers to add time into their recruitment plans for c-suite positions to account for “backlogs” in the Financial Conduct Authority’s approval process as one leading broker hit out at the “ridiculous” delays.

FCA broker c-suite approval times soar with CEOs waiting 151 days for sign-off

The average time taken for the Financial Conduct Authority to approve CEO applications from brokers has nearly tripled from 57 days in 2019 to 151 days this year, a Freedom of Information request by Post has revealed.

FCA ‘Dear CEO letter’ warns brokers about client money amid concern of widespread non-compliance

The Financial Conduct Authority has issued a stark warning to brokers about client money shortcomings it has seen in the market stressing that it will take action.

Google reveals FCA authorisation ad rule to target scammers

Google’s decision to only allow regulated firms to place financial services adverts targeting UK consumers has received a measured response from the Financial Conduct Authority, while a law firm has warned the devil will be in the detail.

CMC fined £110,000 for nuisance calls

Claims Management Company Crosfill & Archer Claims has been fined £110,000 by the Financial Conduct Authority for historic unsolicited telemarketing calls.

Analysis: The CMCs out of scope

When the Financial Conduct Authority took over claims management company regulation in 2019, it fired warning shots at the sector. Should the regulator’s remit be widened to cover those firms that don’t come under its surveillance?

PIB presses 'pause' on recommending Hiscox to clients after Covid crisis response

PIB has hit pause on recommending Hiscox to customers but has not ended its agency with the insurer, Post can reveal.

FCA urged by Treasury Select Committee to set out timeline for culture-changing transformation

Politicians have called for the Financial Conduct Authority to set an end date for a transformation programme that seeks, among other things, to tackle the “siloed” culture within the regulator.

Treasury Select Committee calls for fraudulent ads to be tackled in Online Safety Bill

The Treasury Select Committee has criticised the government for a “missed opportunity” to tackle fraudulent online adverts and prevent customers being scammed by fake financial products.

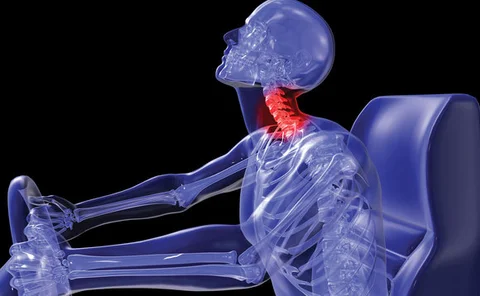

Insurers wary of 'perverse' CMC behaviour following whiplash reforms

Insurers are concerned that whiplash reforms may result in claims management company “displacement”.

FCA Google Ad spending tops £2m in less than three years

A Freedom of Information request by Post has revealed that the Financial Conduct Authority spent over £240,000 on Google Ad words in the first four months of the year, taking the bill since 2019 over £2.1m.

A-Plan targets £1bn GWP within four years

A-Plan Group is aiming to break the £1bn gross written premium barrier within the next four years, CEO Carl Shuker told Post.

FCA warns Google and social media of legal action over scam adverts

The Financial Conduct Authority has warned social media companies that it will take legal action if they keep publishing scam adverts.

EY: motor market to return to loss in 2021; Canopius unveils algorithmic MGA; Kitsune sold to XS Direct

Post wraps up the major insurance deals, launches, investments and strategic moves of the week.

BGL’s Peter Thompson on why the insurance industry must batten down its hatches

Peter Thompson, CEO of insurance, distribution and outsourcing at BGL Group, addresses the crucial importance of operational resilience in a fast changing landscape for the industry.

Podcast: What impact will the FCA review of pricing practices have on insurers?

Insurance Post recently conducted a survey to get an overview on motor pricing trends and the impact the current economic climate has had on consumer behaviour.