Opinion

Snowball will pack a punch

If there had been one criticism levelled at Towergate, it was that it lacked a real City heavyweight...

Website clarity needed

Every day brokers meet the challenge of keeping up to date with new products, to be able to advise t...

The risky world we live in

In the discussions my Marsh colleagues and I have with chief executive officers, chief finance offic...

FSA is starting to justify enforcement war chest

The news that the regulator has once again opened the door marked 'underwriting' at a broker and fou...

Industry still dazed and confused

I think the letter from Debra Williams, managing director of Confused.com, (Post, 5 April, p13) perf...

Repairing the damage done

Agreement with the views of Bronek Mosojada (View From The Top, 22 March, p6) an Peter Barrett (Post...

Has S&C finally cracked?

It seems fitting that the Easter period should hail the breaking down of Smart and Cook's resistance...

Spinning a winning tale

As practitioners of mergers and acquisitions, we are often struck at how misleading the headlines su...

No personal motor plan in place at present

It was good to see Adding1's launch of five new products reported in Post (UK News, 29 March 2007, p...

Give midwives support to support mothers

I was shocked to read Post's article about the need for external funding for midwives' PI insurance ...

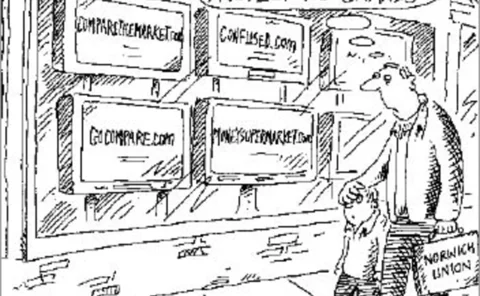

Aggregators need to add more value

I was interested to read your leading article "Norwich Union falls out of love with aggregators" (Po...

Marry in haste, repent at leisure, learn insurers

And lo, the insurance industry has been blessed with its own soap opera akin to Britney Spears and c...

Insurers can profit from comparison

I read with interest your comment on aggregators (Post 22 March p4). You quoted Patrick Snowball as ...

You're only as mature as the market you hold

Whenever we talk about the UK insurance market (or any major European one for that matter), we nearl...

Transparency inevitable

I have no doubt that most of us are in the process of constructing our responses to the European Uni...

Harvey stirs up assessor wrath

I write on behalf of the Institute of Public Loss Assessors. The recent articles from the three maj...

Assessors demand the respect of the industry

We were extremely disappointed to read Malcolm Harvey's letter of 8 March. We could of course respo...

Solvency concerns FSA

After all the whispering and sniping about offshore insurers and the pros and cons of UK brokers usi...

As an industry do we get what we ask for?

I recently attended a seminar on corporate buyers of insurance. They were interested in current mark...

FSA is slowly running out of goodwill

The Financial Services Authority's perceived offer to shift goodwill on a balance sheet to a new hol...

Norwich union falls out of love with the aggregators

The news that Norwich Union group executive director Patrick Snowball claims that his company's enth...

Leave regional broker commission alone

I would like to offer my own views on recent headlines about pressures on commission. As a broker o...

Our own worst enemy?

If I say it quickly, it might not seem so bad: insurers have become their own worst enemy and have l...

Competition winners

The winners of the recent Brit Cheltenham competition were Kathy Berry, SBJ UK, Stockport; Paul Magi...