Opinion

Why the FCA should slash red tape to save brokers

News Editor’s View: Scott McGee examines the impact of the Financial Conduct Authority’s Consumer Duty, debating whether the regulator's promise to reduce the weight of regulation is too little, too late for small brokers struggling as a result of red…

Markerstudy’s Barnard on the continued importance of Lloyd’s

View from the Top: Joe Barnard, director of group sales and business development at Markerstudy, highlights Lloyd’s’ adaptability, strong reputation and talent as key to facing future challenges.

Why overseas capacity has become a concern for MGAs

Will Reddie and Bob Haken, partners at law firm HFW, explore the growing concern among managing general agents operating in the UK without capacity, which would put them in breach of regulations and runs the risk of criminal sanctions for both the…

Foil on why a loss for credit hire companies is a win for insurers and customers

Trade Voice: Max Withington, member of the Forum of Insurance Lawyers’ credit hire sector focus team and Horwich Farrelly partner, and Graeme Mulvoy, Horwich Farrelly partner, look at developments in credit hire claims that could presage cheaper premiums.

Aviva’s Storah urges ‘belt-and-braces approach’ for climate impacts

View from the Top: Jason Storah, CEO of UK & Ireland general insurance at Aviva, says the UK needs a holistic approach to flood risk management in a changing climate.

How insurance is addressing the boom in medical tourism

Vered Lobel, CEO of OneBefore, an MGA specialising in consumer insurance, explores the rise of medical tourism, the accompanying risks, and how insurers are responding to these changes.

CII’s Connell tackles fair pricing for premium finance

Trade Voice: Dr Matthew Connell, director of policy and public affairs at the Chartered Insurance Institute, says there are many ways of justifying whether a price is reasonable or not.

Time to shift from diversity thinking towards inclusive action

Editor’s View: Emma Ann Hughes reflects on Lloyd’s tenth Dive In festival and concludes it showed the insurance industry needs to go from Sunday morning thinking about diversity to Monday morning action to create an inclusive culture.

ABI’s Gurga on why the regulator should follow the Chancellor’s positive lead

Hannah Gurga, director general of the Association of British Insurers, says regulators should take note of Chancellor Rachel Reeves’s optimism at this week’s Labour Party conference.

Miller’s Craven on unconscious nature of excluding behaviour

As Dive In draws to a close, Natacha Craven, chief human resources officer at Miller, considers unconscious bias plus how we are all culture carriers – and responsible for making a difference to the inclusive culture of the insurance industry.

Davies’s Blunt argues if you can see it, you can be it

Carolyn Blunt, vice president of the Academy at Davies, says school outreach programmes are attracting diverse talent into the sector but, to create an inclusive culture, the make-up of the highest levels within all insurance organisations needs to…

AmTrust’s Challis on embedding inclusion in the HR life cycle

Helen Challis, group head of HR at AmTrust International, reflects on diversity efforts in the past decade and why inclusion initiatives must be meaningful and results oriented.

BMS Group’s Erwin champions employee networks

Louisa Erwin, group head of diversity, equity and inclusion at BMS Group, argues it is essential for the insurance industry to continue to amplify the voices of employee resource groups and networks.

Sedgwick’s Cowell on inclusivity lessons learned from Covid

Vicki Cowell, head of colleague resources at Sedgwick, considers the lessons learned from Covid-19 about flexible working and how the insurance industry must move away from linear progression paths to become more inclusive.

Markel’s Humphreys on ensuring everyone can thrive

Dr Julie Humphreys, head of diversity and inclusion at Markel International, outlines the importance of a people-powered approach to achieving inclusivity in the insurance industry, with a focus on creating an environment where everyone can thrive.

CFC’s Hadebe urges others to embrace commonalities

Sukoluhle Hadebe, assistant underwriter at CFC, says creating an inclusive insurance industry culture requires intentional mentoring and active allyship.

Raise your hand to smash through glass ceiling

Aishling Meyler, assistant vice-president for technology at LexisNexis Risk Solutions in UK and Ireland, says to smash through the insurance industry's glass ceiling you need to raise your hand and get involved.

Markerstudy’s Smith-Foreman on creating a sense of belonging

Lizzie Smith-Foreman, chief marketing, communications and sustainability officer at Markerstudy, on why insurers can’t rest on their laurels and must regularly assess and evolve initiatives to ensure they reflect the needs and wants of colleagues.

First Central’s McGowan on ensuring challenges don’t limit careers

Jo McGowan, chief people officer at First Central, shares how her fertility challenges made her an even bigger advocate of ensuring colleagues receive the necessary support during difficult times in their lives.

SSP Broker’s Majeed on raising diverse talent through the ranks

Nazia Majeed, head of project and service delivery at SSP Broker, observes she remains the minority in a leadership role in insurance and outlines action needed to get more diverse talent to the top of the sector.

Instanda’s Shipley on why meritocracy should replace metrics

Sara Shipley, chief human resources officer at Instanda, on the power of no longer chasing metrics but instead genuinely seeking talent in all its forms.

ISC Group’s Powell on the next steps towards inclusion in insurance

Carmen Powell, managing director of ISC Group, reflects on how her organisation has created safe spaces, fostered leadership, and promoted cross-organisational collaboration plus shares plans to create a a more equitable future in insurance.

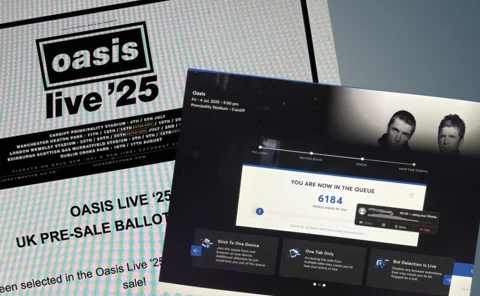

Lessons insurers should learn from Ticketmaster’s dynamic pricing

Editor’s View: Emma Ann Hughes questions whether the fallout from Ticketmaster’s dynamic pricing approach to selling Oasis tickets could have an impact on insurance premiums.

CFC’s Beattie on the pitfalls of following tech buzz

View from the Top: George Beattie, head of innovation at CFC, warns the industry is in danger of focusing too strongly on headline grabbing technology rather than the business and customer outcomes it can deliver.